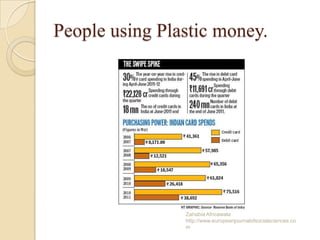

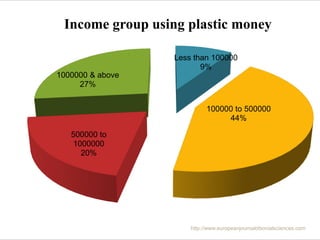

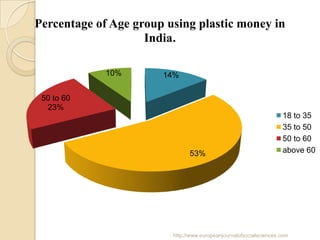

Plastic money refers to payment methods like credit cards, debit cards, and smart cards that are made of plastic rather than paper or metal. While plastic money provides advantages like purchasing power and safety, it is not widely accepted in India due to infrastructure issues, lack of government support, and cultural mindsets that are averse to credit. Younger, higher-income Indians are more likely to use plastic money, but overall adoption remains relatively low compared to more developed countries. For plastic money to succeed in India, improvements are needed in financial literacy, technology infrastructure, and addressing cultural preferences for cash-based transactions.