The document discusses various aspects of capital structure including:

1) Capital structure refers to the combination of debt and equity used to finance a company's operations and growth. The capital structure decision considers factors like control, risk, and cost.

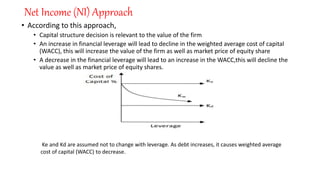

2) Several capital structure theories are described including the net income approach, traditional approach, and Modigliani-Miller approach. The net income approach suggests maximizing debt to minimize costs while the traditional approach finds an optimal debt level.

3) Worked examples demonstrate calculating a firm's value, cost of equity, and weighted average cost of capital under different capital structure assumptions.