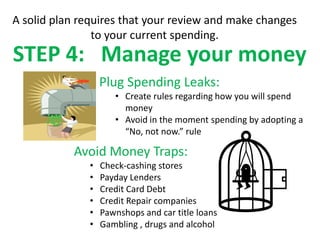

Trident Technical College's Student Support Services program provides resources to help students learn how to manage their money through organizing their finances, setting financial goals and creating budgets. The document outlines six steps for students: 1) Organize personal financial records and accounts, 2) Review current income and expenses, 3) Set short, mid, and long-term financial goals, 4) Create a budget and identify areas for improvement, 5) Understand different types of bank and credit accounts, and 6) Save for emergencies, goals and the future by investing money wisely. Additional resources for students seeking financial help include on-campus programs, tax credits, discounts, and online financial planning tools.