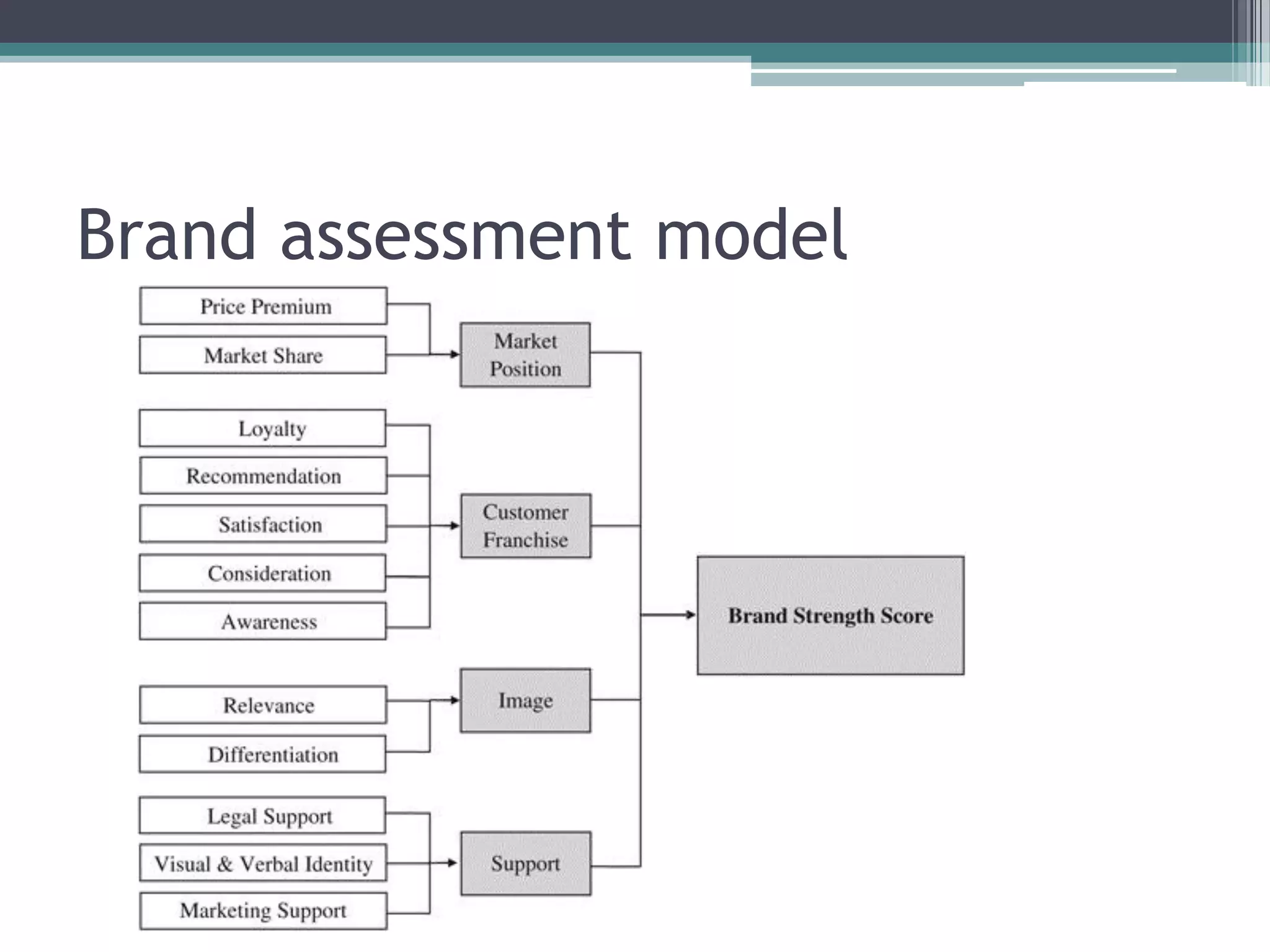

The document discusses various methods for measuring brand equity, including cost, market, and income approaches, emphasizing the importance of intangible assets. It outlines a framework for brand valuation and highlights the significant impact of strong brand equity on shareholder returns. The content is based on a presentation for a diploma in brand management, referencing foundational concepts and models in strategic brand management.