Banking Contracts and Customer Rights Explained

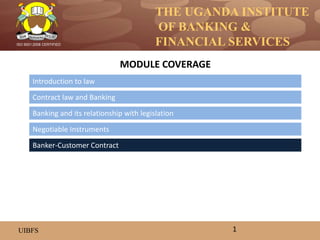

- 1. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Introduction to law Contract law and Banking Banking and its relationship with legislation MODULE COVERAGE 1 Banker-Customer Contract Negotiable Instruments

- 2. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Definitions – Banker / Customer We start our study of the banker – customer contract by defining the key terms ‘banker’ and ‘customer’. You may, at first, consider this to be unnecessary – after all everyone who has reached primary school level knows what a bank is, and a banker is generally thought to be someone who works in a bank!. Consequently, a customer is someone who uses services of a bank. We are talking about a ‘contract’ and from our knowledge acquired in previous study units, we have continuously hinted at the application of the law or the legal implications of behavior exhibited in the performance of a contact. It is important to know that the banker’s relationship with his customers’ gives rise to legal rights and duties apart from any commercial considerations. This simply means our approach in defining these key terms of the contract should keep reference to the existing regulations. Remember, unit 4 covered the legislation directly affecting the banking. Who is a banker? Having learnt what contract law is in the unit2, we should easily conclude that the relationship between a banker and his customer is basically contractual. Therefore with ease of imagination, we should expect this relationship to be regulated by the general rules of contract; and, most likely, banking practice. This is very true especially when we check the legislation at hand. 2

- 3. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED From the Financial Institutions Act, the word ‘bank’ means any company licensed to carry on the financial institution business as its principal business. For our purposes, in addition to loans, current accounts, etc; let us say that whatever we see banks doing tantamount to ‘financial institutions’ legally acceptable business. On the other hand, the Bills of Exchange Act provides that the term ‘banker’ …..”includes any persons who carry on the business of banking”. Now, what should we take to be the business of banking? Without going into the details, and as explained in our discussions of interpretation of statutes in unit 1, Courts of law identified three activities as definitive characteristics of bankers: o accepting money from, and collecting cheques for customers and place them to their credit; o honouring cheques and orders drawn on them by their customers when presented for payment and debit the accounts accordingly; and o keeping current accounts or something of that nature, in their books in which the credits and debits are entered. o In addition the court stressed that this definition was not static and would always depend on current practice. Having satisfied ourselves with who a banker is, then … 3

- 4. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Who is a customer? You and me have, no doubt, encountered persons call someone, rather literally – customer. As far as available legislation is concerned, there is no definition offered. But basing on contract law, decided court cases (historical, anyway!) show that a customer of a bank is a person who has entered into a contract with the bank for the opening of an account in his /her name. Surely, even from the legal definition of the ‘banker’ above, banks do more than the mere opening of current accounts. But there is no modern authority on this (legal) definition. We conclude by stating that, ‘in the more practical sense, a customer is anyone who makes a contact for any of a bank’s services, e.g. business advice, sale of US dollars, etc. even though they may not have an account with the bank. The Banker-Customer Relationship At this point of our studies, we can confidently state that the relationship between the banks and their customers is contractual, primarily that of the debtor (the bank) and creditor (customer) with these roles reversed where the customer has a liability (is indebted) with the bank, say has a loan he is servicing (repaying). In either case, whether bank or customer as the case may be, is obliged to seek out their creditor (lender) to make repayment. No doubt in practice, banks do not try to persuade customers to withdraw their balances but wait for the customer to demand repayment from the bank.. 4

- 5. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Since the relationship is contractual, general rules of contract law apply. You may need to refer back to unit 2 where we discussed the basic principles of contract law and saw how they apply in a banking context. • We should however point out that the most astonishing fact about the banker- customer is its ‘informality’, if we may use the term, and the case of implied and not express terms as the basis of the contract. • Opening of the bank account is usually done without a written agreement but by oral discussion, completion of administrative forms, and sometimes, introductory letters from areas of residence or employment. • We cannot tell how many customers are aware of (or are made aware of) the rights and duties which are implied in the contract. • As mentioned in Unit 1, the rights and duties of bankers and customers have evolved from custom and practice, as amended by various court decisions and statutes. • The duties and rights are generally implied but whenever a customer complete bank form for any particular product or service, then the implied rights and duties turn into express written contacts. • There is a variety of forms signed by customers during the various banking facilities that they undertake for example mandates (signed when opening an account), charge forms (when giving securities for credit), payment instructions, etc. 5

- 6. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED The above not withstanding: • In all agreements (contracts), an implied term is included which requires the bank to carry out its services to the customer with reasonable care and skill. • In contracts between the Bank and customer, there is a requirement that Bank’s written terms and conditions will be fair and in good faith. • When it deals with the customer on its written standard terms of business, it cannot exclude or restrict its liability for breach of contract, nor can it claim to be able to render a performance substantially different from that which was reasonably expected of it. • The nature of the banker – customer relationship gives rise to consequential bankers’ rights and duties. These are essential to understand particularly for those new to banking operations. • We have seen that the issue of an account is a key factor for someone to qualify as a (bank) customer. Therefore before we look at the rights and duties of a banker, lets us familiarize ourselves with the creation and operation of a bank account. 6

- 7. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Opening and Operating an Account Before opening an account, a bank must be satisfied as to the character and standing of the applicant and know their employer’s name and nature of employment. This information can be obtained by either: • By a personal introduction from an existing customer or another branch or bank; or • By taking references from the applicants employers and/or local leaders from one’s place of residence. The authenticity of the reference should be checked. • Banks must obtain satisfactory references if they stand to be protected by the law and to avoid unsatisfactory accounts. Two of the opening formalities are obtaining of specimen signatures of the parties to the account; and a mandate covering all operations on the account. Bankers’ Legal Rights and Duties Arising from the banker-customer contract are a number of legal rights and duties. Basing on the arguments above, almost all are implied and not express terms of the ever engrossing contract. It is not in the practice of banks to try to make implied terms explicitly express. Indeed even the courts are known to respect established practice – the code of banking. These rights and duties are outlined below. A detailed analysis of them is beyond the scope of this course but can be accessed in the ‘law relating to banking’ course. 7

- 8. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Rights A banker has the following rights. • To charge his customer reasonable commission for services rendered to him, and to charge interest on loans made to him • To repayment on demand from his customer of any overdrawn balance which has been permitted on a current account • To be indemnified by his customer for expenses and liabilities incurred while acting for them • To exercise a ‘lien’ (is a right to retain possession of the property of another in lieu of payment due from that person) over any of the customer’s securities that are in its possession other than those for safe keeping (custody), for any money owing to it • To dispose of its customer’s money as he pleases provided it honours its customers’ valid cheques. • To combine or set-off accounts of the customer. This arises where the customer has more than one account with the bank - the bank is entitled to settle a debt on one account by transferring funds from another of the customer’s accounts • To expect his customer to exercise due care in drawing cheques. The customer is under a duty to inform his bank of any known forgeries on the account. 8

- 9. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Duties A banker has the following duties. • To abide by any express mandate from his customer (a mandate is signed by the customer when opening the account. It shows the terms to be followed and observed by the bank in honouring instructions from the customer) • To honour its customer’s cheques (this duty is subject to a number of provisos which are observed when paying cheques in the normal course of business; for example availability of sufficient funds on account) • Not to disclose information about its customer’s affairs unless qualified • To render statements of account to its customer periodically or upon request • To collect cheques and other normal banking instruments for its customer and to credit the proceeds to the customer’s account • To exercise proper care and skill in carrying out any business it has agreed to transact for its customer • To give reasonable notice before closing a credit account As already mentioned, for purposes of this course, it is enough to remember these rights and duties. Their detailed discussion entails much branch banking practice and real life situations. 9

- 10. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED It would be abnormal to imagine that the banker-customer contract can never die out. Just like the commercial contracts generally seen in business circles, the banker- customer contract can also come to an end, for more or less, the same reasons covered under contact law. We end this unit by looking at termination of the banker-customer contract. Termination of the of banker customer contract The banker-customer contract may be terminated. However, the banker -customer relationship may survive indefinitely because of the bank’s duty of confidentiality (secrecy). The banker customer contract can be terminated in the following ways: Termination by the Customer - The customer may demand full repayment of the credit balance on the account at any time, but a nil balance on an account does not necessarily mean the customer has closed the account. Confirmation that terminating the contract is the intention of withdrawing all the funds must be sought. The customer with an overdrawn account may not terminate the banker-customer contract without repaying the debt. 10

- 11. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Termination by the bank A bank may only close an account after giving reasonable notice and making provision for outstanding cheques. Operation of Law The following will terminate the contract in law: Death of the customer; Mental incapacity of the customer; Bankruptcy or insolvency of bank or customer. 11

- 12. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED END 12

Editor's Notes

- Again for purposes of this course we shall just mention the category of institutions that are legally ‘banks’. These are: commercial banks (e.g stanbic); post office savings bank; merchant banks (e.g Citibank); and mortgage banks (e.g housing finance).

- Money deposited at the bank becomes Bankers’ property absolutely at its disposal and the bank acknowledges receipt of money as `debtor` with the obligation to honour customer’s demand. The timing of the demand may be prescribed by the express terms of the contract, say in the case of ‘Term’ deposits