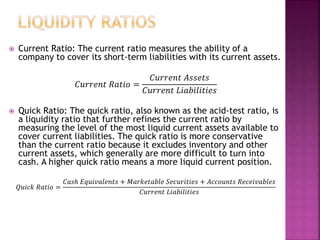

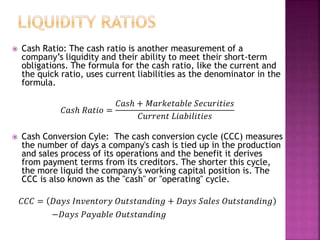

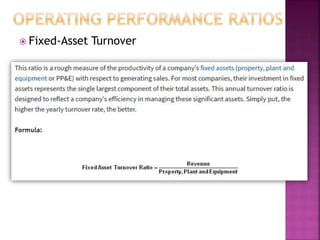

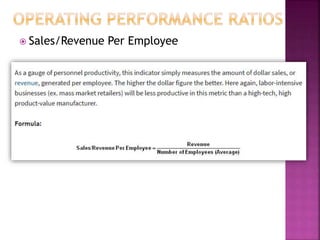

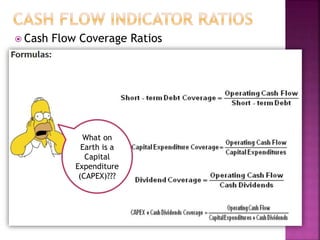

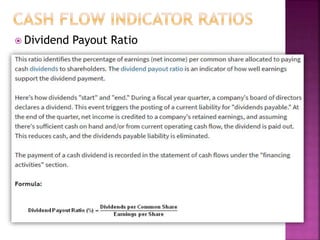

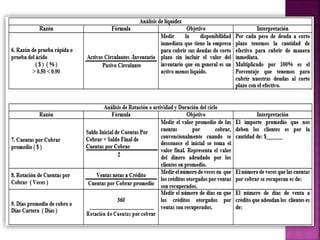

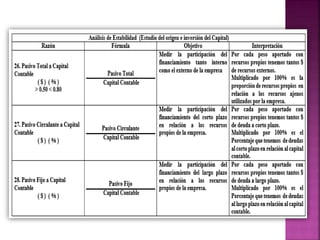

The document provides a comprehensive overview of various financial ratios and metrics used to assess a company's liquidity, profitability, debt, capital expenditures, and valuation. It explains key ratios such as current ratio, quick ratio, cash ratio, and profit margin analysis, along with the implications of debt interpretations. Additionally, it highlights the significance of per-share data in evaluating investment opportunities and emphasizes the importance of comparing ratios to historical performance and industry benchmarks.