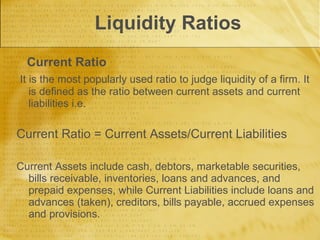

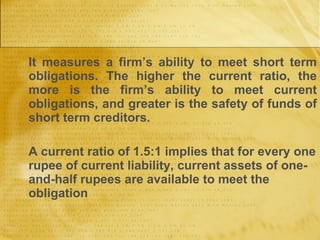

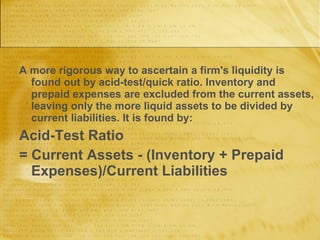

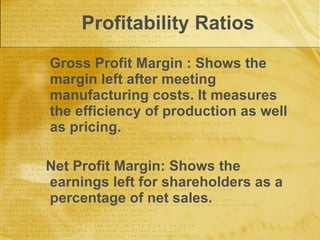

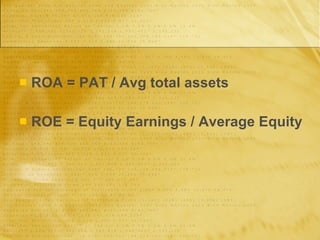

The document discusses various types of financial ratios used to analyze companies. It describes liquidity ratios like current ratio and acid test ratio which measure a company's ability to meet short-term obligations. Leverage ratios like debt-equity ratio and debt-asset ratio assess the financial risk from a company's use of debt. Efficiency ratios examine how effectively a company uses its assets. Profitability ratios evaluate a company's net profit margins and returns on assets and equity.