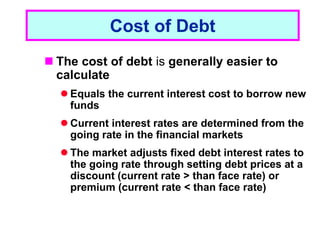

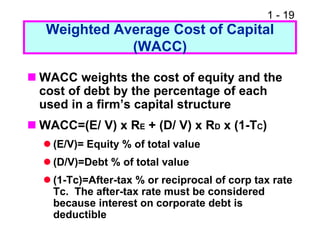

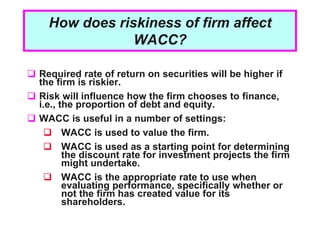

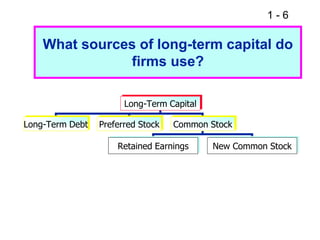

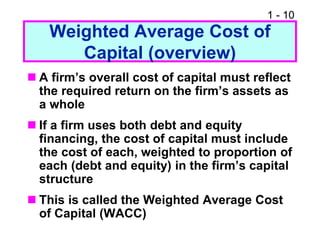

The document discusses the weighted average cost of capital (WACC). WACC incorporates the required rates of return of a firm's lenders and investors based on the mix of financing sources used, including debt, equity, and hybrid securities. WACC is important because it provides the minimum return a firm must earn to compensate its investors for the risk of its assets. Firms calculate WACC by weighting the cost of equity and the cost of debt by their respective proportions in the firm's target capital structure.

![1 - 17

Example – Cost of Equity

Suppose our company has a beta of 1.5. The

market risk premium is expected to be 9%, and

the current risk-free rate is 6%. We have used

analysts’ estimates to determine that the market

believes our dividends will grow at 6% per year

and our last dividend was $2. Our stock is

currently selling for $15.65. What is our cost of

equity?

Using SML: RE = 6% + 1.5(9%) = 19.5%

Using DGM: RE = [2(1.06) / 15.65] + .06 =

19.55%

When possible average the two methods

14-17](https://image.slidesharecdn.com/wacc-230128040548-004260d0/85/WACC-ppt-17-320.jpg)