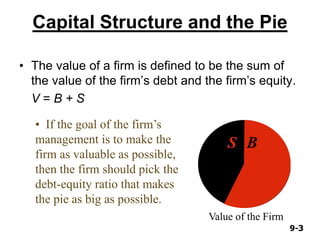

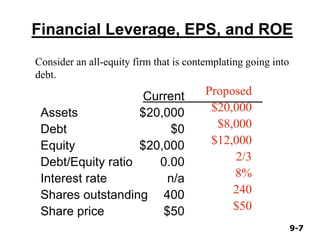

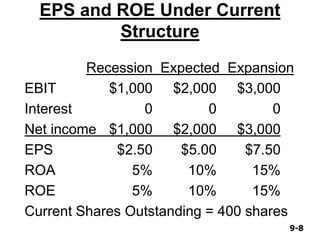

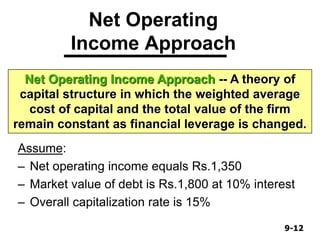

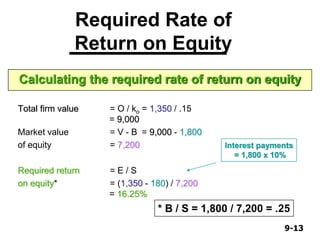

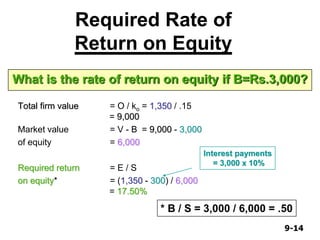

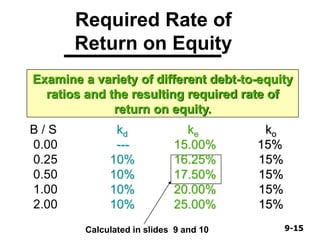

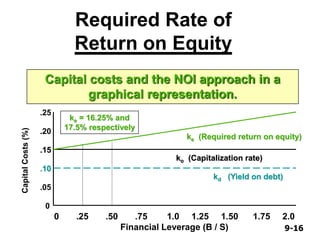

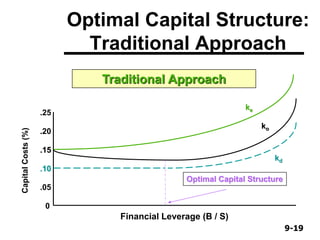

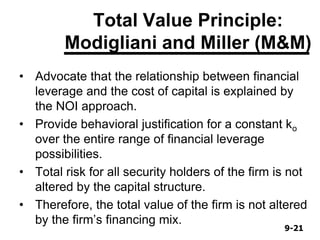

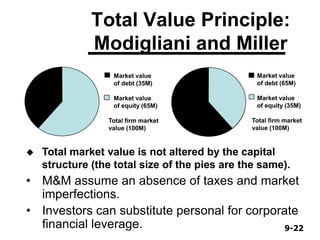

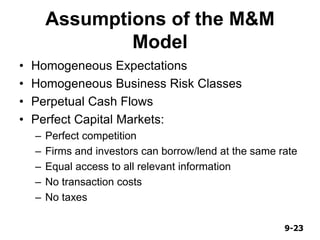

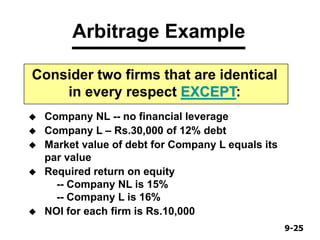

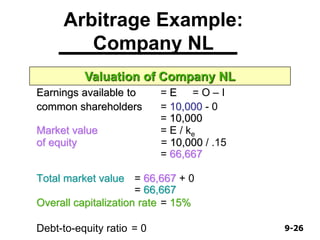

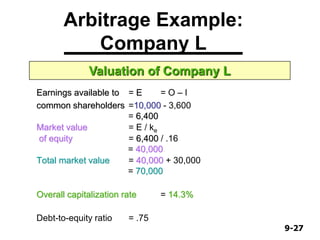

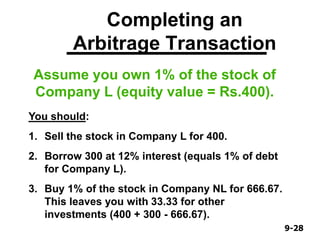

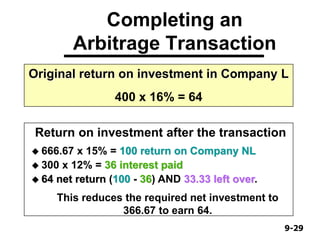

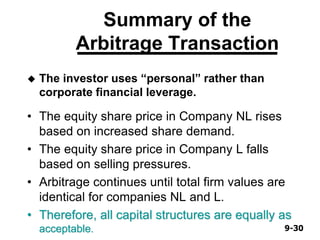

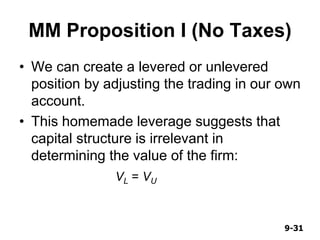

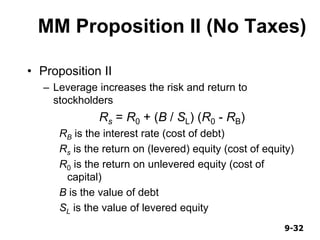

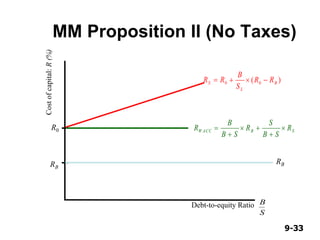

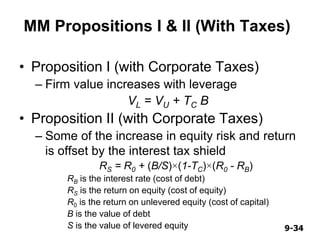

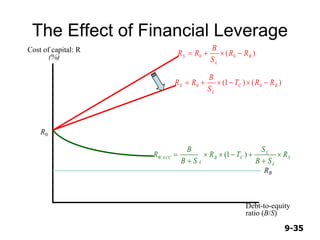

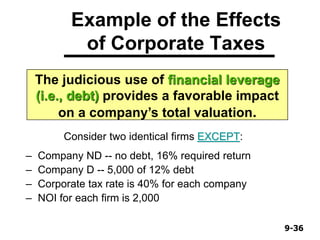

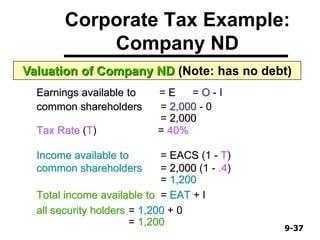

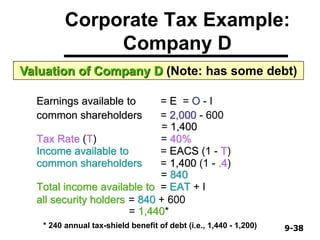

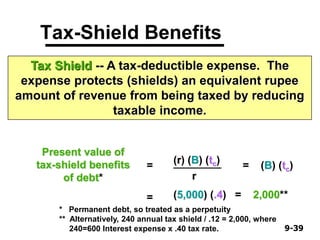

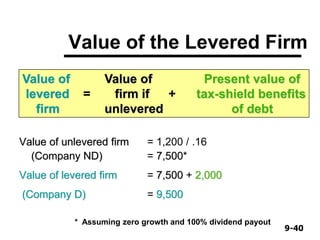

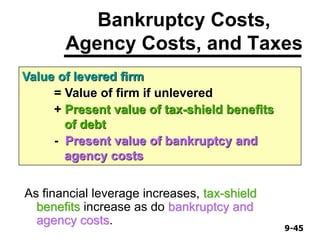

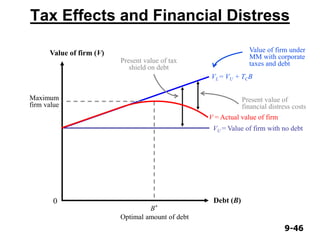

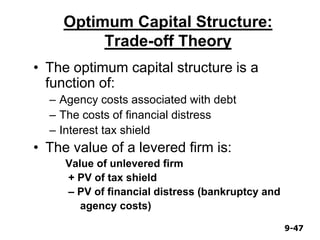

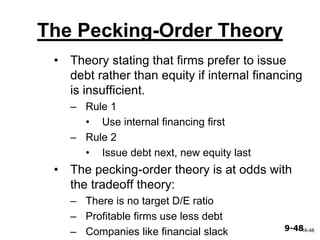

The document provides information on capital structure and the Modigliani-Miller (M&M) theories. It discusses the Net Operating Income (NOI) approach, Traditional approach, and M&M propositions. The NOI approach assumes the weighted average cost of capital and total firm value remain constant as leverage changes. The Traditional approach suggests an optimal capital structure that minimizes the cost of capital. M&M proposition I states that the total market value of a firm is unaffected by its capital structure if markets are perfect. Proposition II shows how leverage impacts the risk and return of equity holders. The document also provides an example of how corporate taxes can increase firm value through the use of debt.