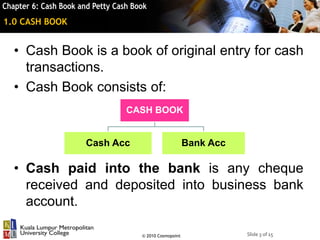

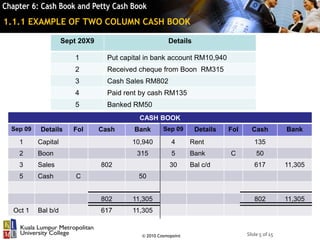

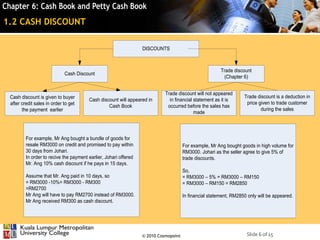

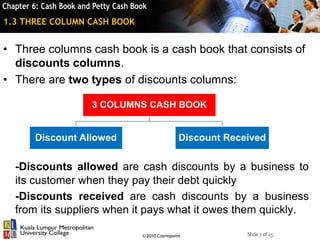

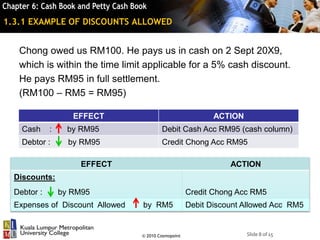

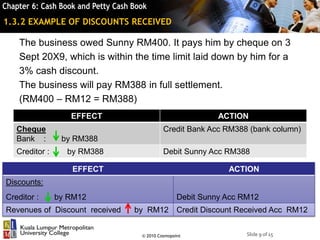

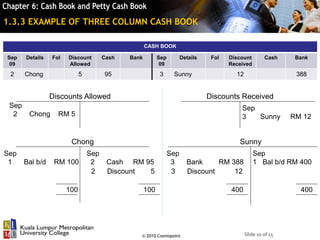

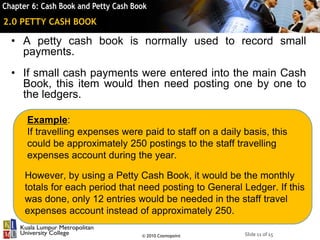

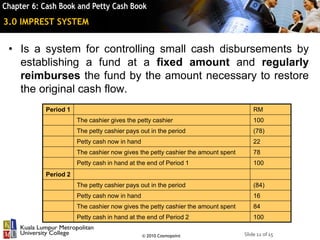

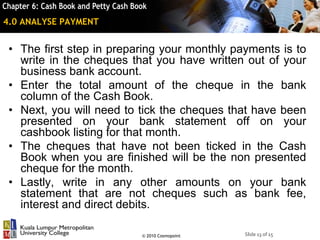

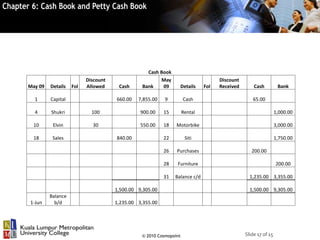

This document provides an overview of cash books and petty cash books. It defines a cash book as a book of original entry for cash transactions that records money paid into and out of a business bank account. It also describes the importance of cash books for safeguarding assets and ensuring accurate accounting records. The document explains petty cash books are used to record small cash payments to avoid numerous individual ledger postings. It also outlines the imprest system for controlling petty cash funds through regular reimbursements to restore the original cash float amount.