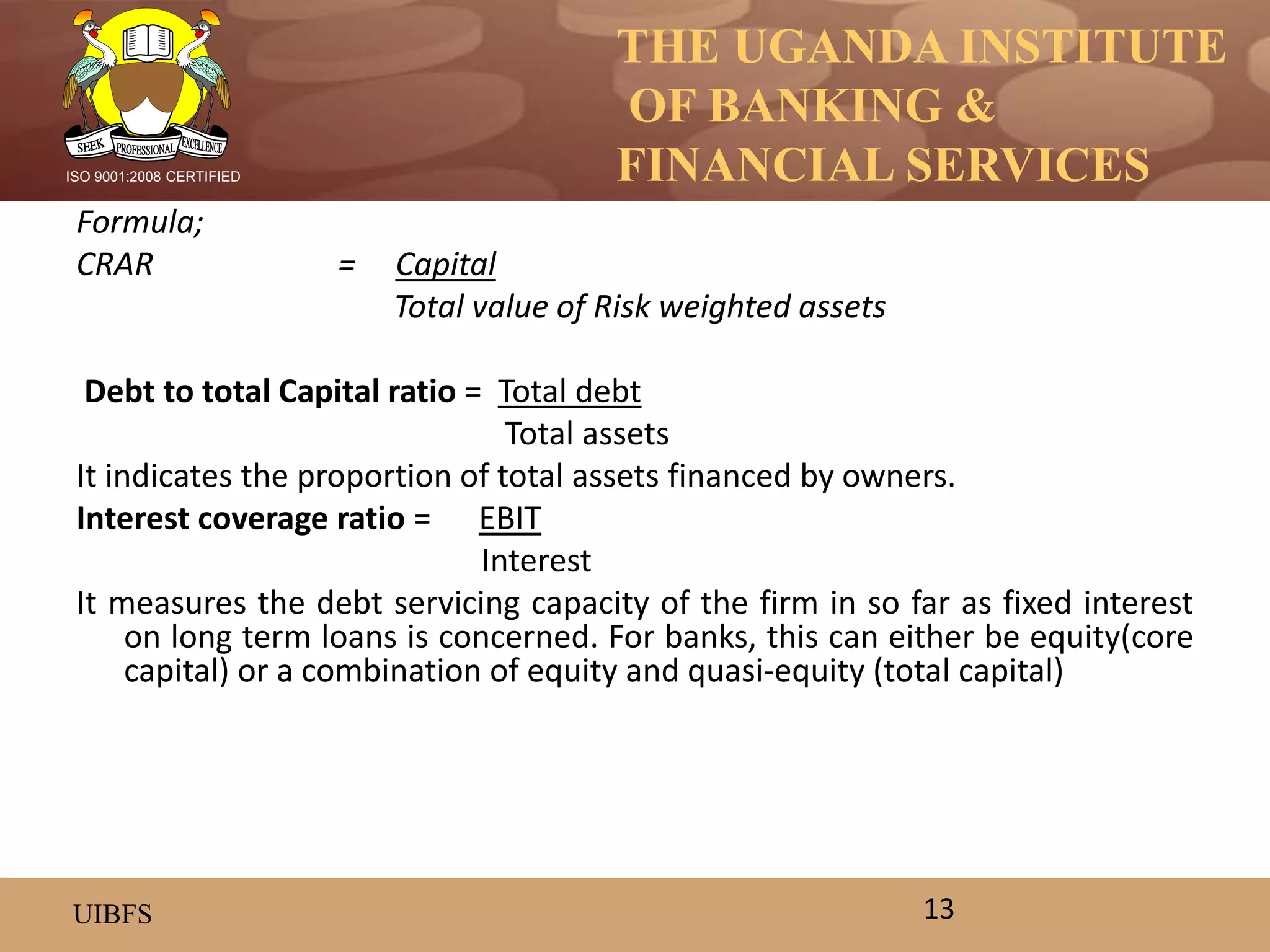

This document provides an overview of key financial ratios used to analyze the financial performance and health of banking institutions. It discusses ratios categorized as profitability, liquidity, asset quality, efficiency, and capital/solvency ratios. Specific ratios covered include net margin, cost-to-income, return on equity, return on assets, current ratio, non-performing loans ratio, debt-to-equity, and capital-to-risk weighted assets. The document emphasizes that analyzing multiple ratios together provides a fuller picture of a bank's financial standing than any single ratio alone.