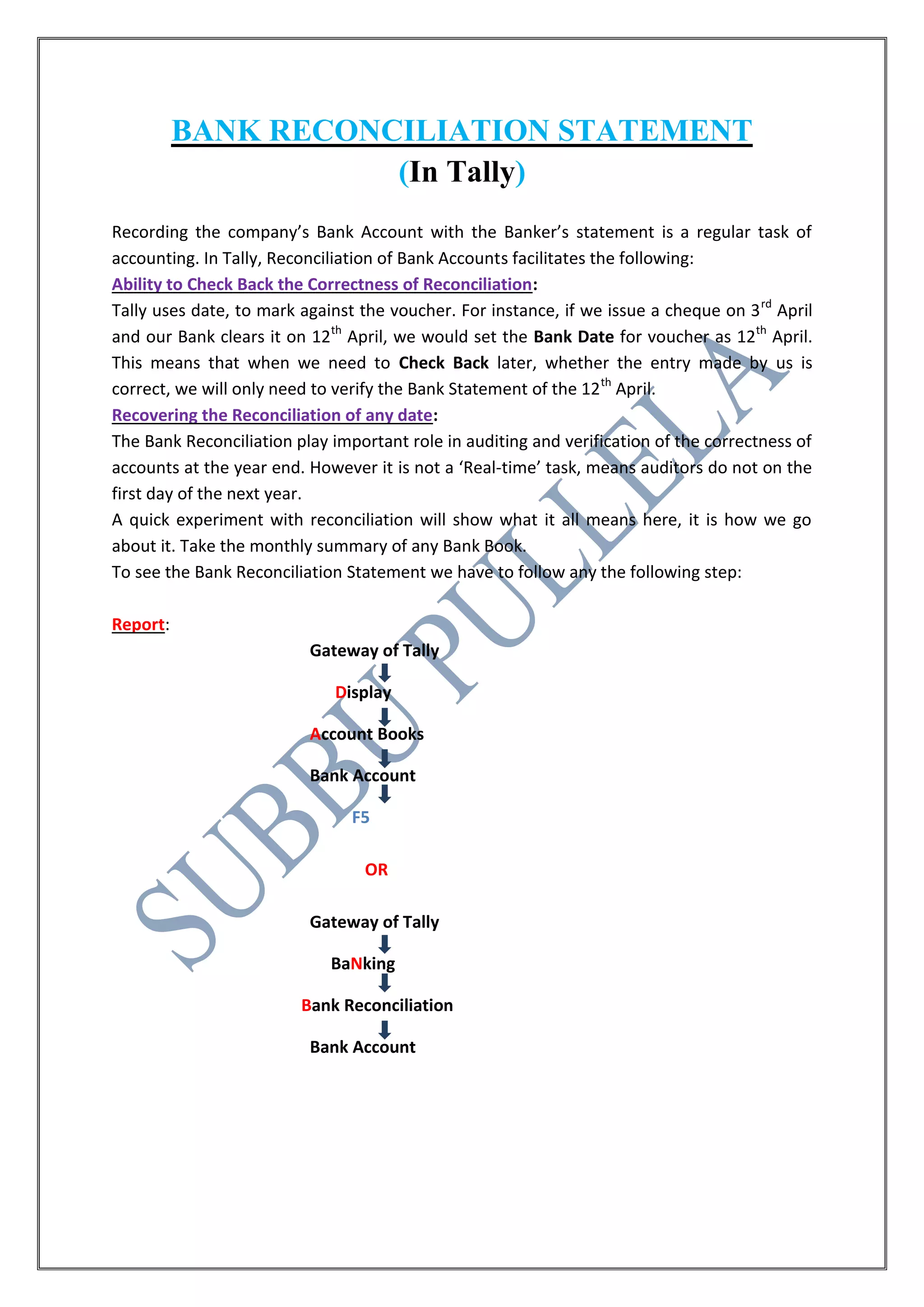

The document discusses bank reconciliation in Tally, which allows accounting of a company's bank account balance with the bank statement. It facilitates checking the correctness of reconciliation by marking vouchers with bank dates, and recovering reconciliations of any date. The reconciliation process in Tally involves displaying the bank account, entering the bank date for vouchers, and updating the reconciliation totals as vouchers are marked to match the bank balance.