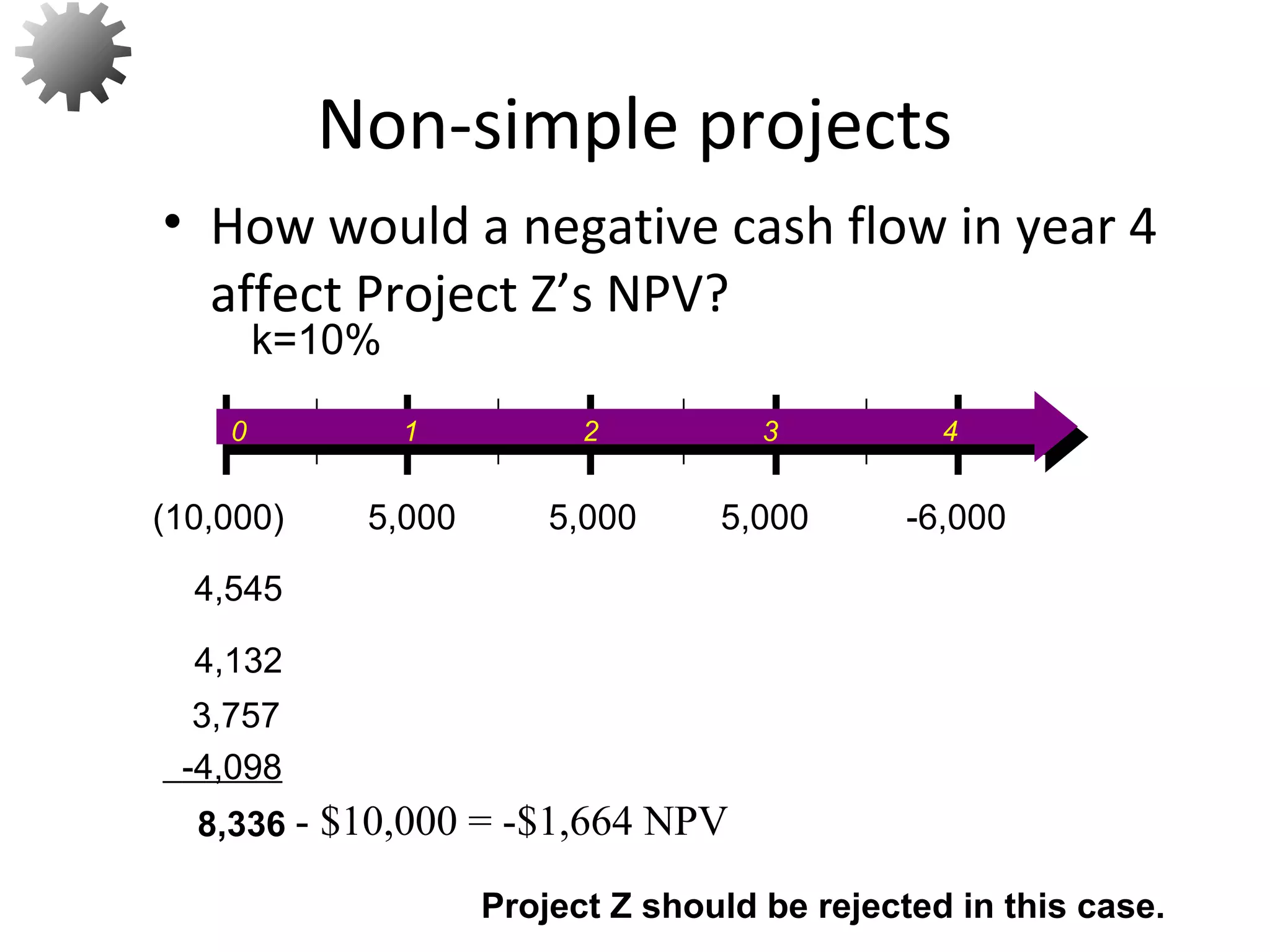

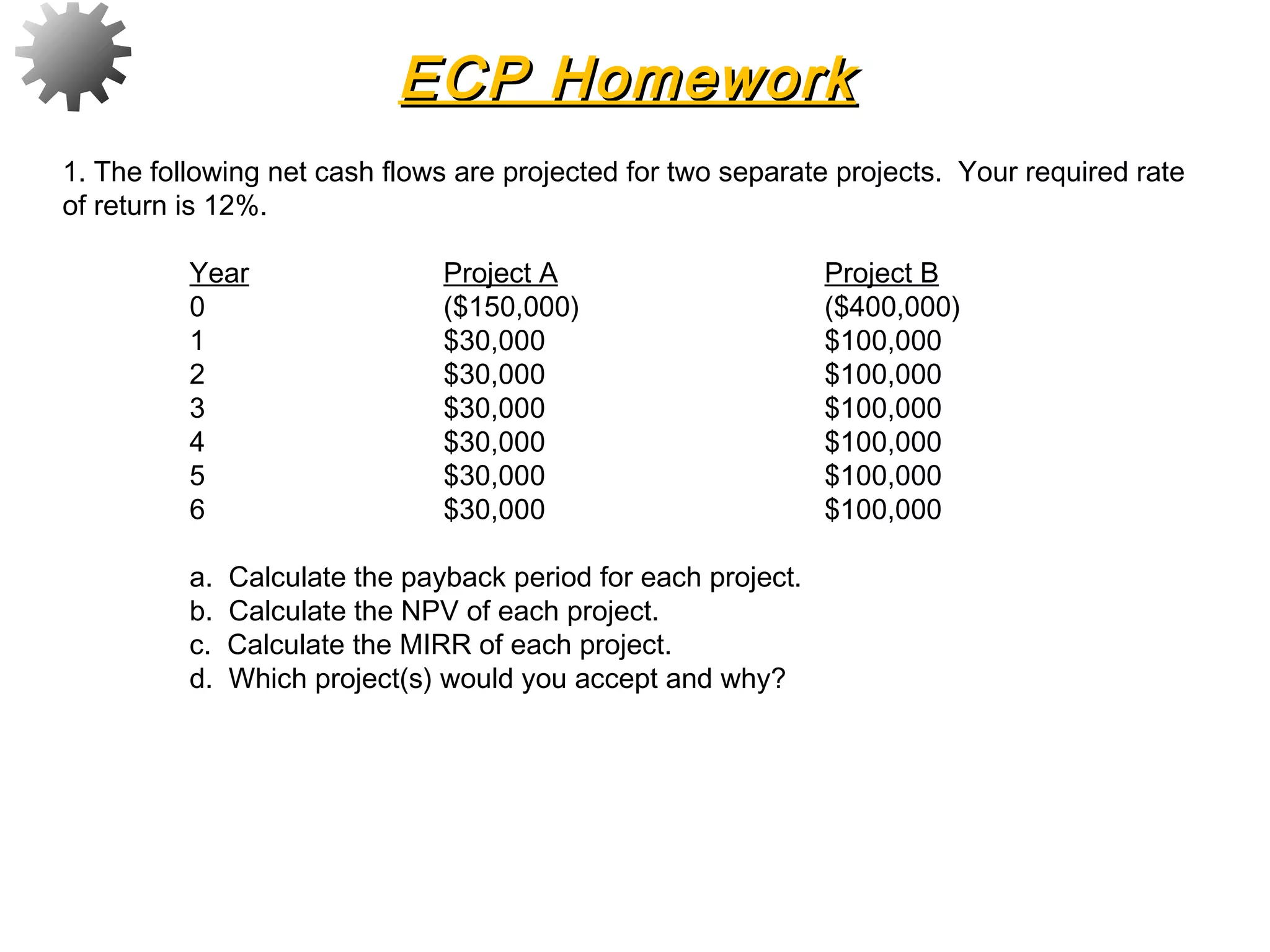

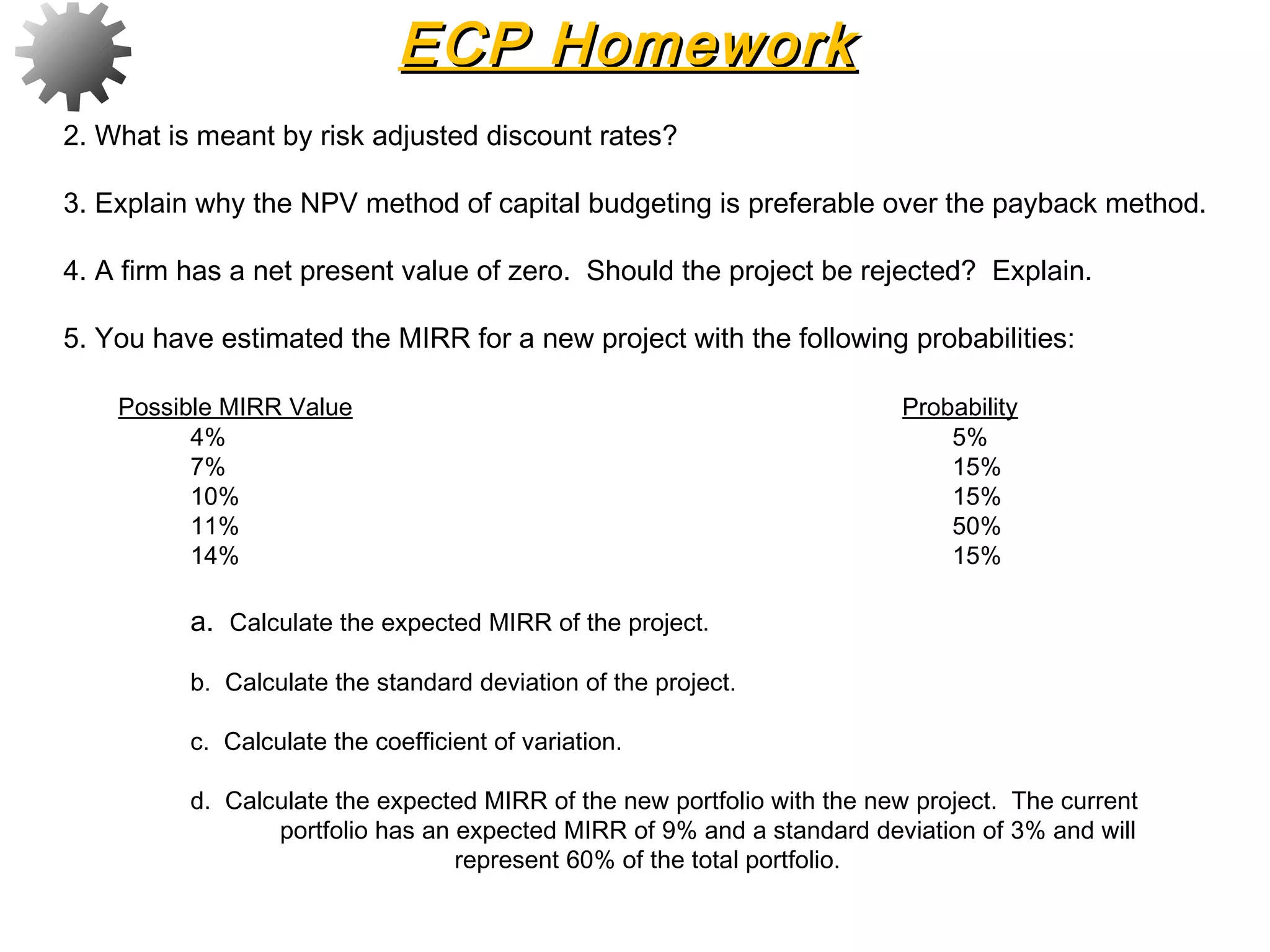

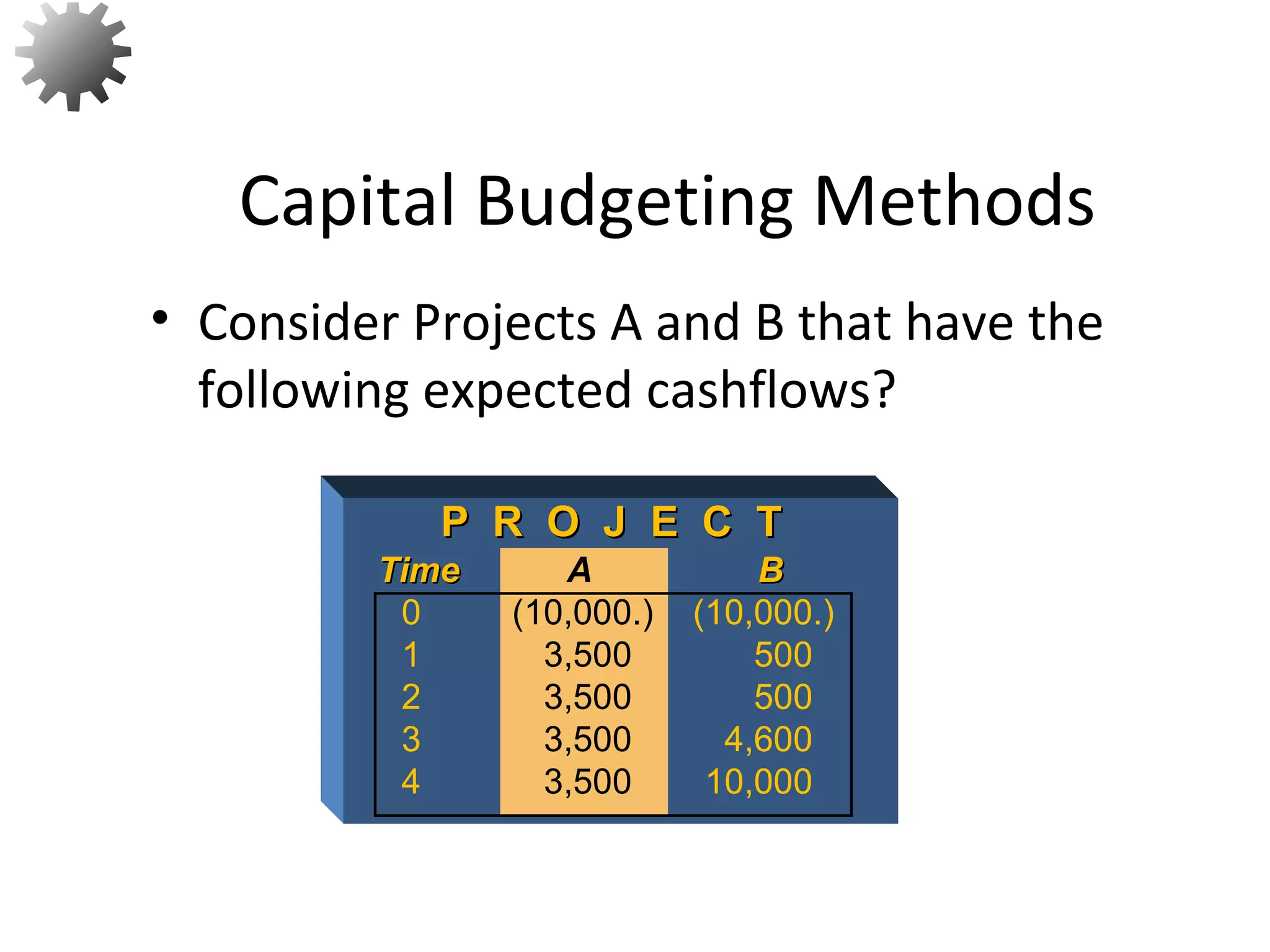

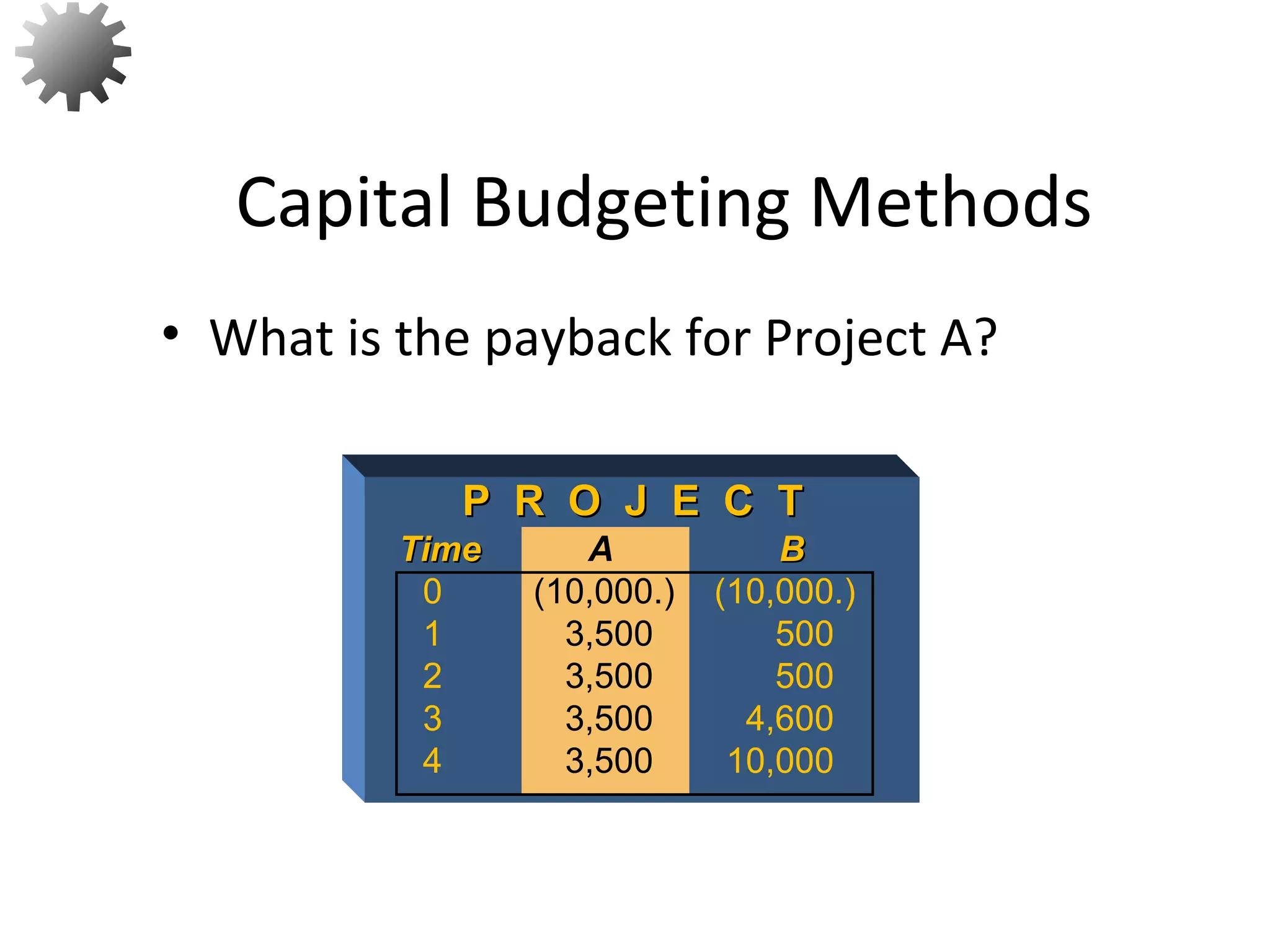

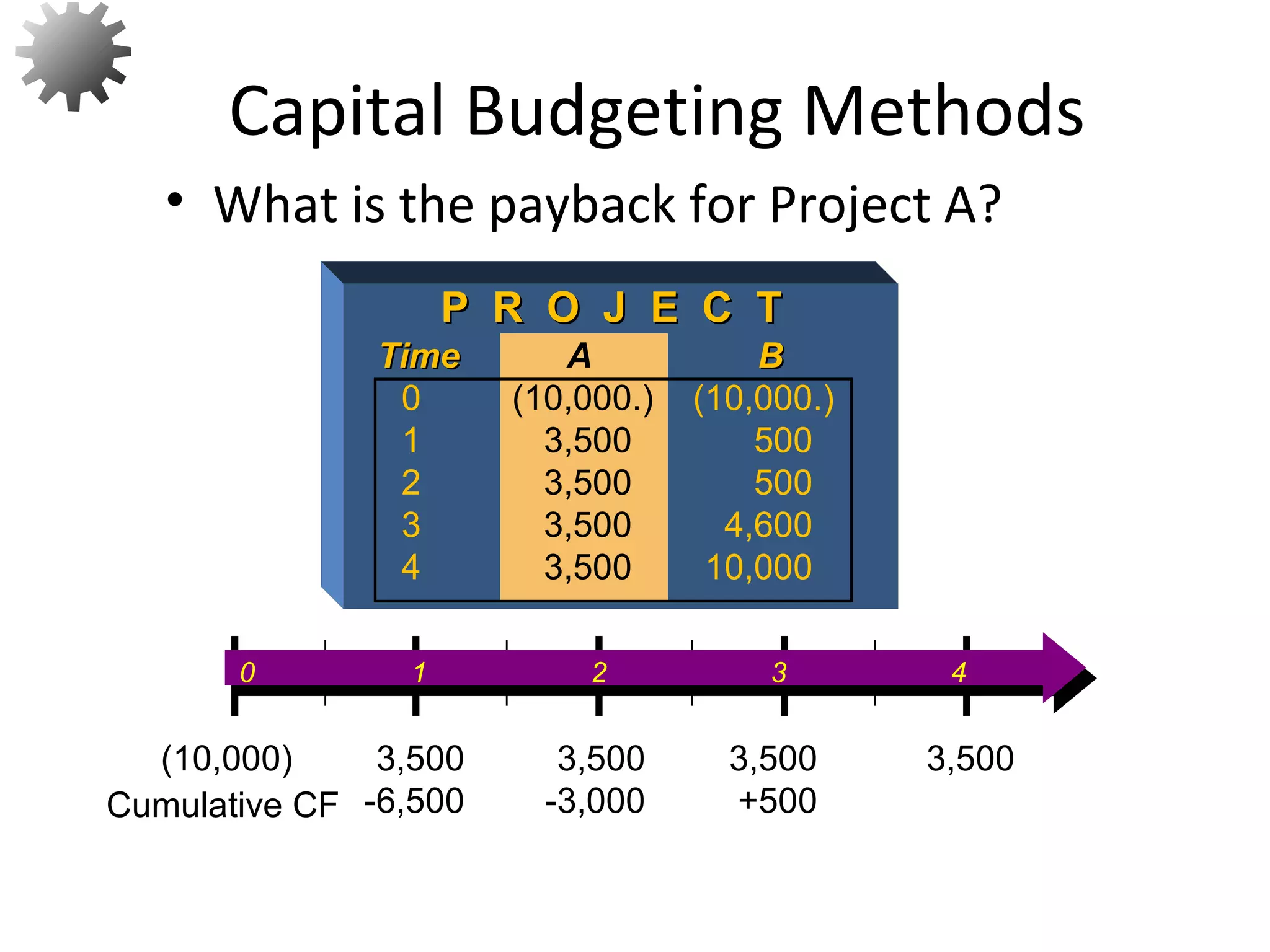

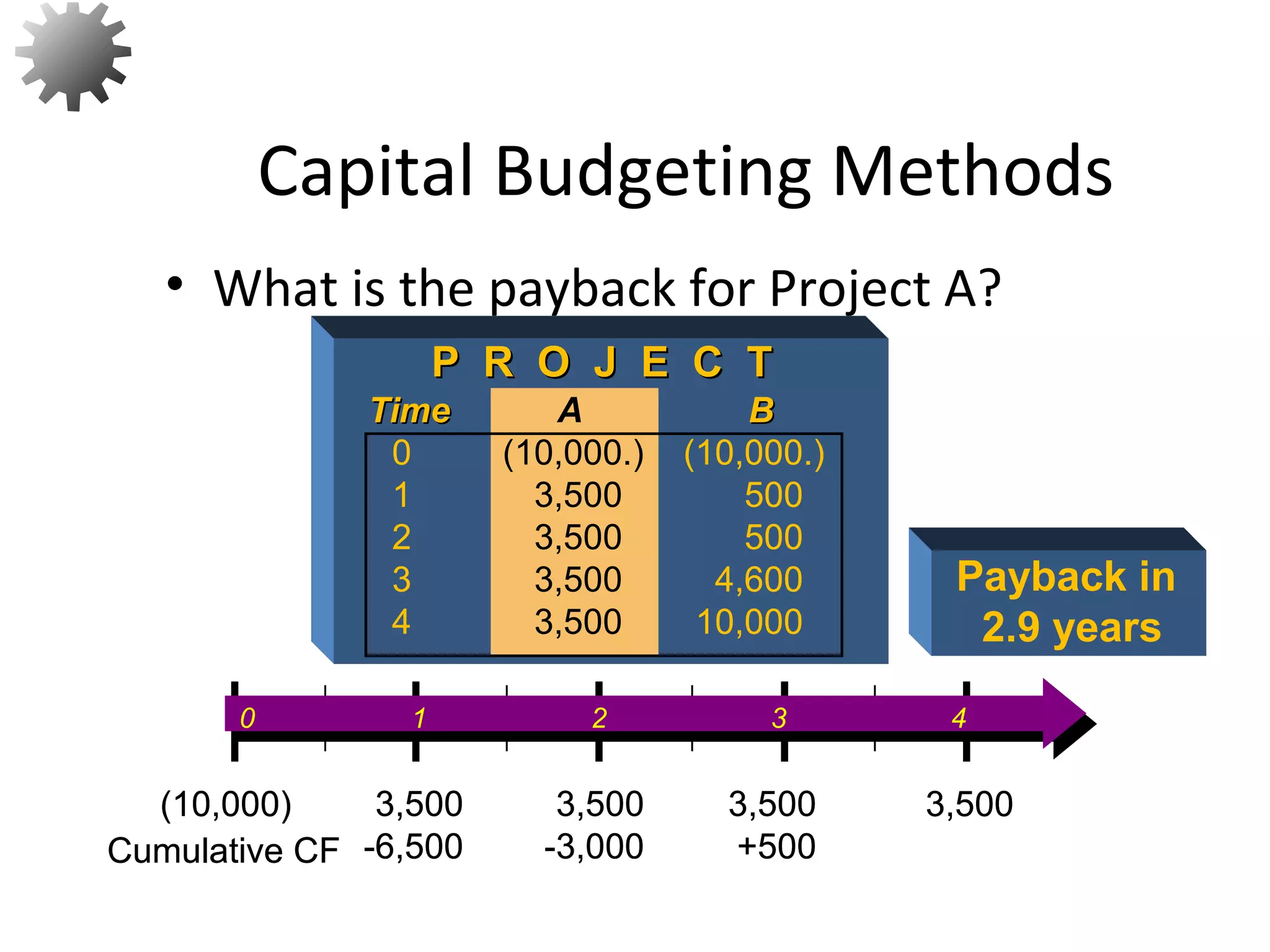

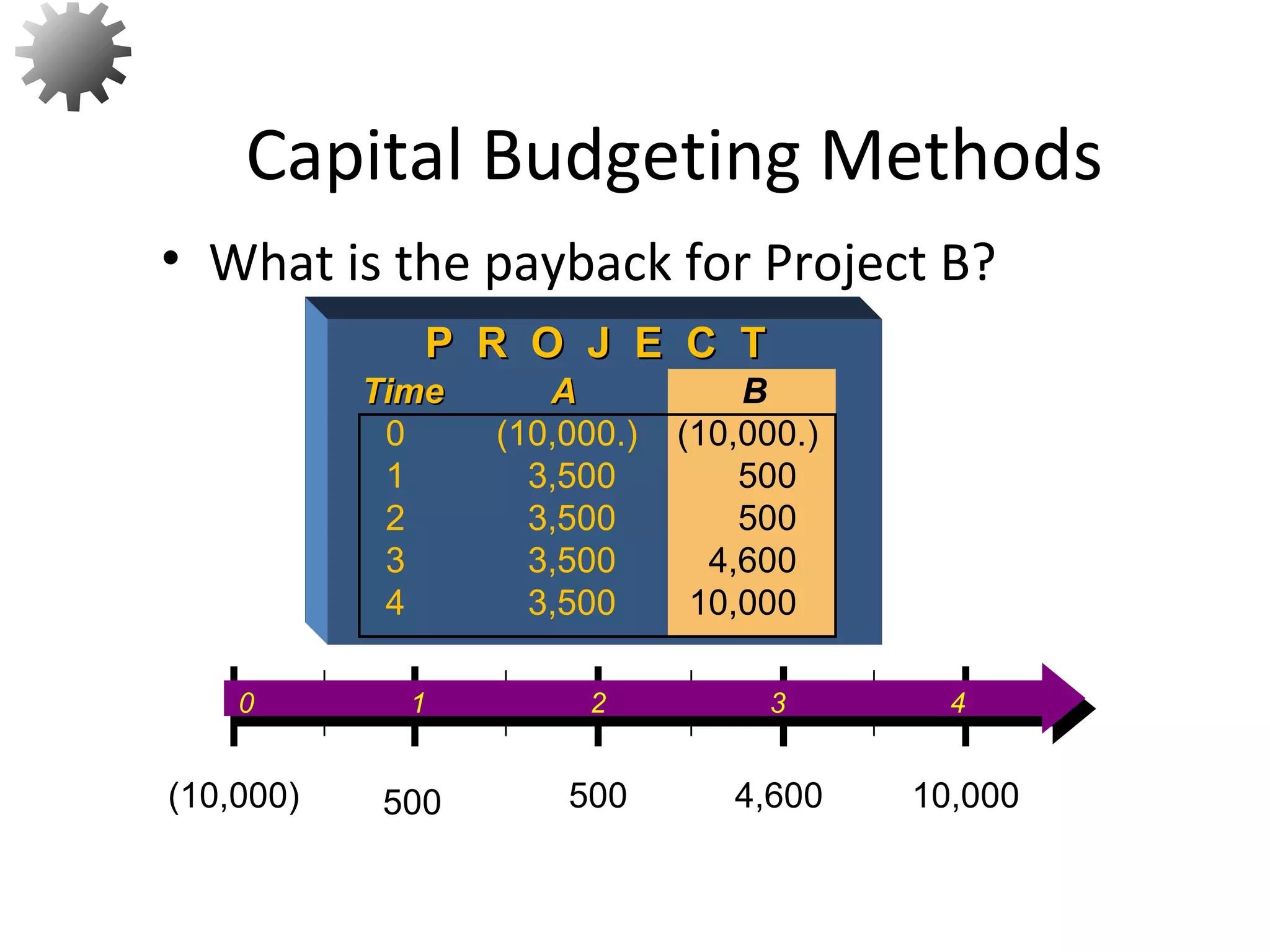

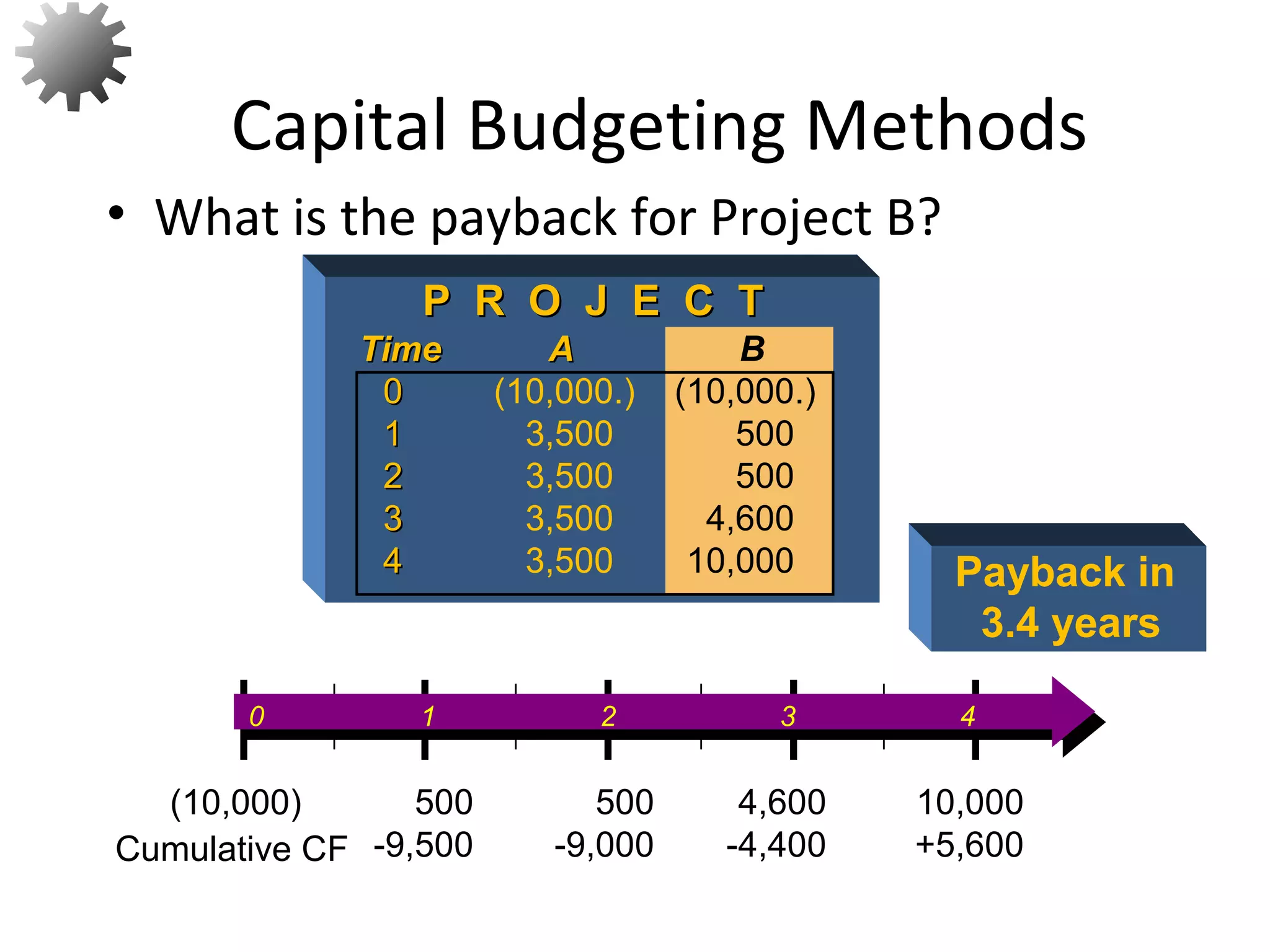

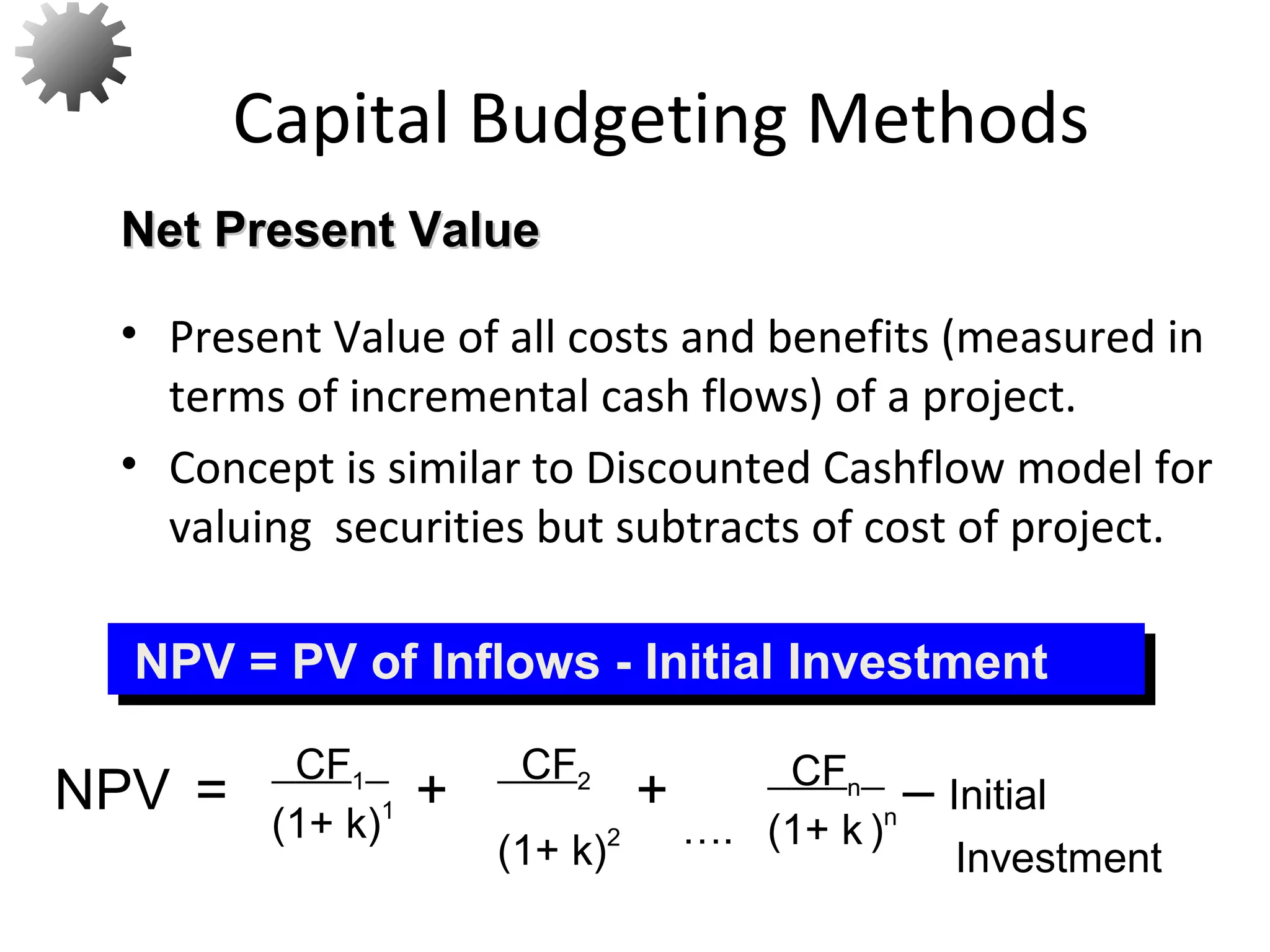

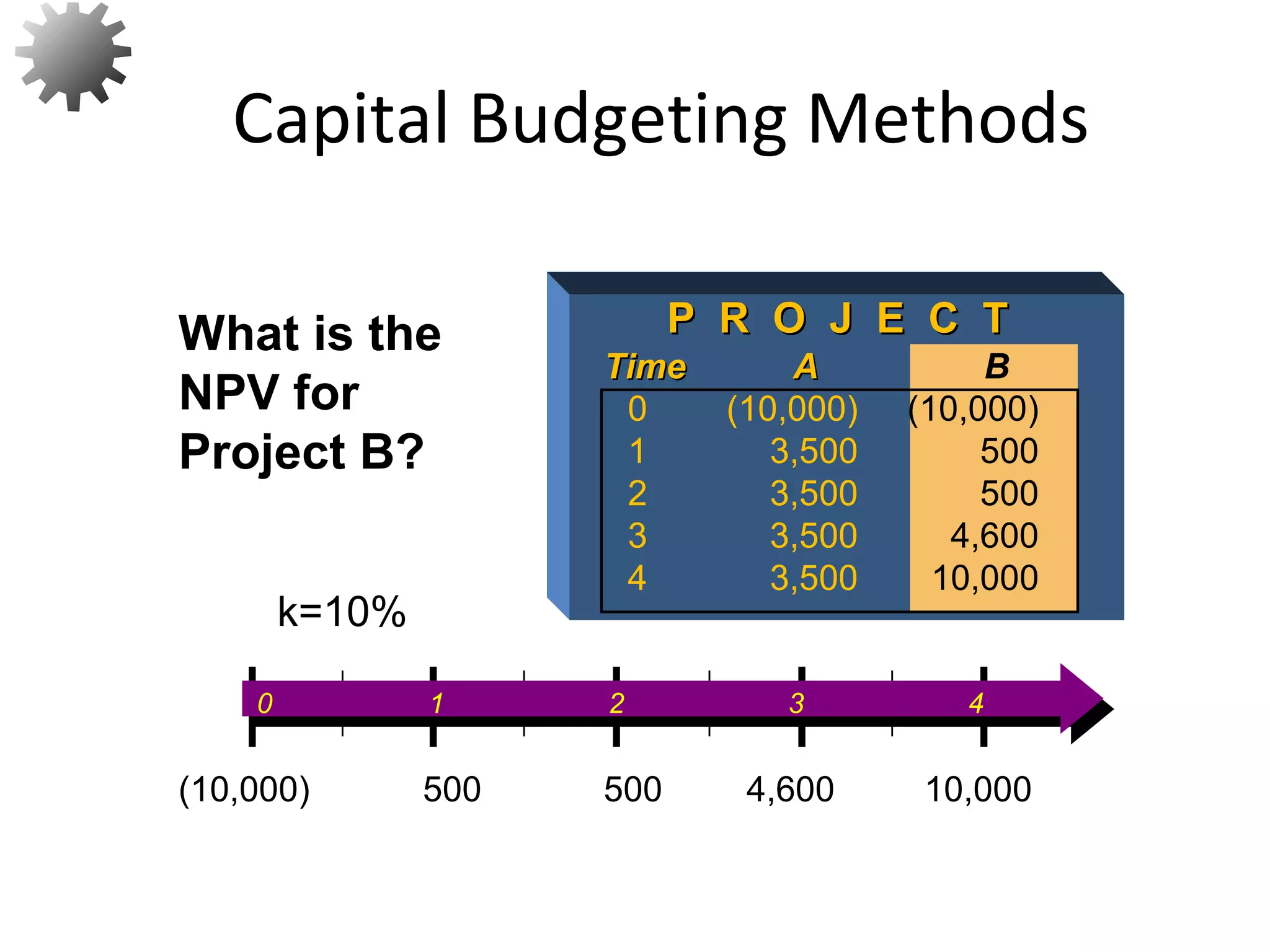

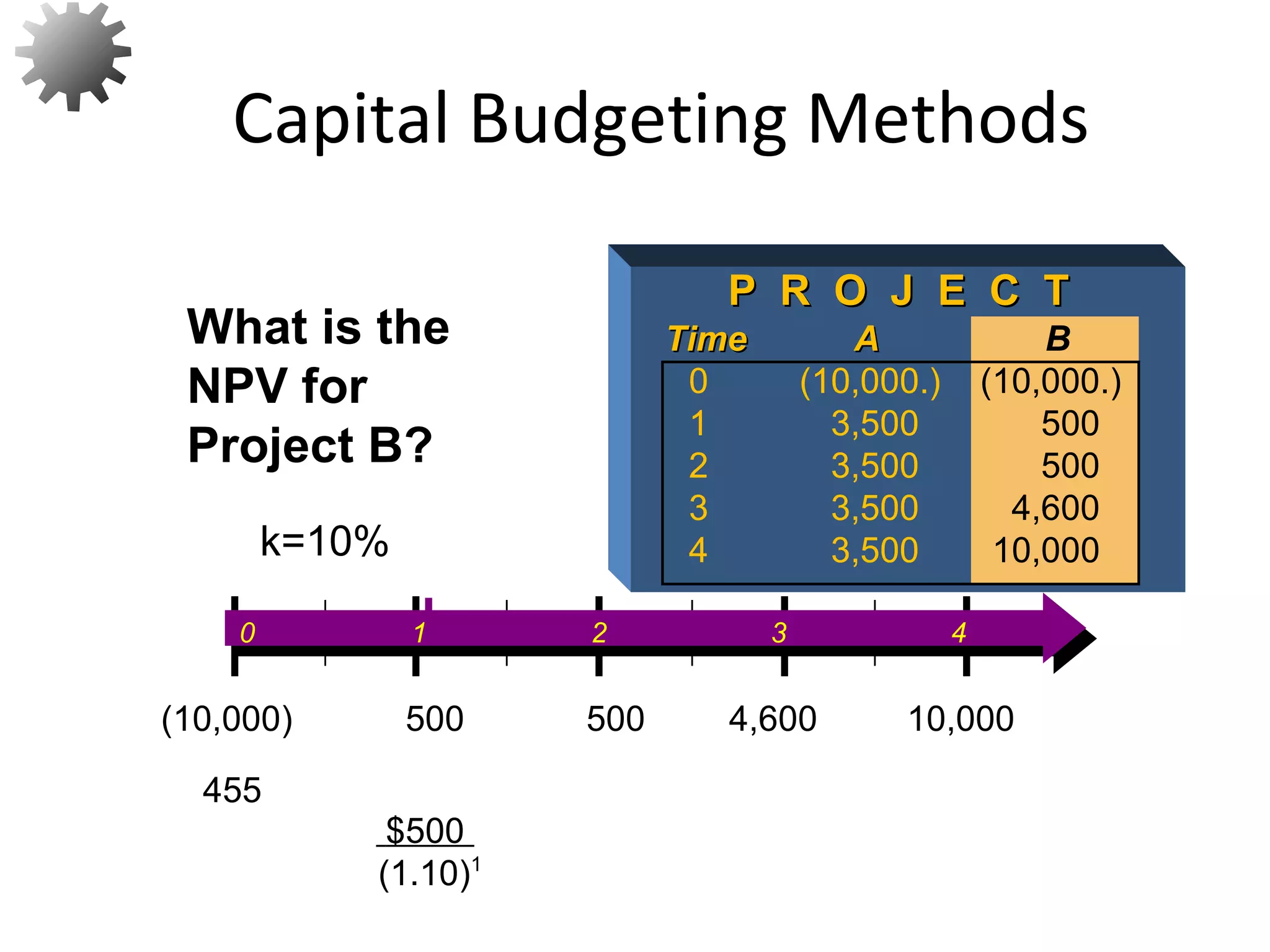

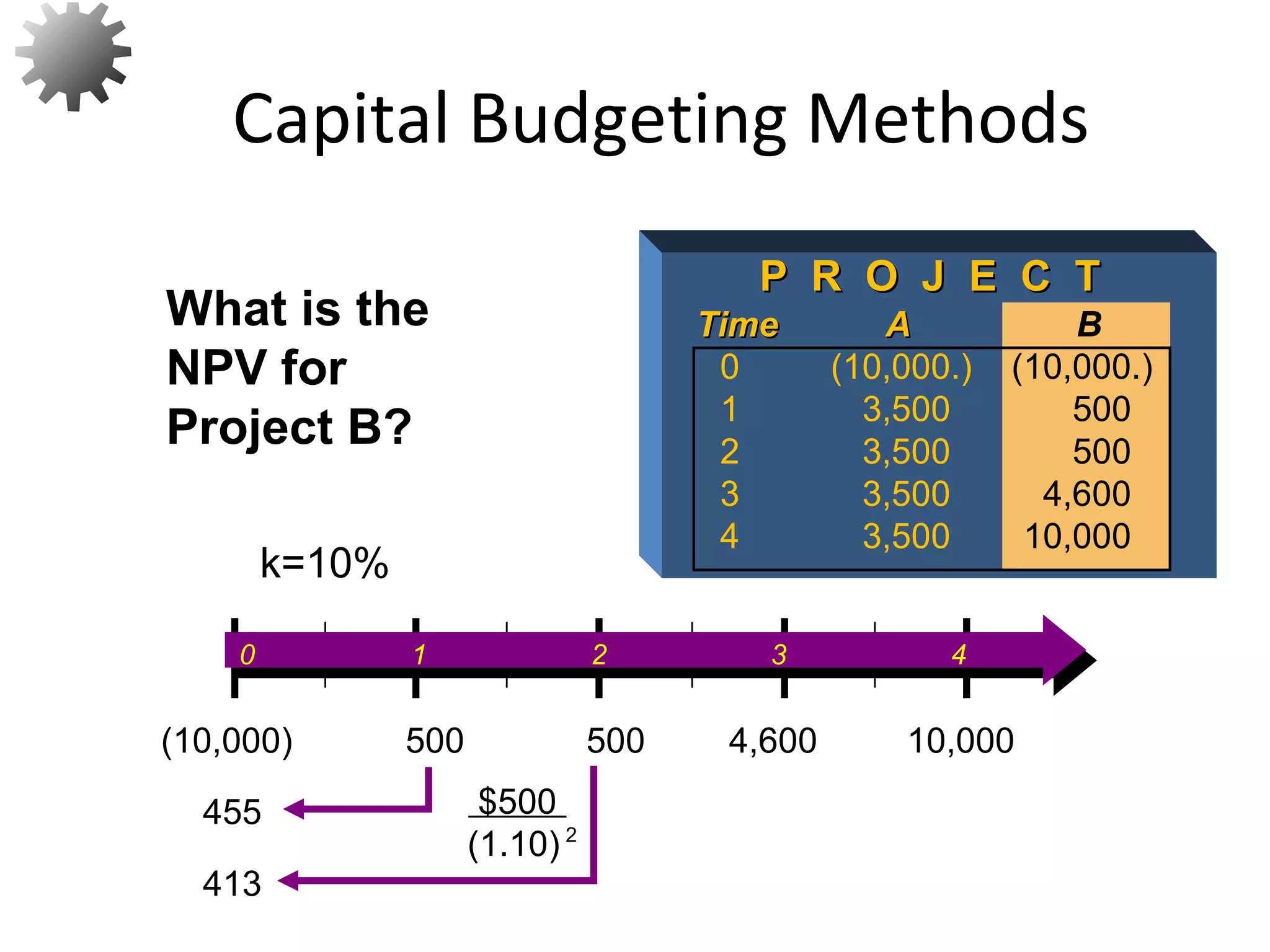

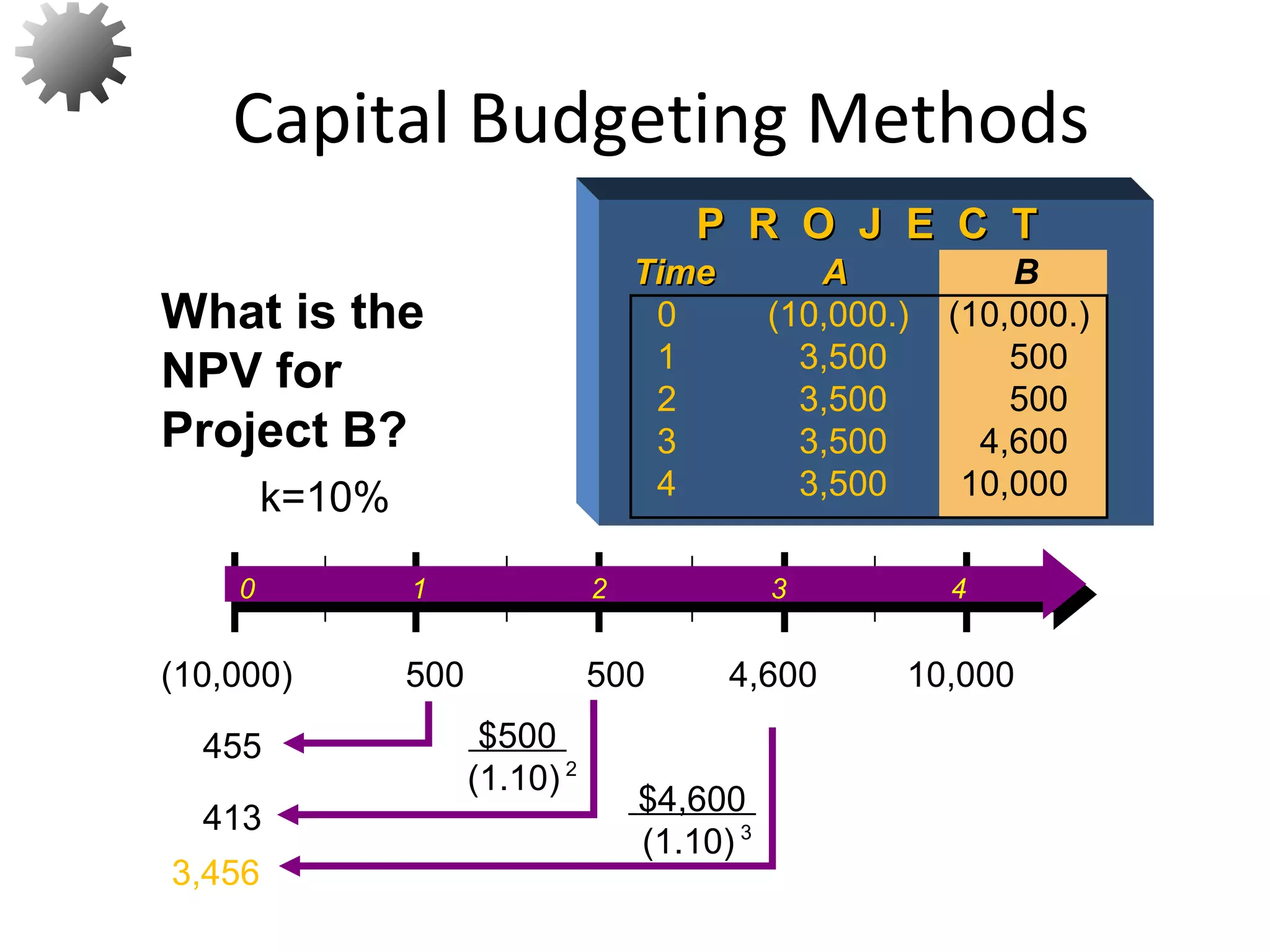

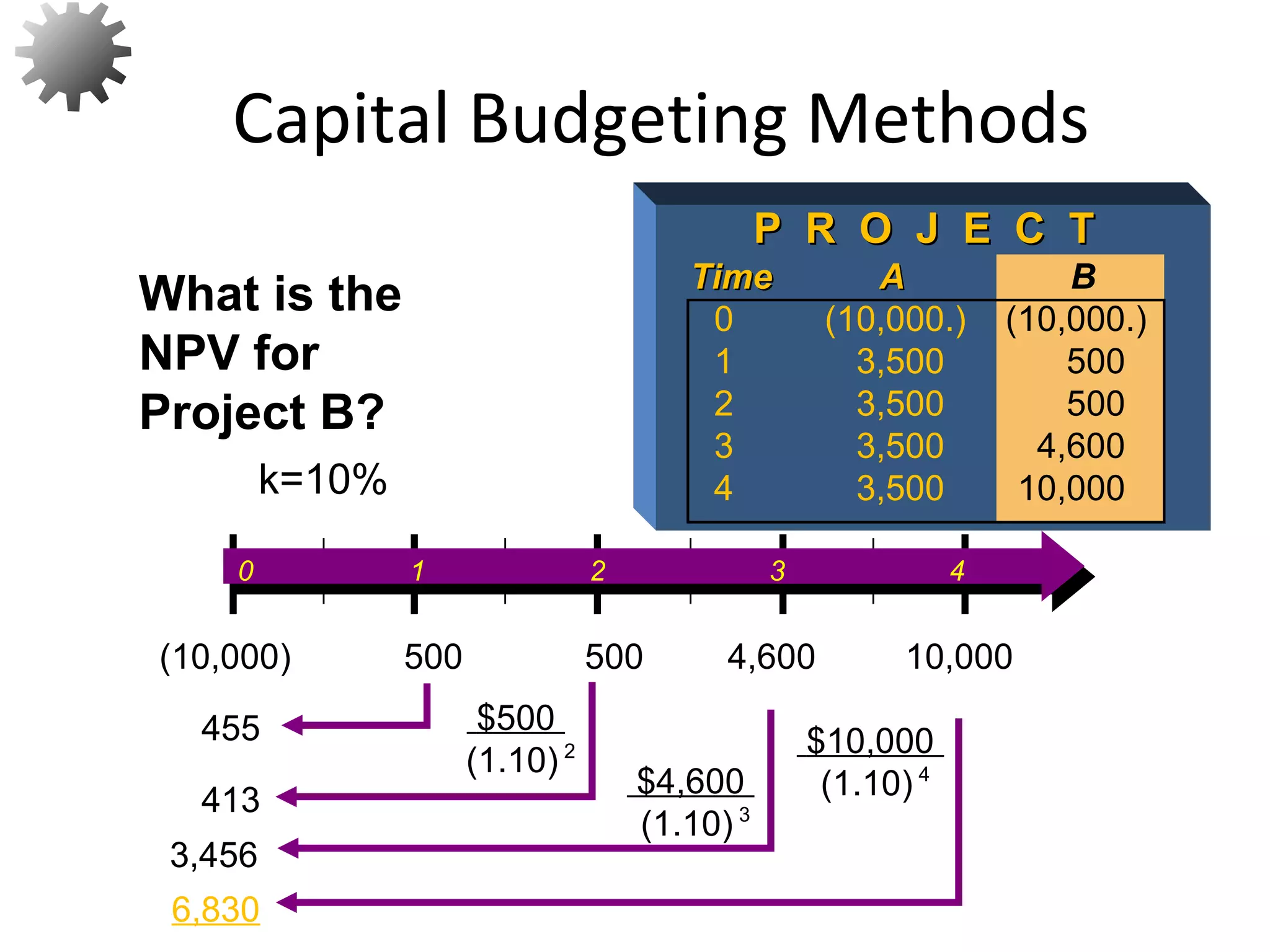

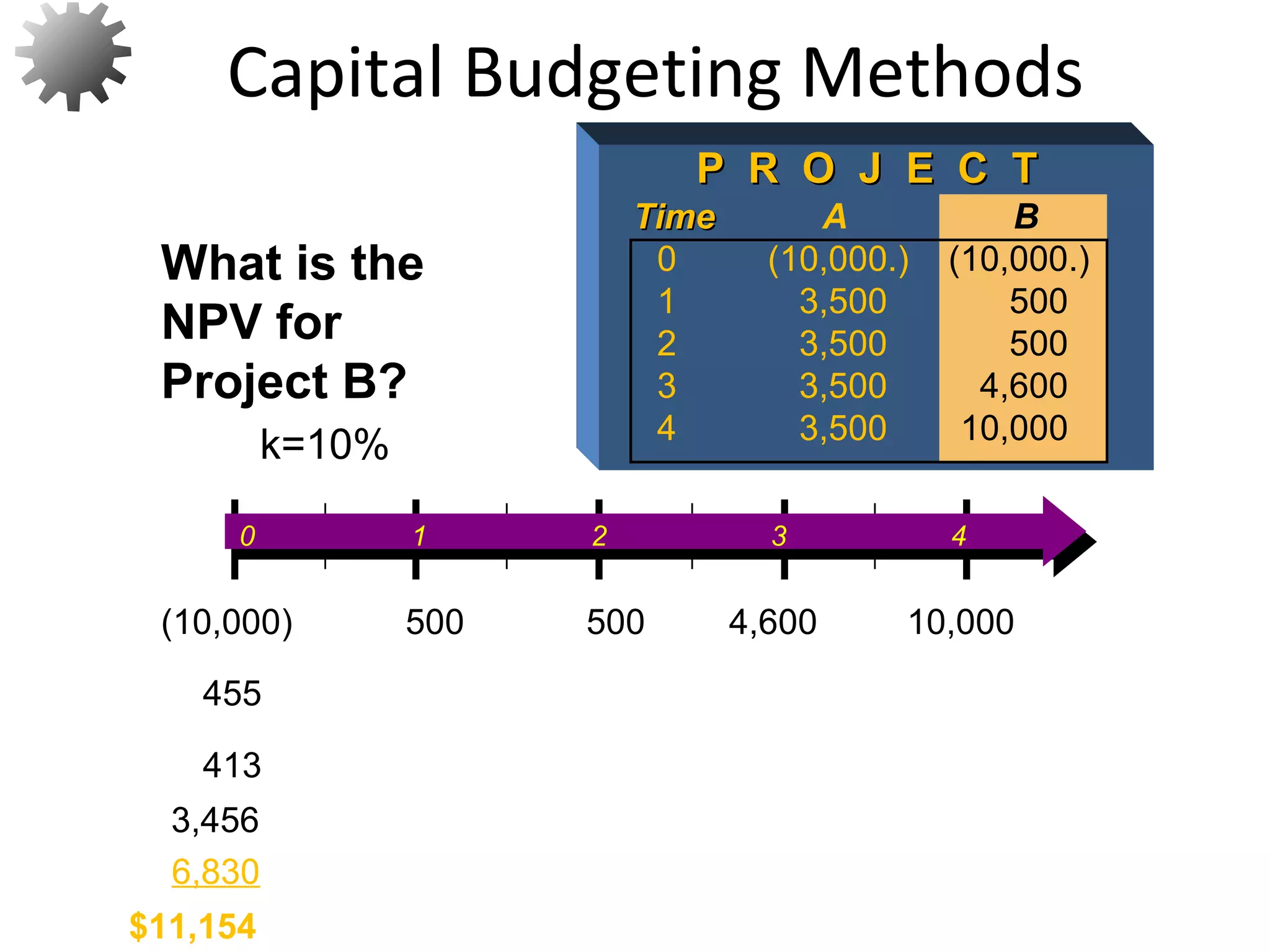

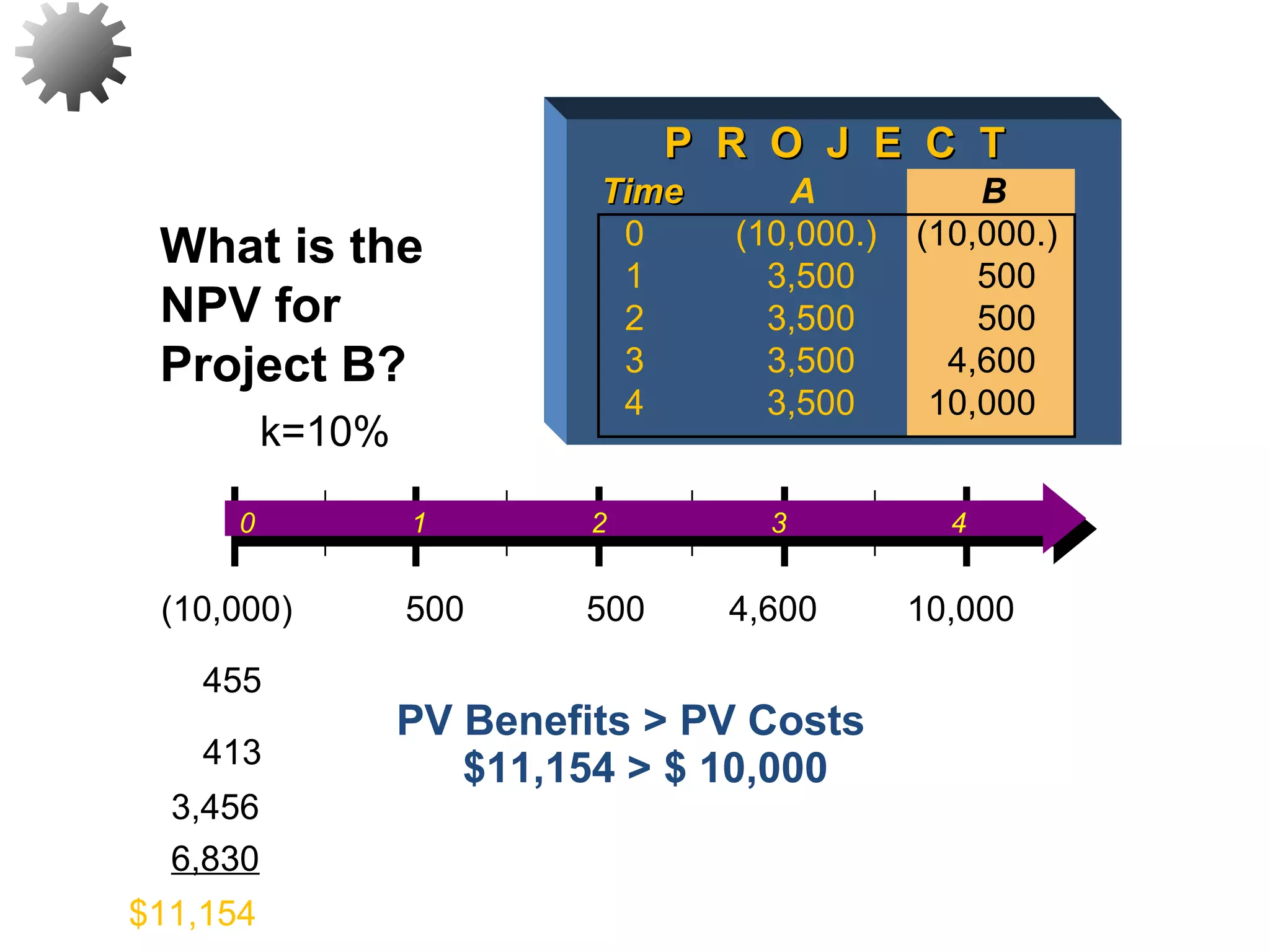

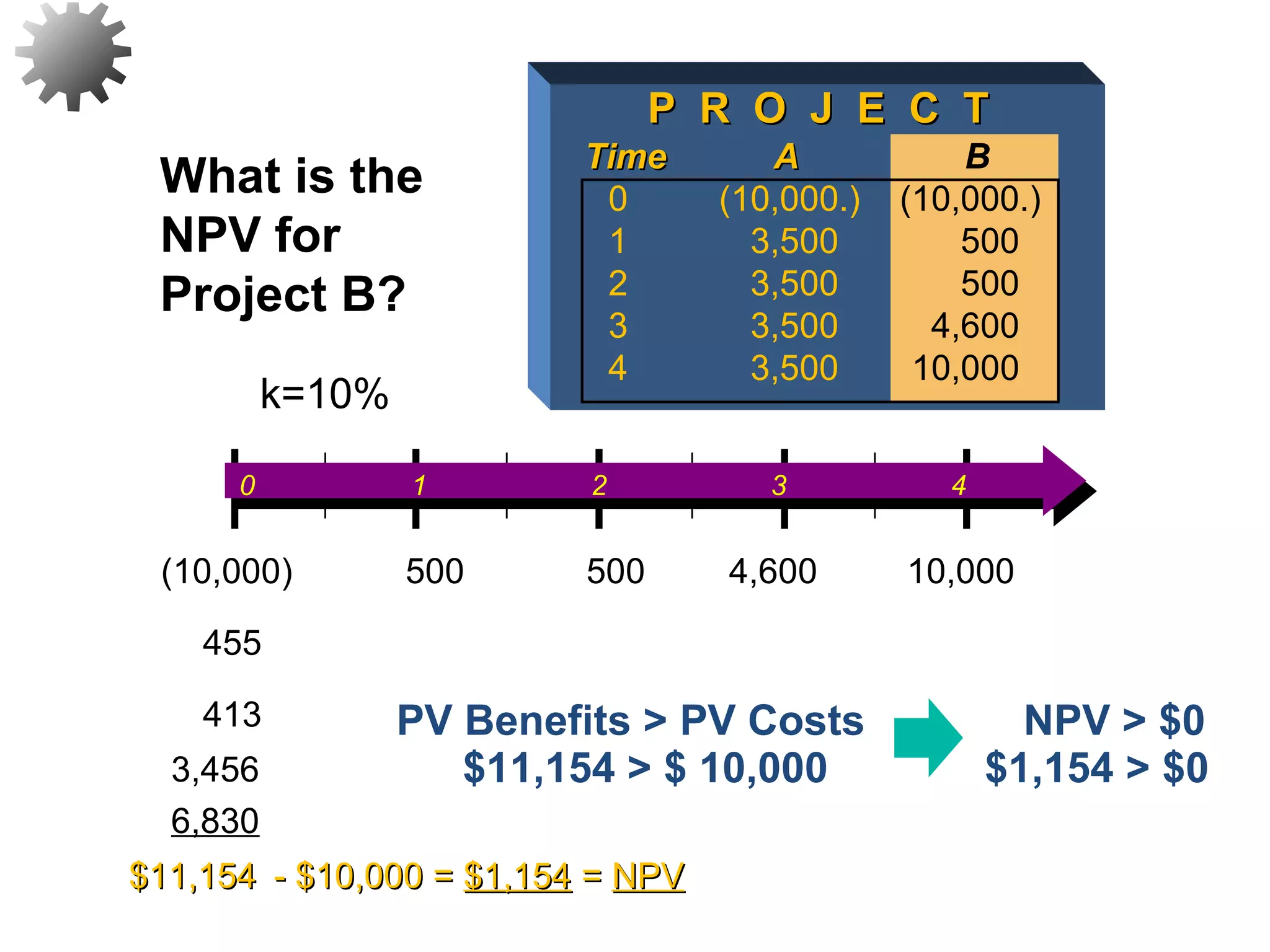

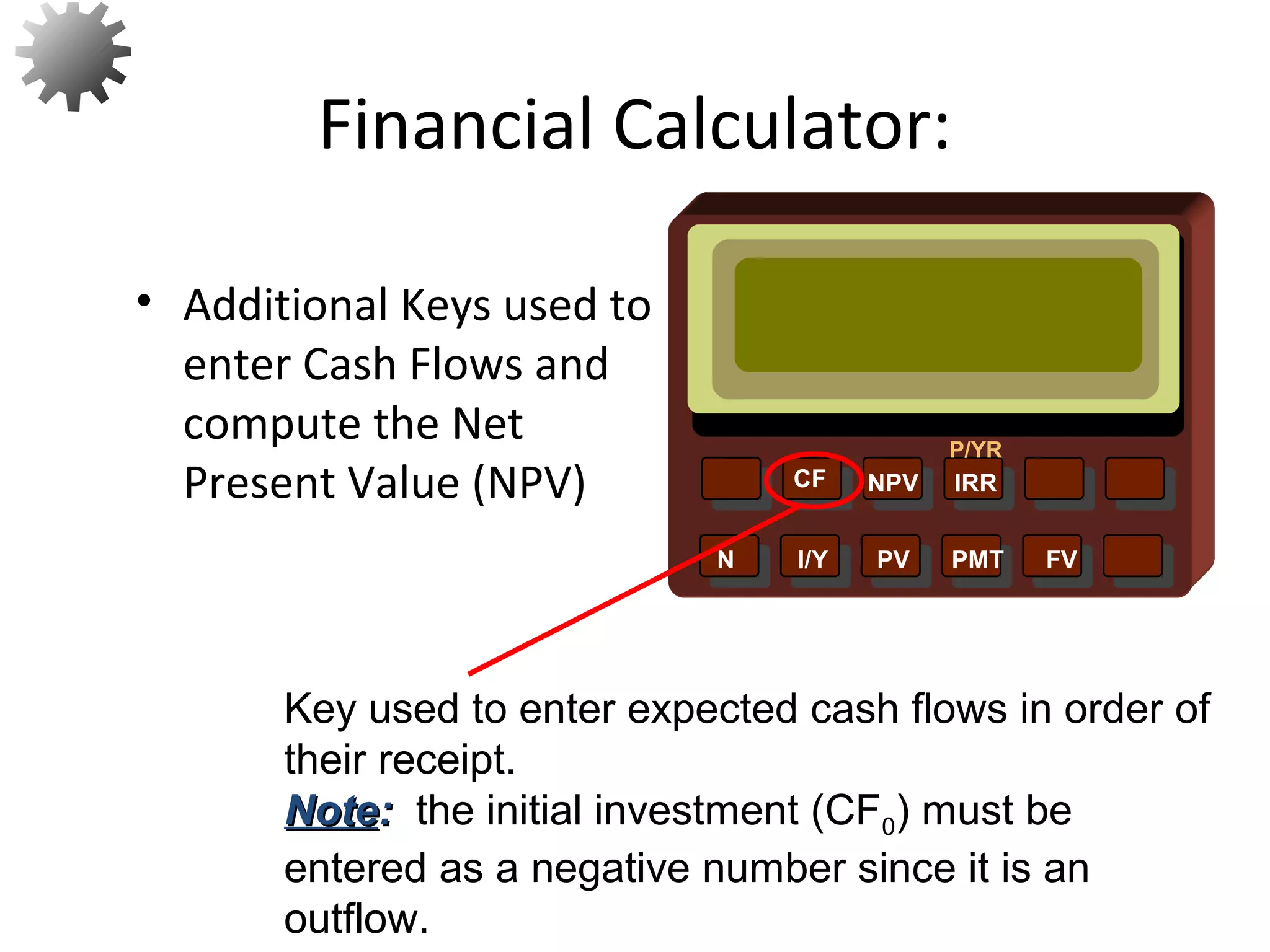

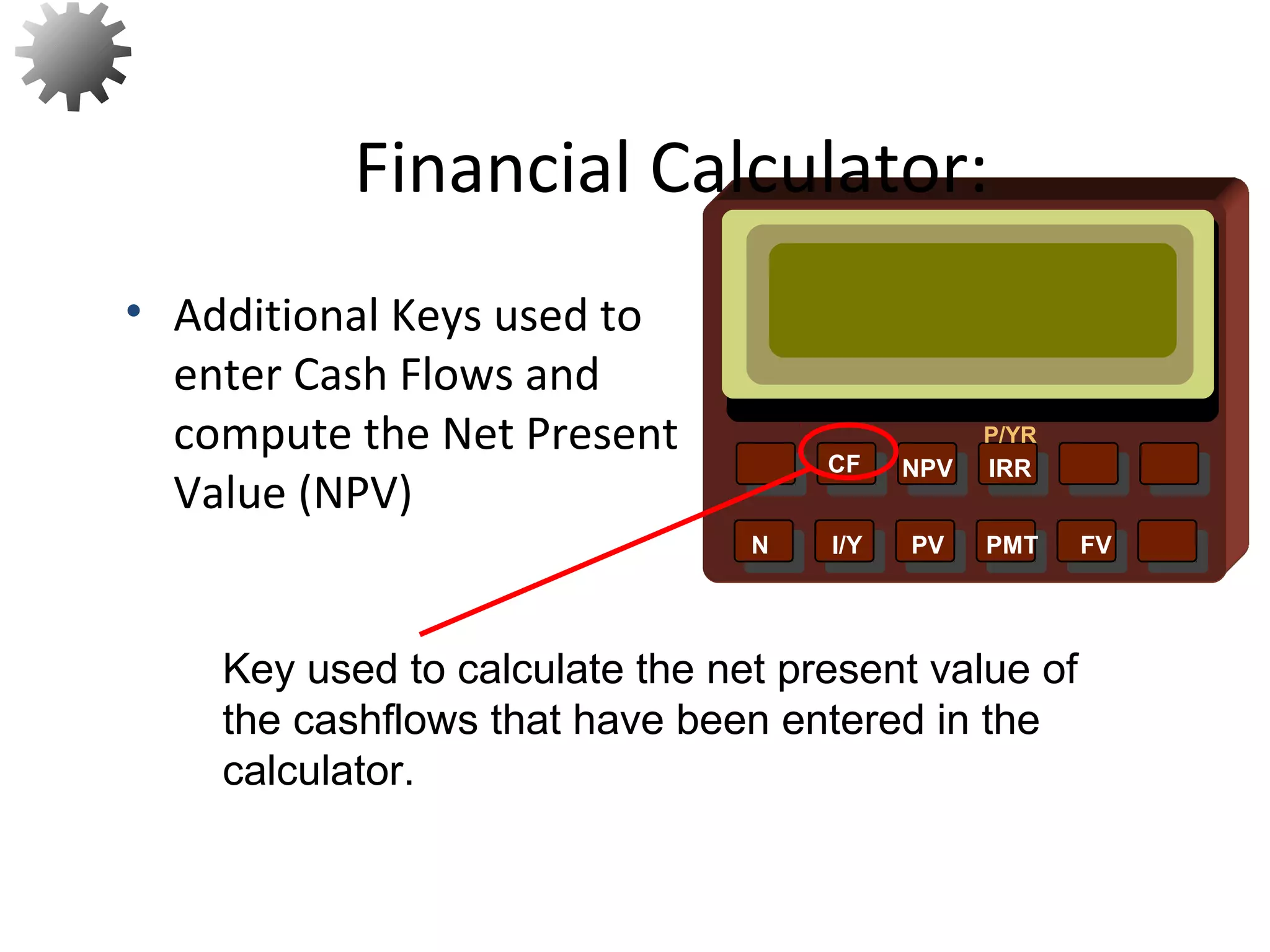

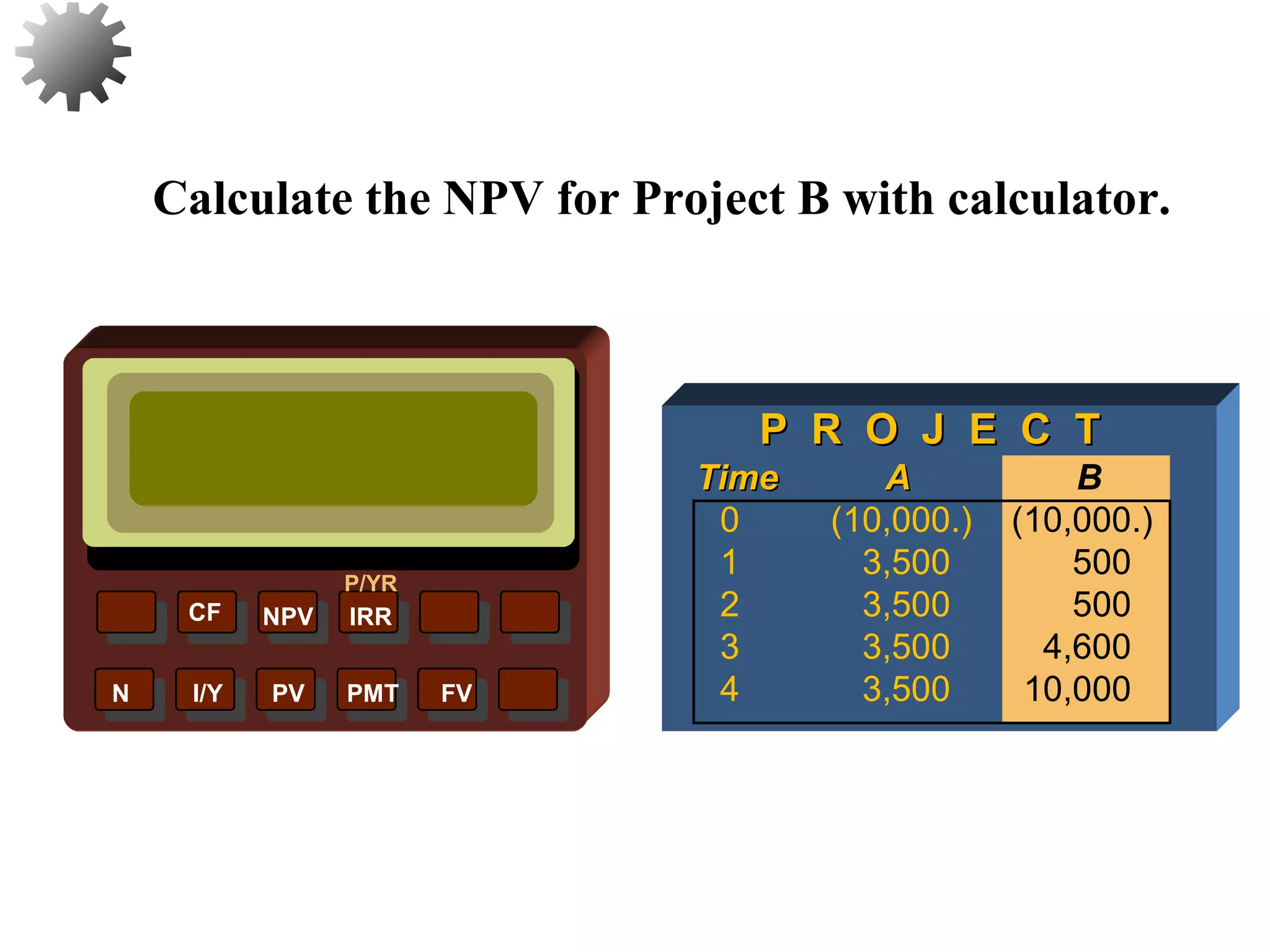

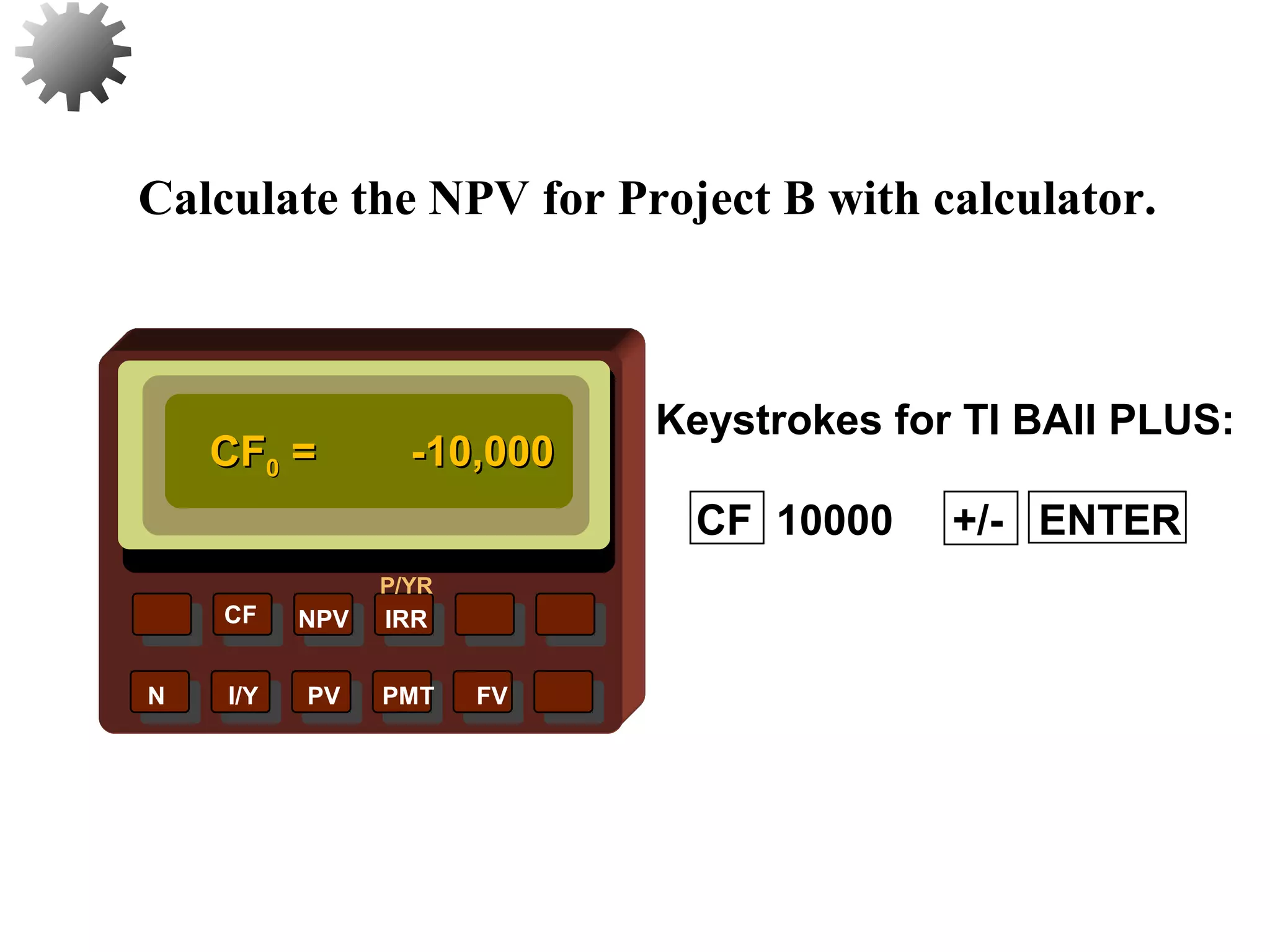

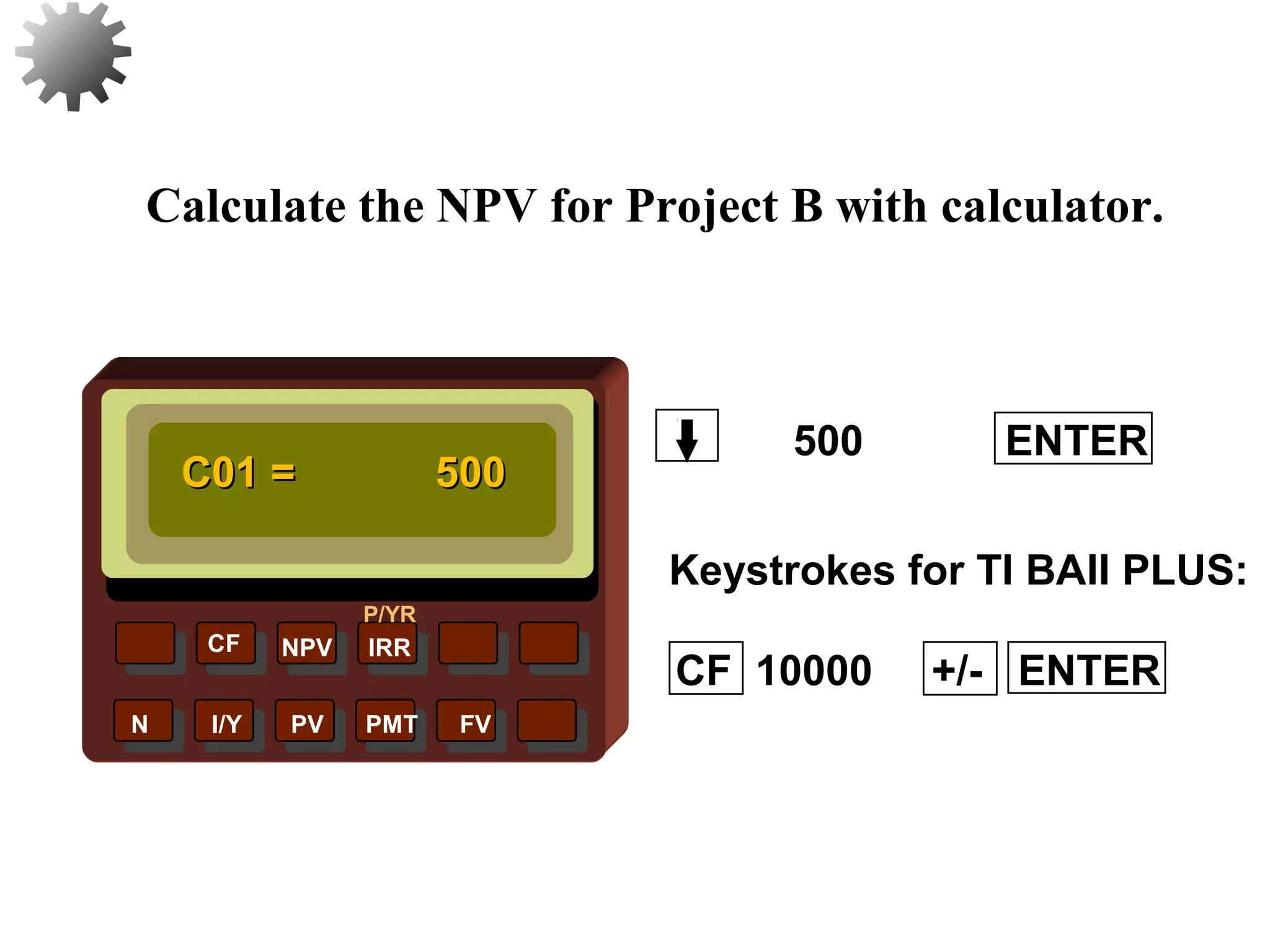

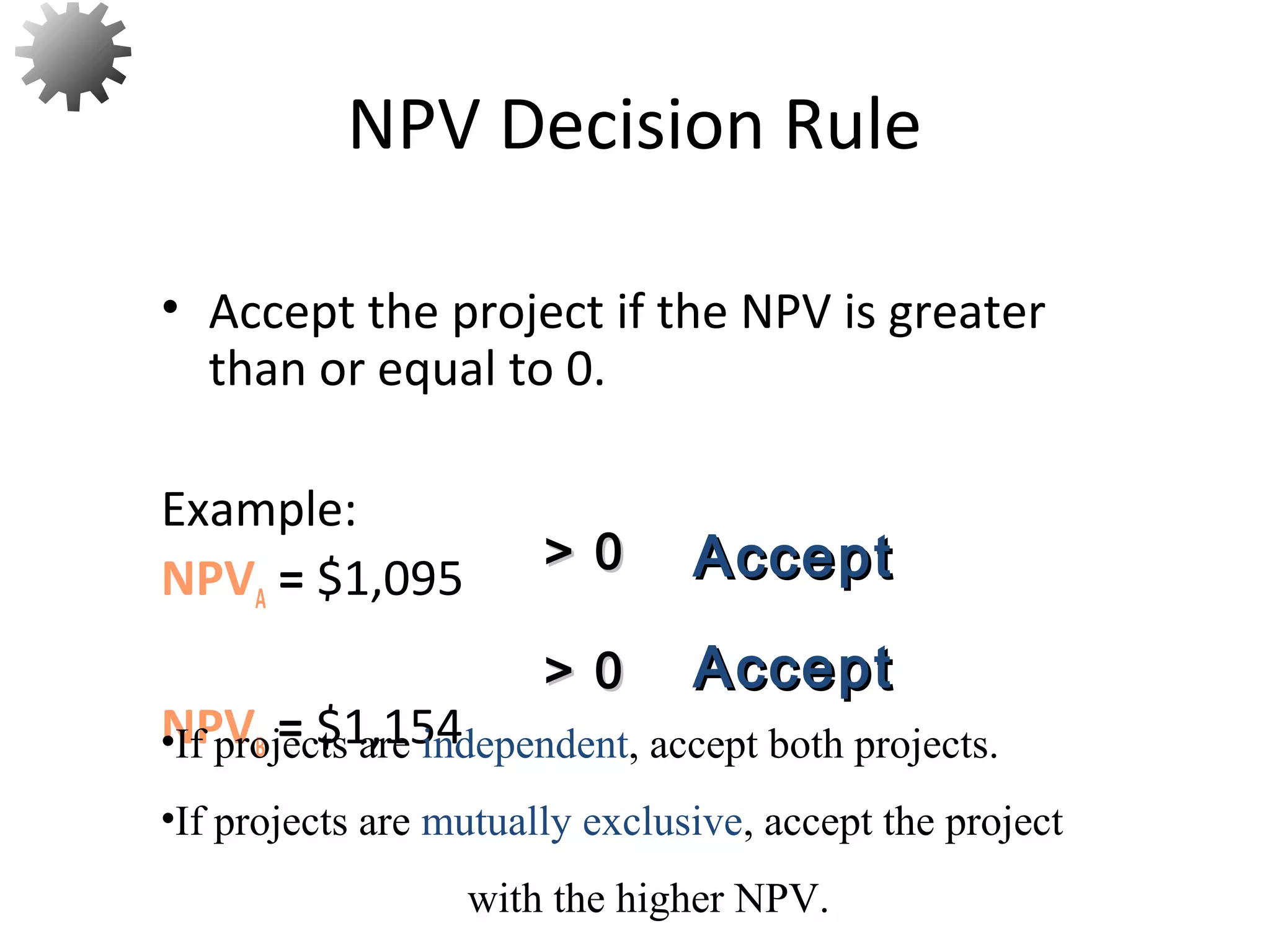

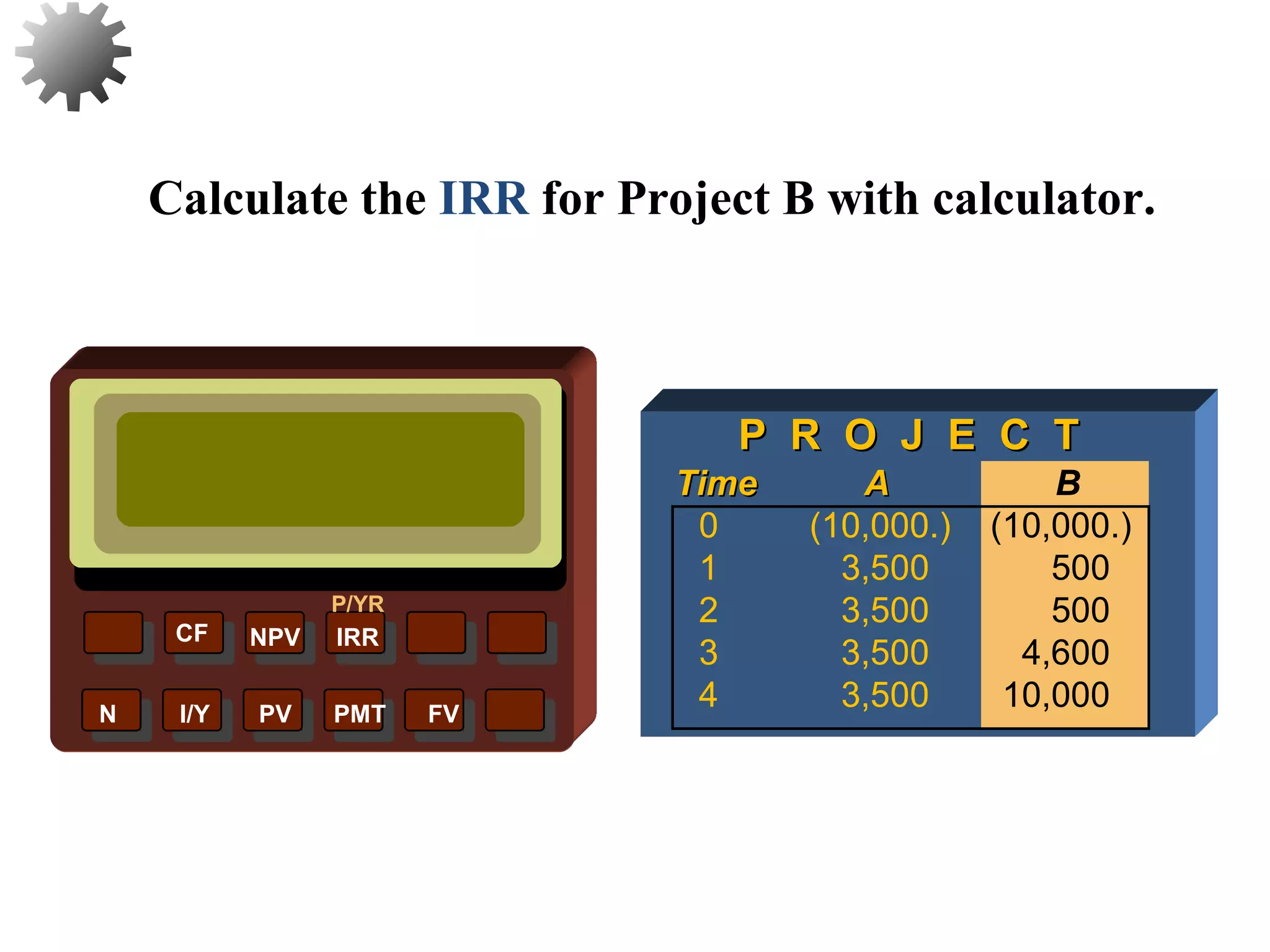

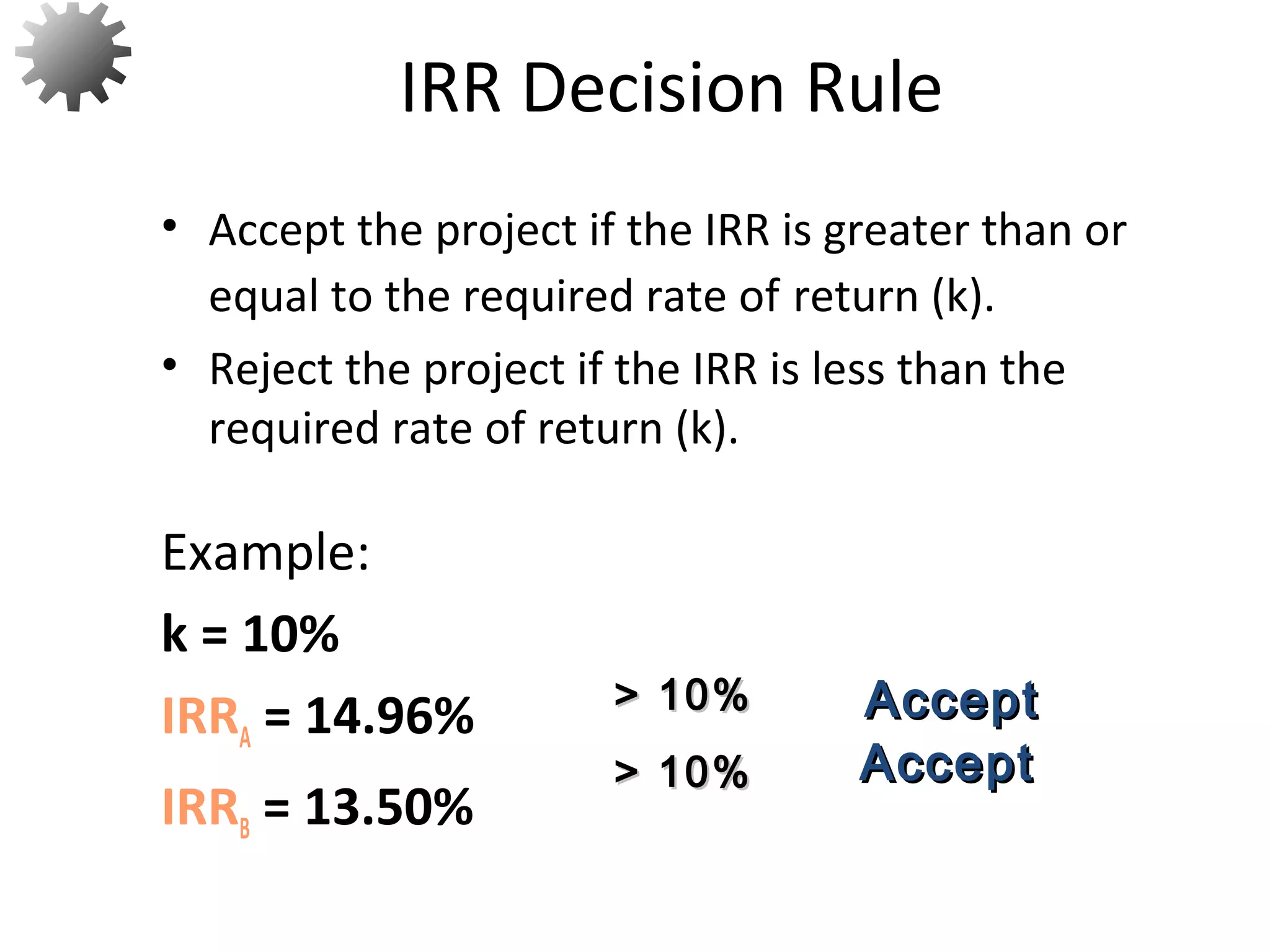

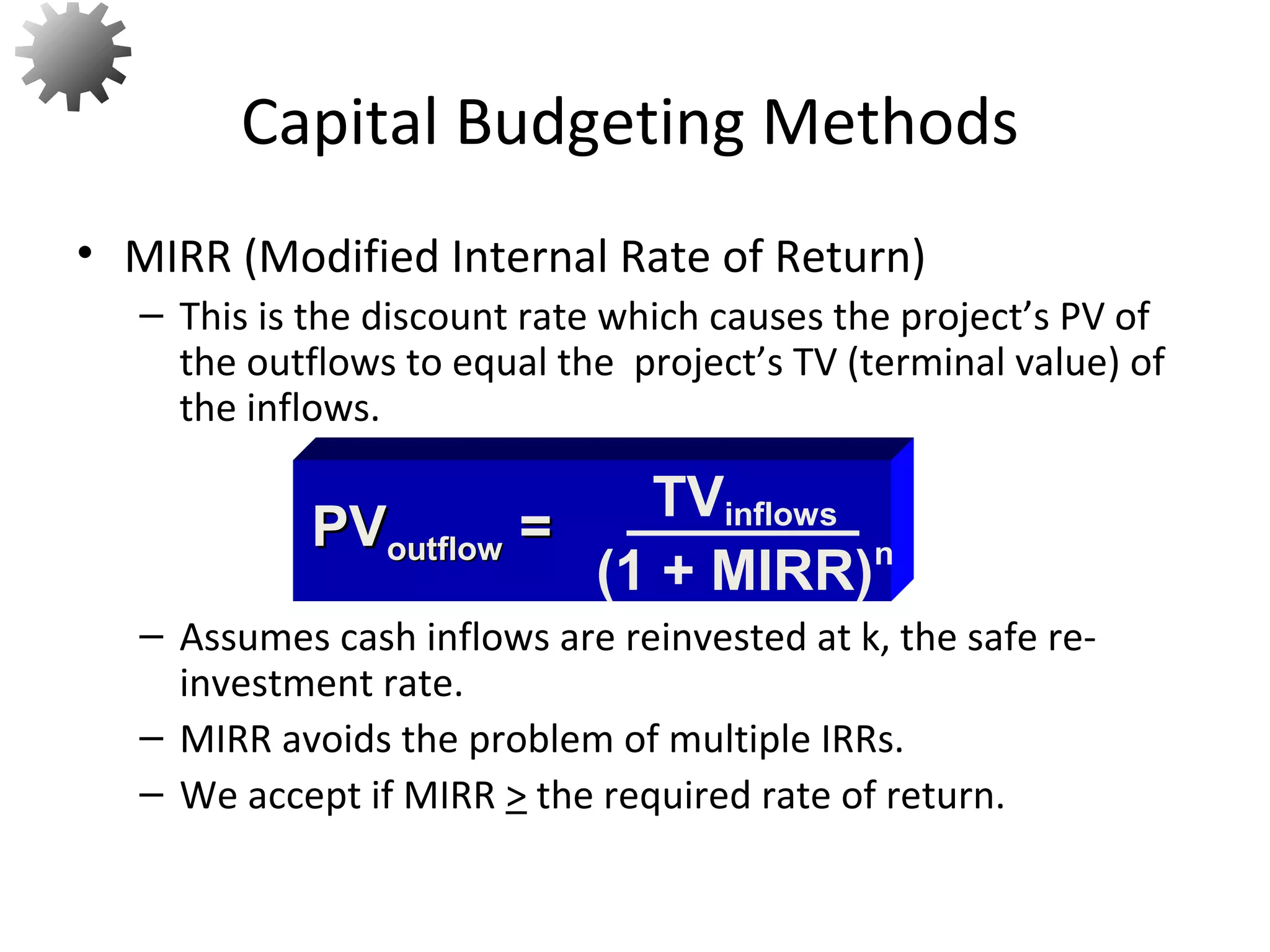

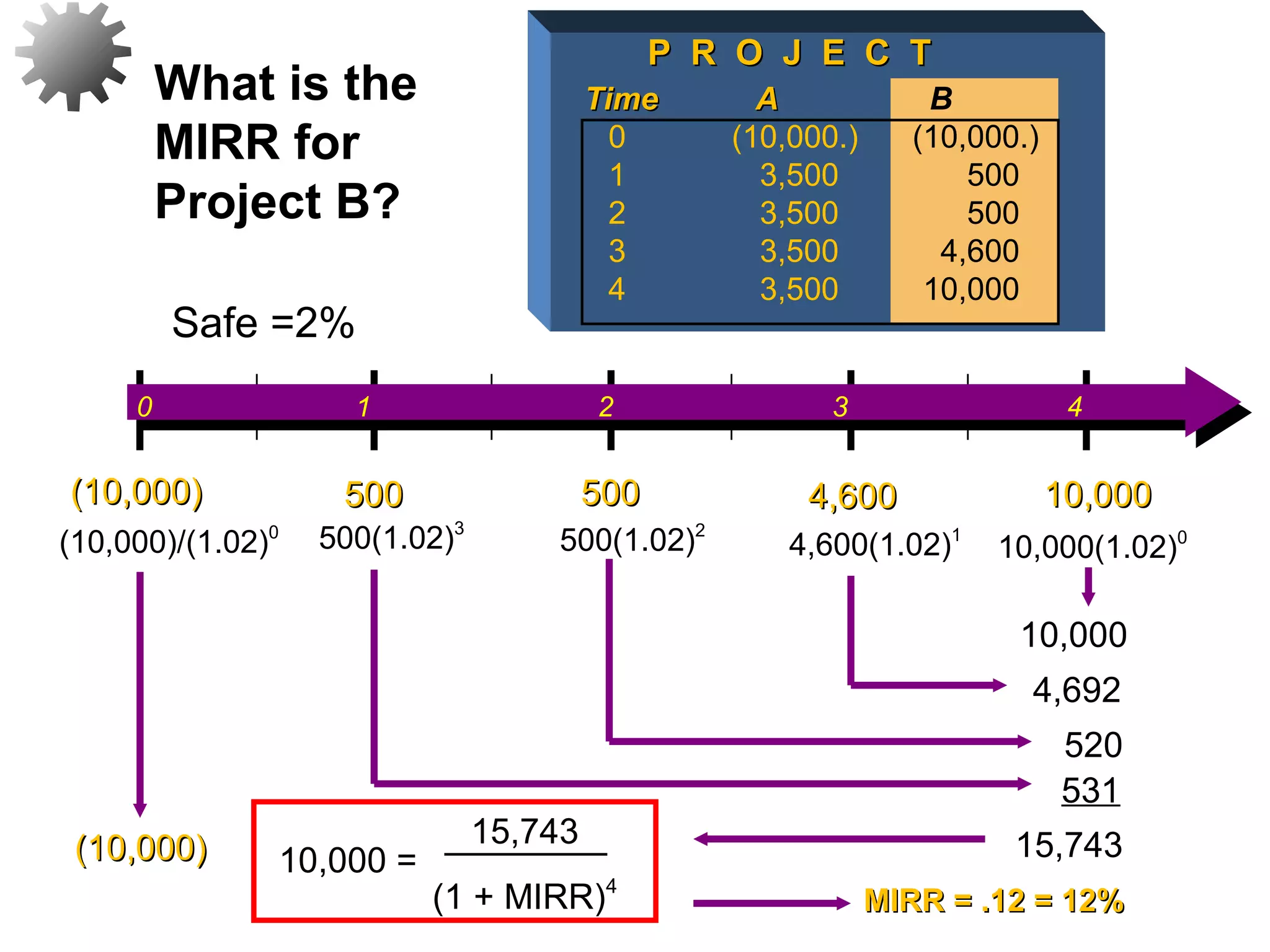

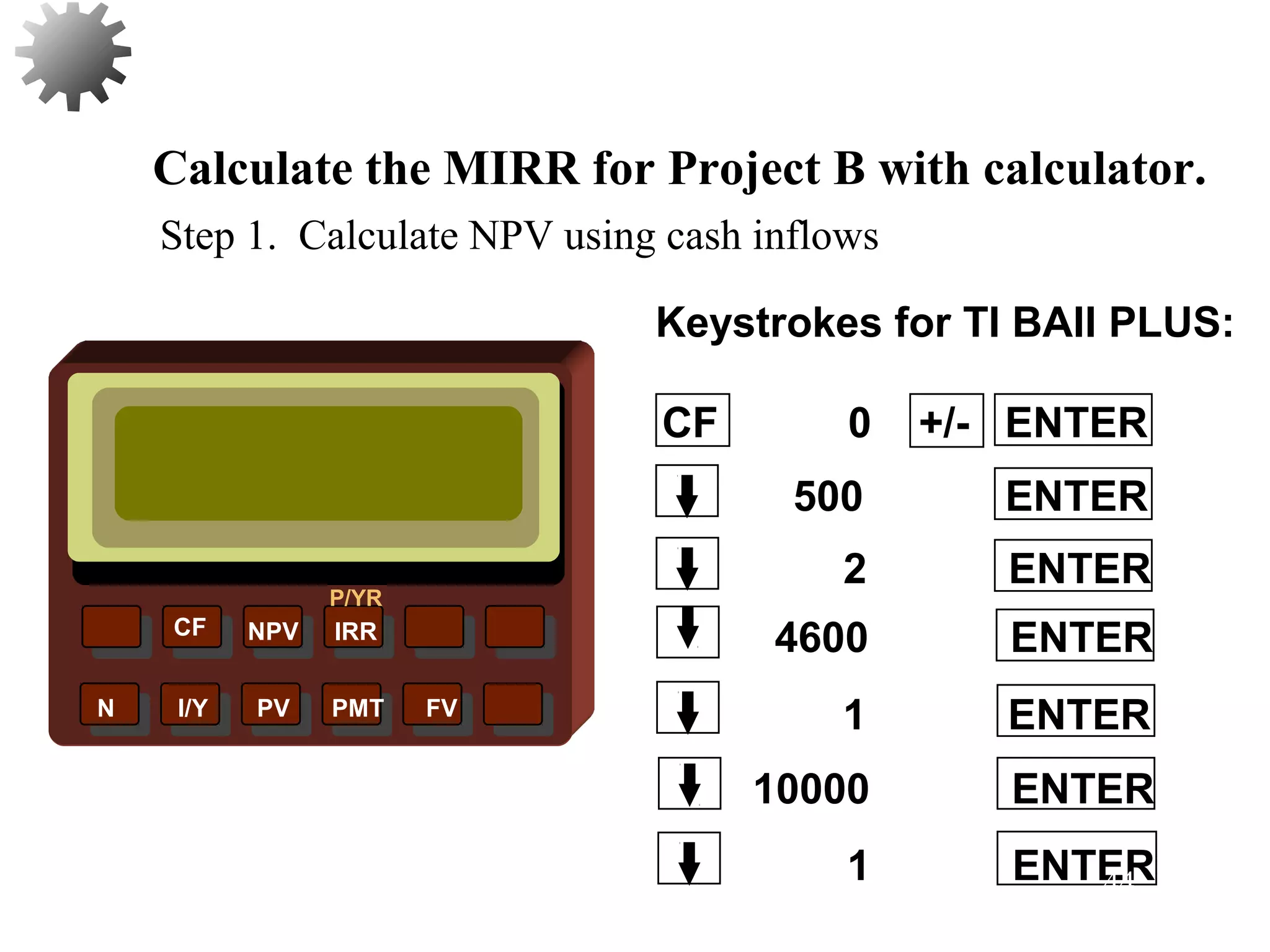

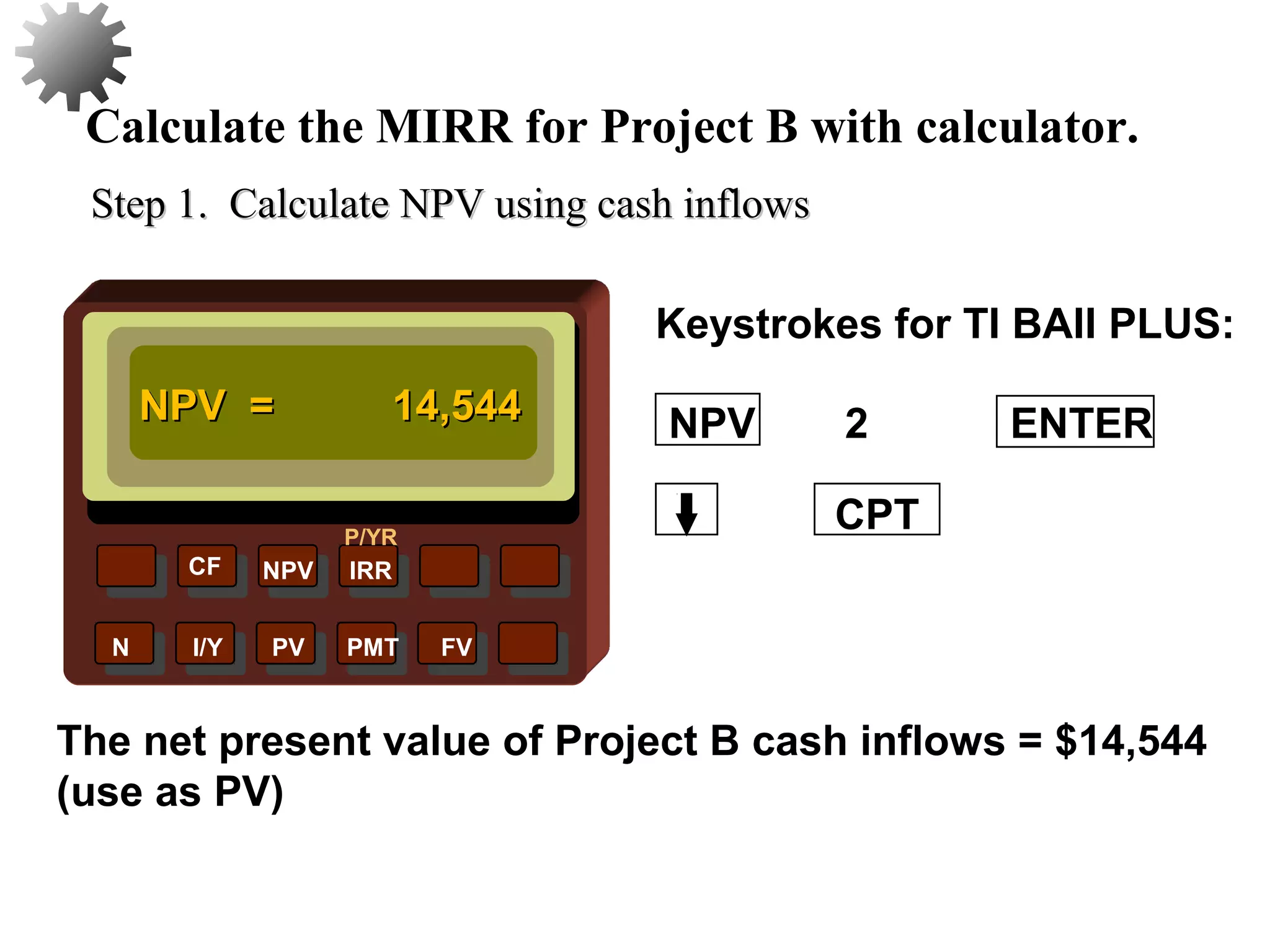

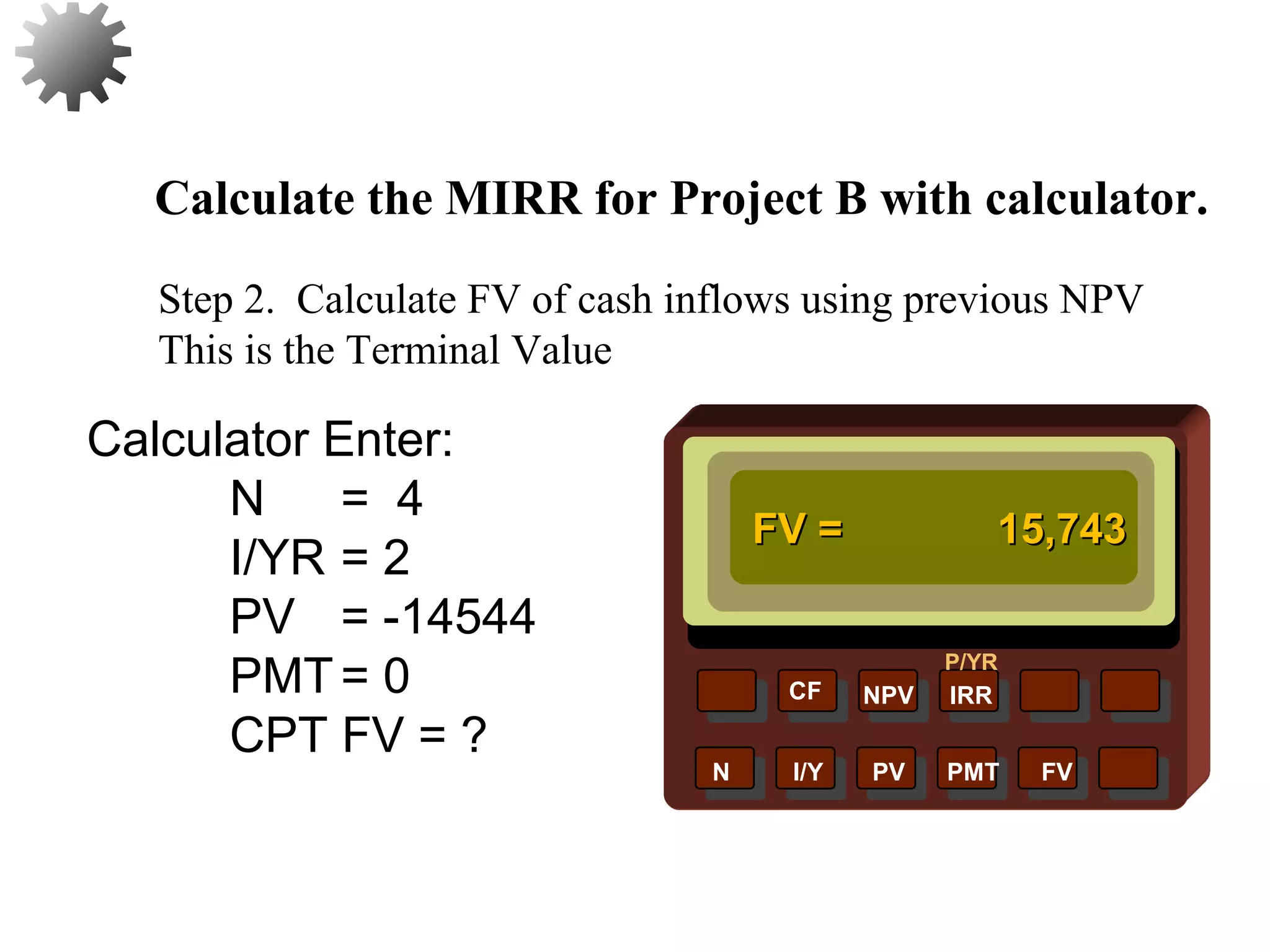

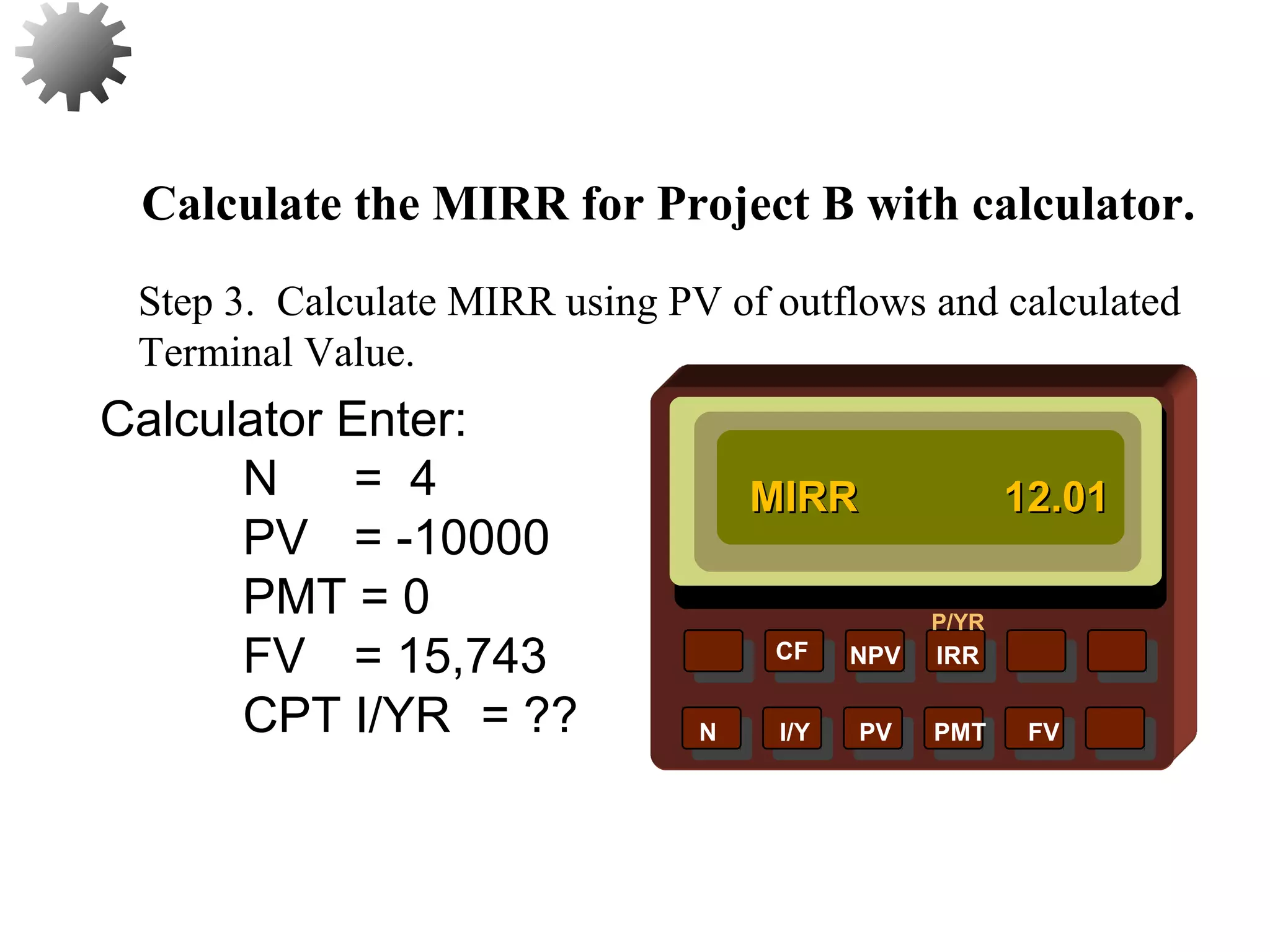

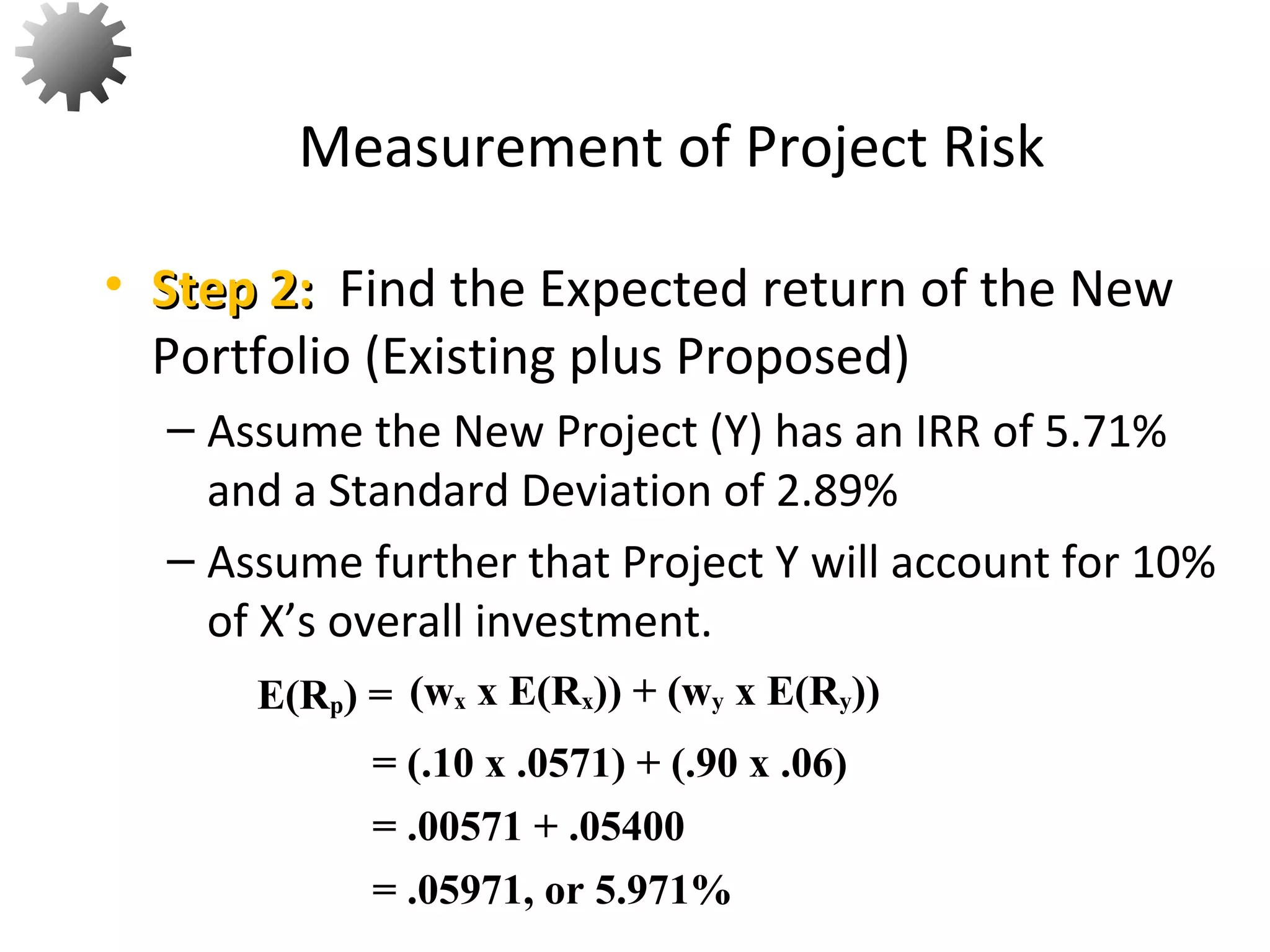

The document discusses capital budgeting methods for evaluating investment projects, including payback period, net present value (NPV), internal rate of return (IRR), and modified internal rate of return (MIRR). It provides an example calculation of the payback period for Project A using a table of cash flows for Projects A and B over 4 time periods. The payback period for Project A is calculated to be 2.9 years.

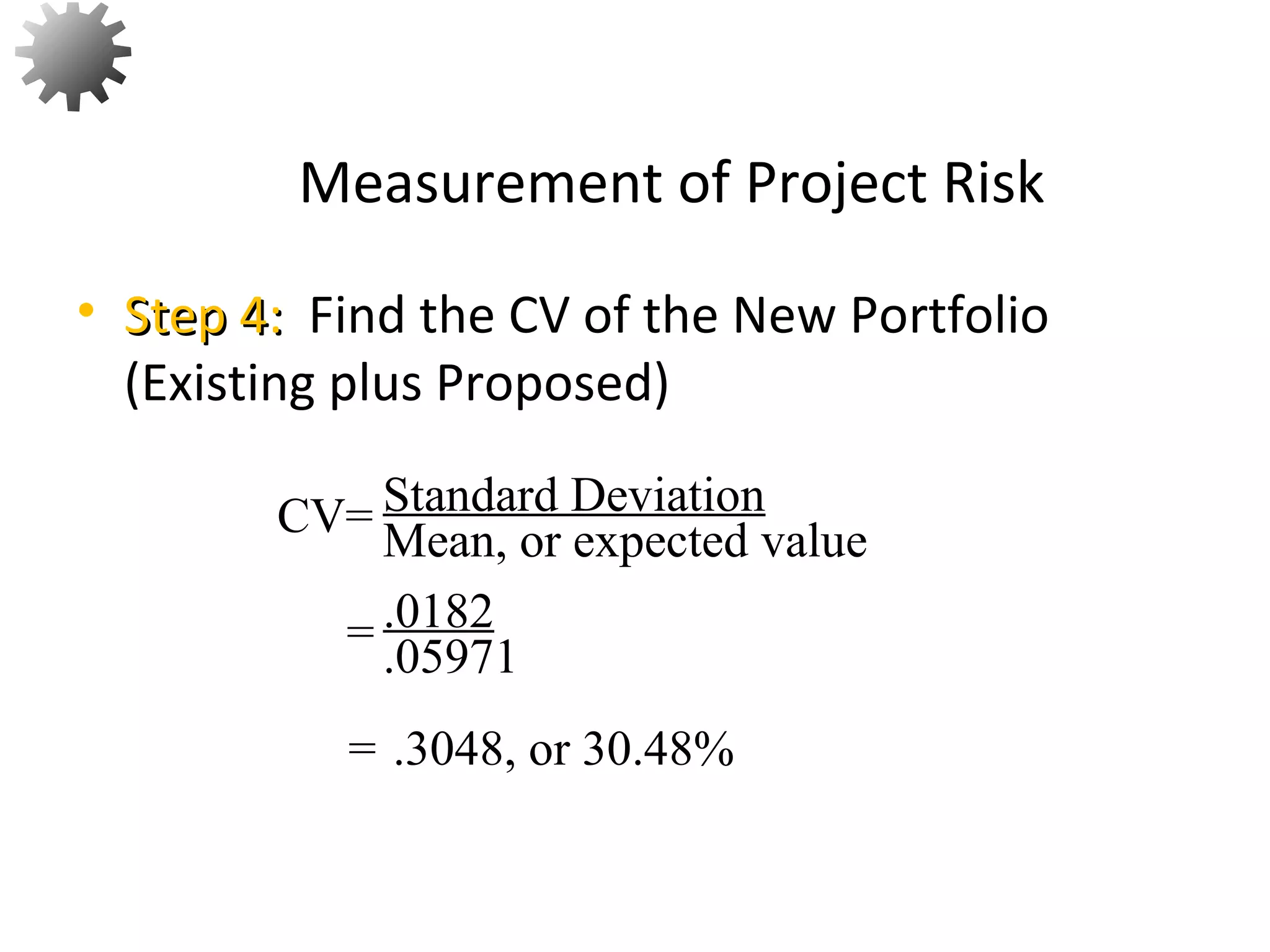

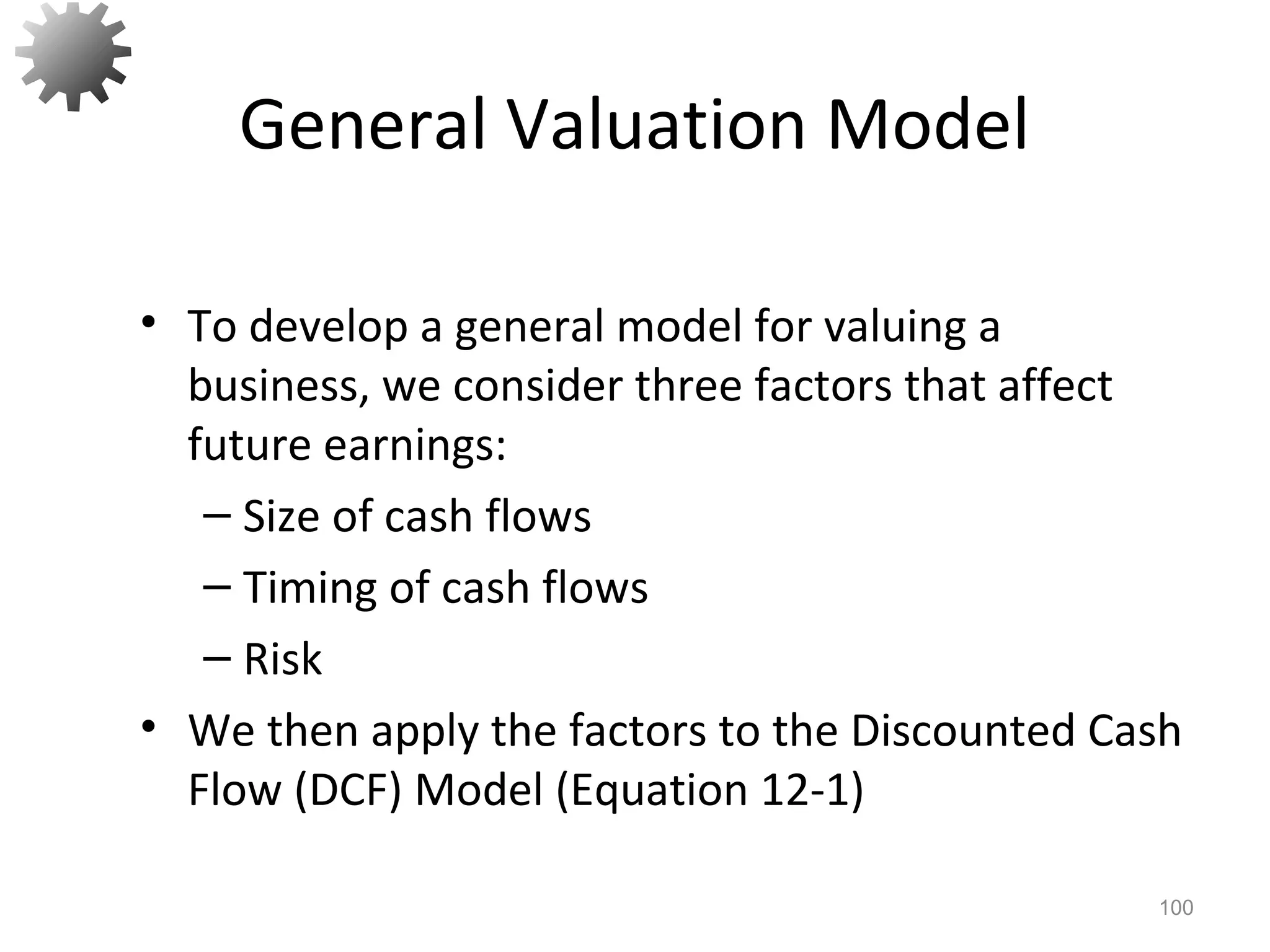

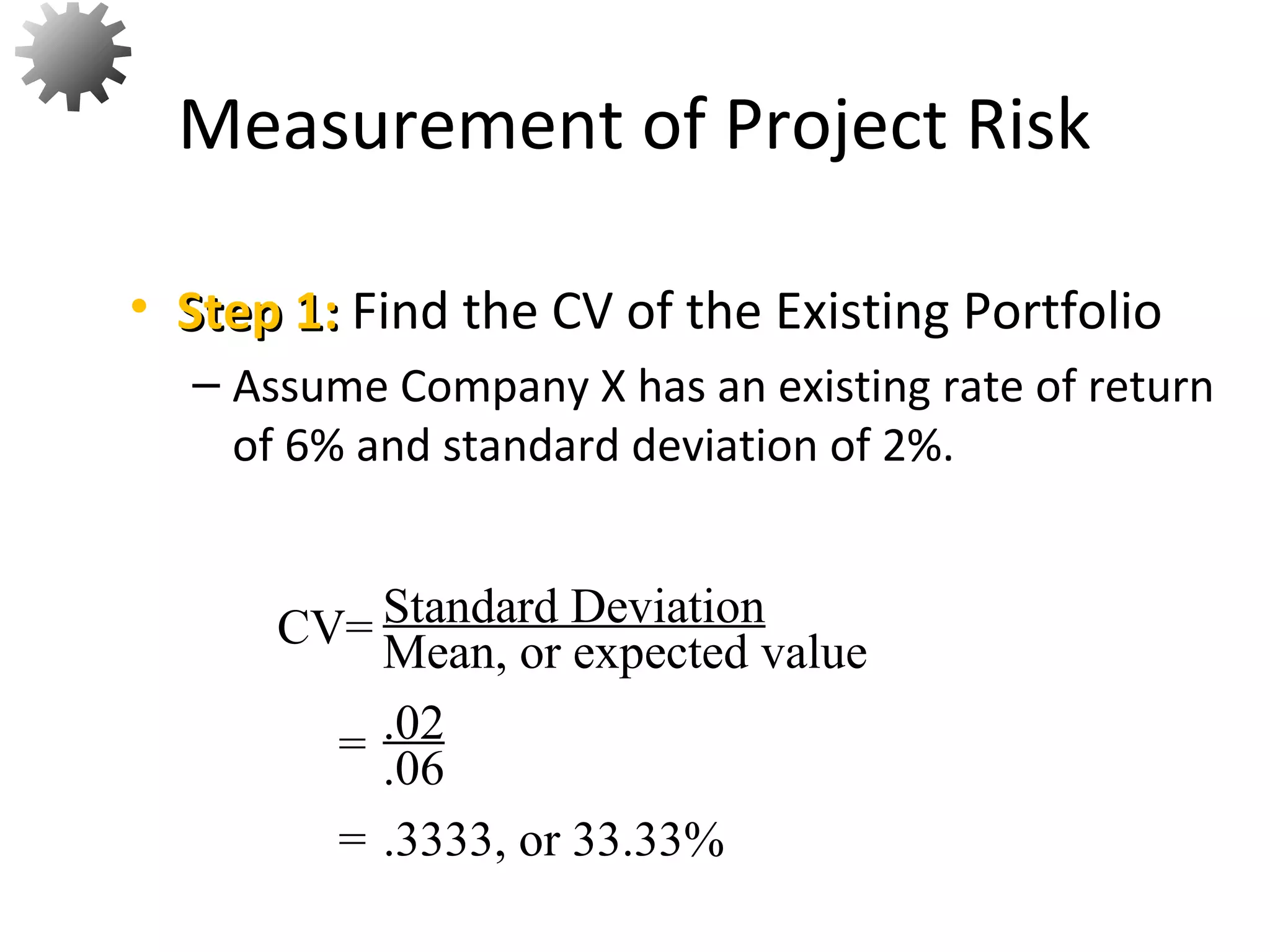

![• Step 3:Step 3: Find the Standard Deviation of the New

Portfolio (Existing plus Proposed).

– Assume the proposed is uncorrelated with the

existing project. rxy = 0

Measurement of Project Risk

58

[wx

2

σx

2

+ wy

2

σy

2

+ 2wxwyrxyσxσy]1/2

= [(.102

)(.02892

) + (.902

)(.022

) + (2)(.10)(.90)(0.0)(.0289)(02)]1/2

= [(.01)(.000835) + (.81)(.0004) + 0]1/2

= .0182, or 1.82%

= [.00000835 + .000324]1/2

= [.00033235]1/2

σp =](https://image.slidesharecdn.com/costofcapitallearning-130615170821-phpapp02/75/Cost-of-Capital-Learning-84-2048.jpg)