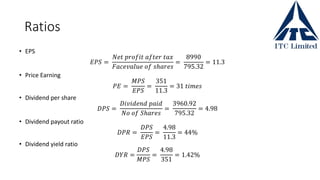

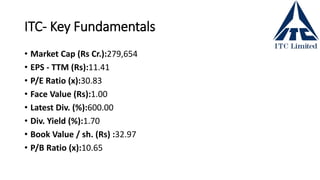

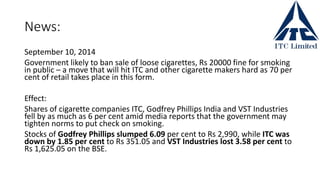

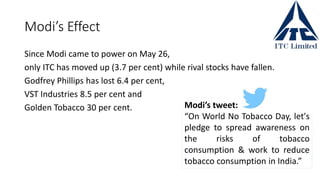

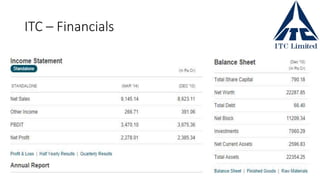

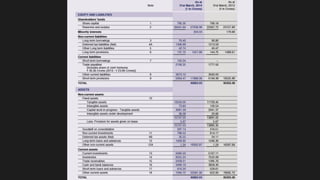

ITC Limited is one of India's largest private sector companies with a market capitalization of $45 billion and annual turnover of $7 billion. The company was incorporated in 1910 and has created multiple drivers of growth through diversification across industries including cigarettes, hotels, paper, agri, and information technology. ITC's financial analysis shows a return on equity of 33% with earnings per share of 11.3 rupees and dividend payout ratio of 44% for the fiscal year. Recent news reports indicate the government may impose stricter regulations on tobacco sales and smoking in public, which could negatively impact ITC and other cigarette companies.

![Return on Equity [RoE] – DuPoint Analysis

𝑃𝐴𝑇

𝐸𝑞𝑢𝑖𝑡𝑦

=

𝑃𝐴𝑇

𝑃𝐵𝑇

𝑥

𝑃𝐵𝑇

𝐸𝐵𝐼𝑇

𝑥

𝐸𝐵𝐼𝑇

𝑆𝑎𝑙𝑒𝑠

𝑥

𝑆𝑎𝑙𝑒𝑠

𝐴𝑠𝑠𝑒𝑡

𝑥

𝐴𝑠𝑠𝑒𝑡

𝐸𝑞𝑢𝑖𝑡𝑦

Return on Equity = Tax burden 𝑥 Int. Burden 𝑥 Margin 𝑥 Efficiency 𝑥 Leverage

8990

27236

=

8990

13051

𝑥

13051

13058

𝑥

13058

31323

𝑥

31323

34984

𝑥

34984

27236

.33 = .688 𝑥 .99 𝑥 .416 𝑥 .89 𝑥 1.28](https://image.slidesharecdn.com/itc-presentation-150326184149-conversion-gate01/85/ITC-Fundamental-Analysis-8-320.jpg)