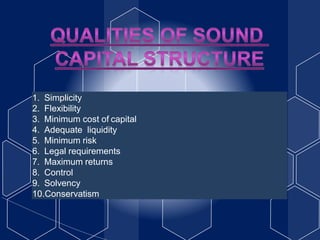

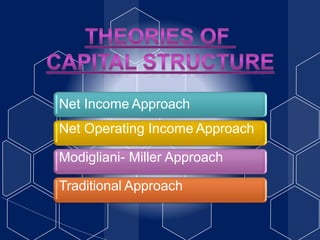

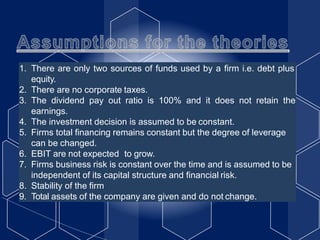

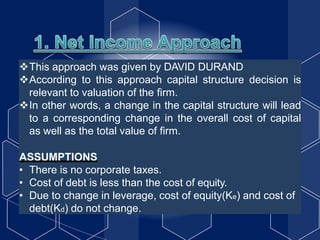

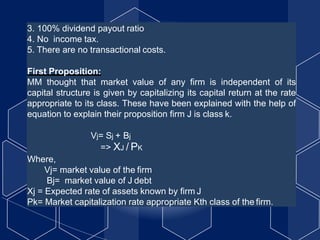

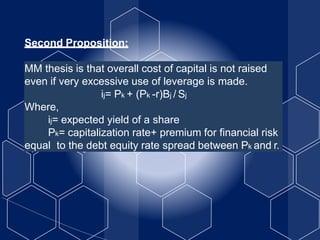

The document discusses capital structure and the factors considered when determining a firm's optimal capital structure. It defines capital structure as the mix of long-term financing sources like debt, preference shares, and equity. Management should choose a capital structure that minimizes the firm's cost of capital while maximizing shareholder value. Different approaches for determining the optimal capital structure are described, including the net income, net operating income, Modigliani-Miller, and traditional intermediate approaches.