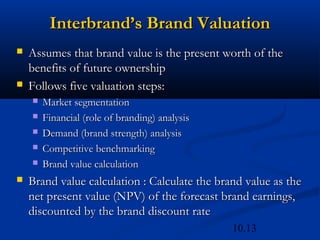

This document discusses various methods for measuring brand equity and market performance, including comparative, holistic, and valuation approaches. Comparative methods examine consumer responses based on changes in branding versus marketing elements. Holistic methods attempt to place an overall value on a brand through residual or valuation techniques. Valuation approaches seek to assign a financial value to brand equity for purposes like mergers and acquisitions. The document specifically describes Interbrand's brand valuation methodology, which calculates brand value as the net present value of forecast brand earnings discounted by a brand-specific rate.