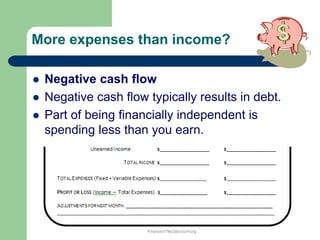

A spending plan, also called a budget, is a tool to track projected and actual income and expenses over time. It helps people reach financial goals by preparing for regular and unexpected expenses and controlling spending. Benefits include saving for goals, reducing stress, and providing freedom through wiser choices. Creating a budget involves assessing needs, setting goals, monitoring income and spending, and regularly reviewing progress.