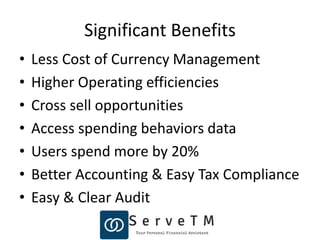

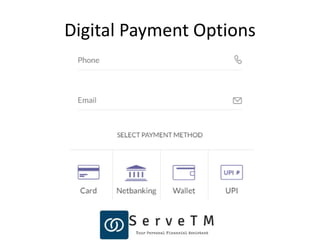

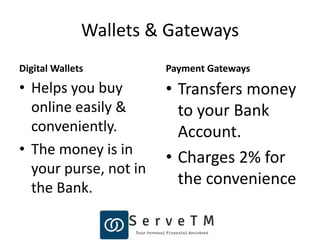

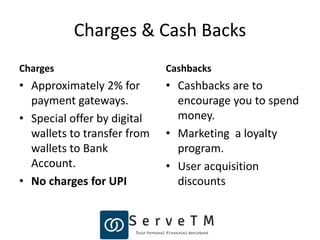

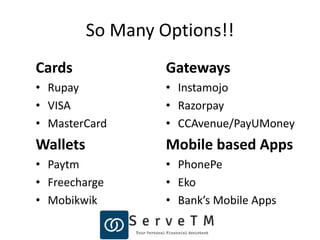

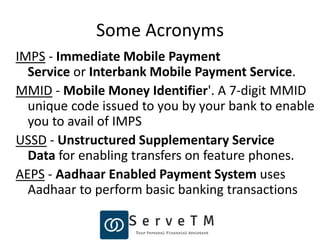

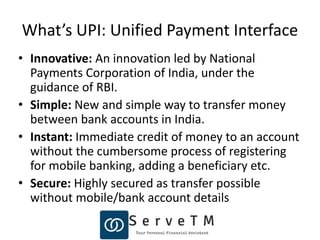

The document discusses digital payment options, including wallets and gateways, highlighting their benefits such as lower currency management costs and increased spending efficiency. It explains various charges, cashbacks, and introduces acronyms related to payment systems like UPI (Unified Payment Interface) and IMPS (Immediate Mobile Payment Service). The emphasis is on the convenience and security of digital transactions, encouraging users to adopt cashless solutions.