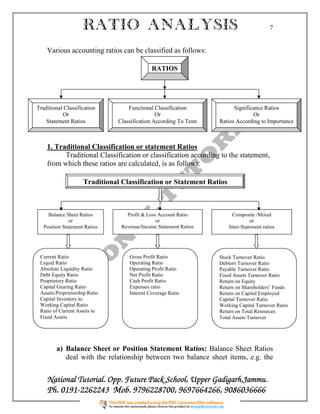

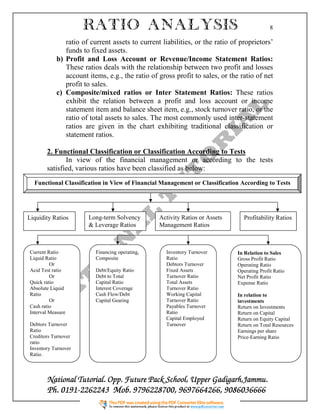

Ratio analysis is a technique used to analyze and interpret financial statements. It involves calculating ratios that establish relationships between financial data and comparing them over time, against industry standards, or between companies. Key ratios help evaluate a company's liquidity, operational efficiency, and profitability. Ratio analysis provides a quick assessment of a company's financial health and performance.