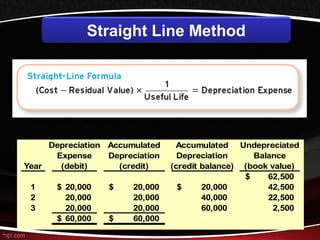

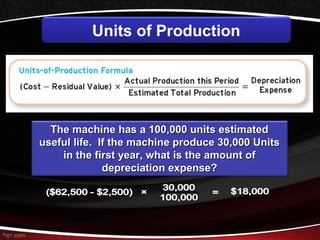

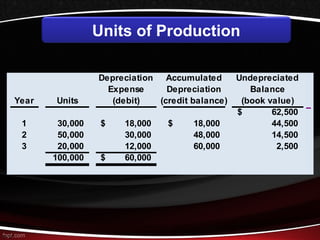

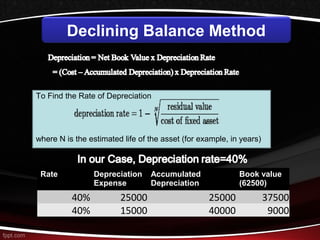

This document discusses different methods for calculating depreciation of tangible and intangible assets. It provides examples of straight-line depreciation, units of production depreciation, and declining balance depreciation methods. It also mentions that most corporations use the Modified Accelerated Cost Recovery System (MACRS) for tax depreciation purposes, which allows for rapid write-off of assets to stimulate new investment.