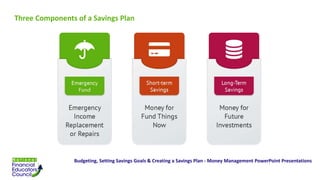

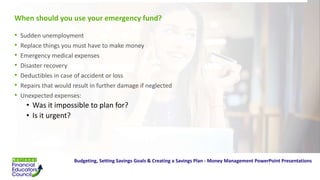

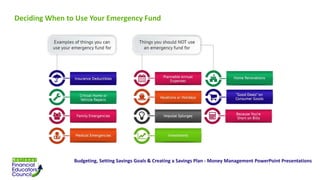

The document outlines the fundamentals of budgeting and money management, emphasizing the importance of creating a budget to control finances and achieve financial goals. It discusses components of a budget, the necessity of savings, and strategies for setting savings goals, including emergency funds and long-term savings plans. Additionally, it highlights the consequences of failing to budget effectively, such as overspending and limited savings.