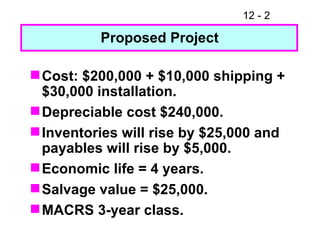

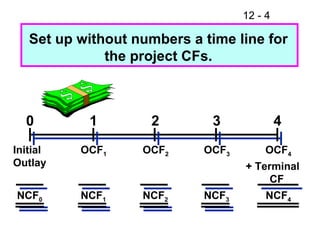

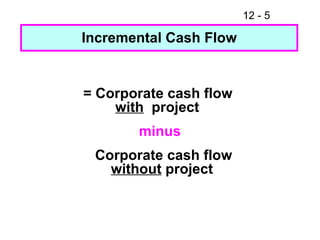

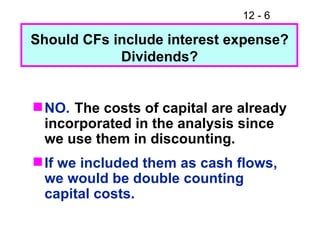

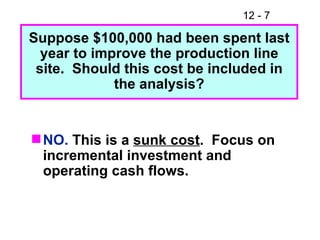

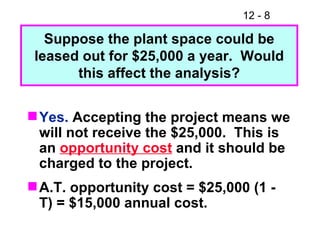

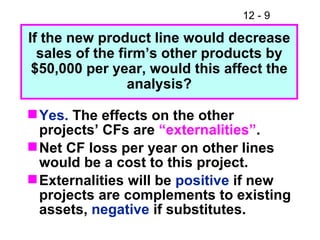

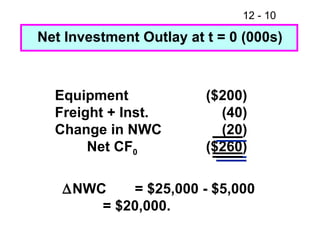

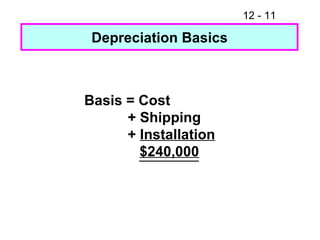

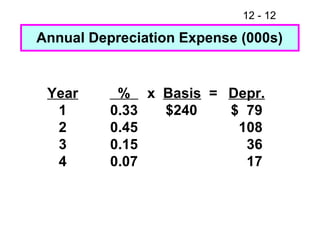

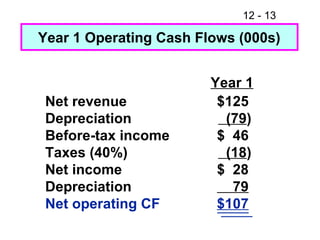

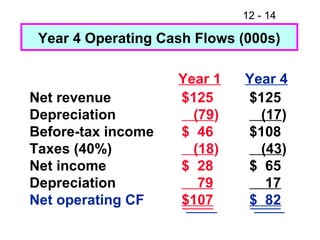

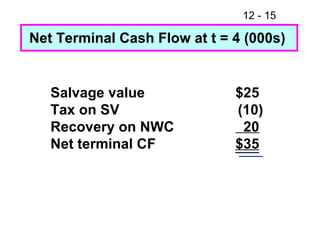

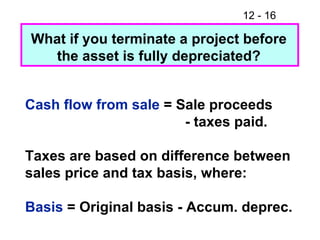

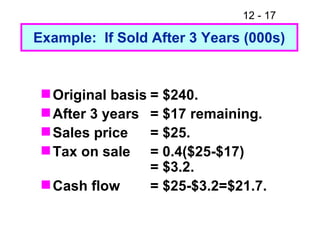

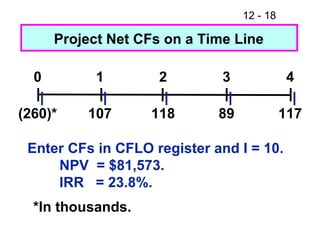

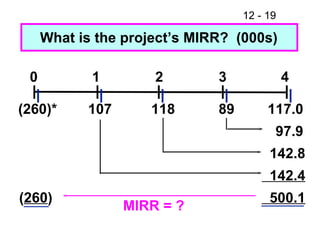

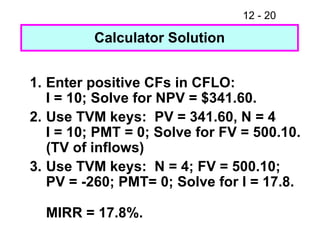

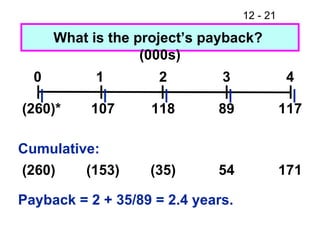

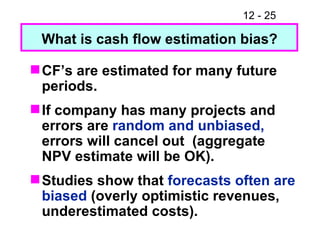

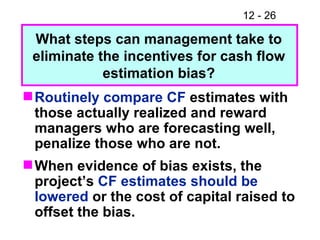

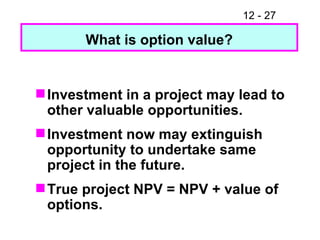

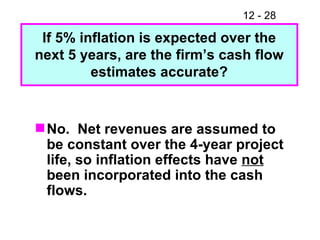

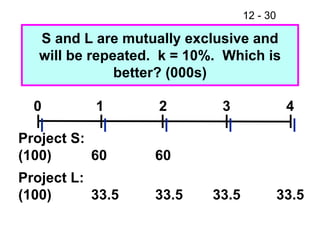

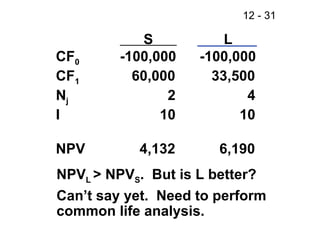

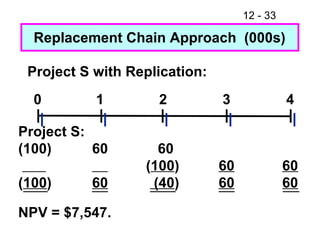

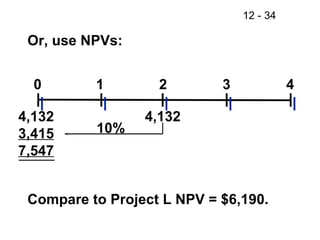

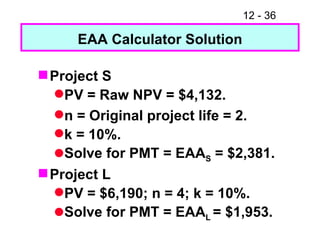

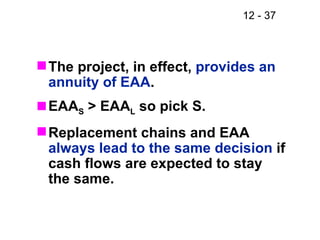

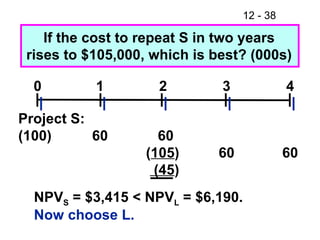

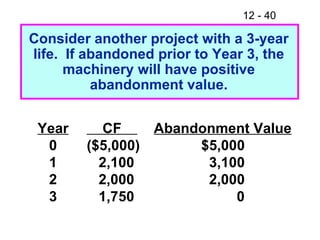

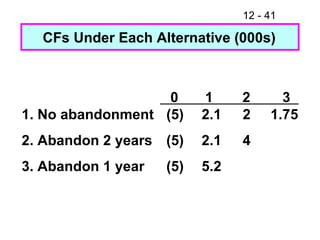

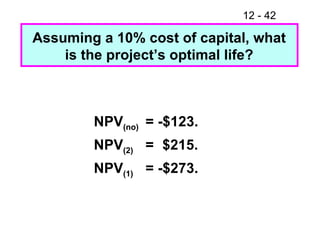

The document discusses concepts related to project cash flow analysis including relevant cash flows, unequal project lives, abandonment value, inflation, and cash flow estimation bias. It provides an example project with initial outlay, operating cash flows, tax rate, salvage value, and cash flows over 4 years. It calculates NPV, IRR, MIRR, and payback for the example project. The document also discusses making decisions between mutually exclusive projects using replacement chains and equivalent annual annuity analysis.