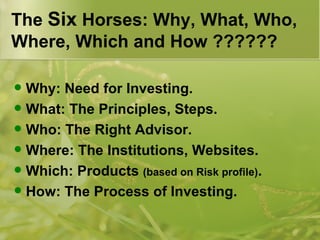

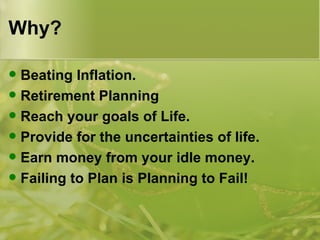

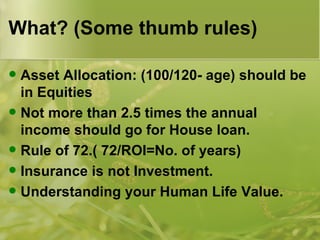

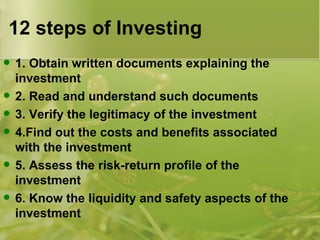

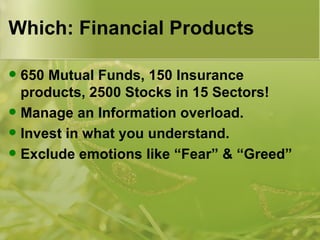

The document provides advice on taking responsibility for personal finances and outlines six key aspects to consider when investing: Why, What, Who, Where, Which, and How. It discusses reasons for investing like beating inflation and retirement planning. It also covers understanding risk profiles, asset allocation strategies, choosing reputable advisors, comparing investment options, and taking a long-term approach to investing for the best returns.