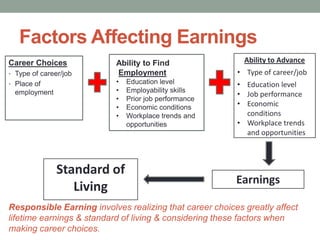

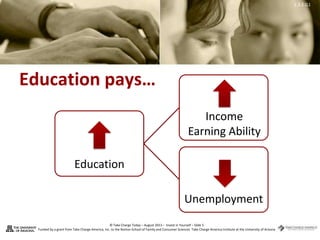

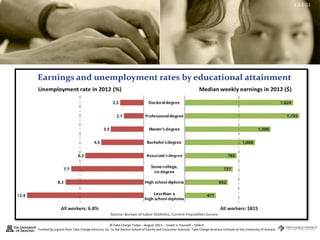

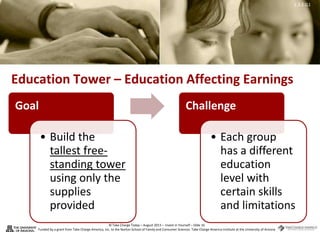

This document discusses personal finance concepts related to earning, spending, saving, and borrowing. It explains that earning involves gaining money through work or owning a business, and career choices, employment opportunities, and ability to advance affect lifetime earnings. Spending involves using money to purchase goods and services, and responsible spending involves planning and considering opportunity costs. Saving puts money aside for future needs and has benefits like providing for emergencies or earning interest. Borrowing obtains money now in exchange for future repayment, and should only be done for amounts that can be realistically repaid. The document emphasizes making responsible financial choices in light of considerations like career impacts, trade-offs, savings benefits, and borrowing obligations.