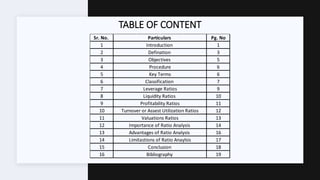

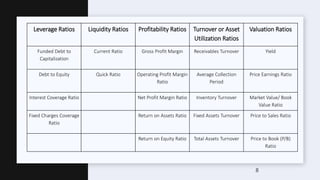

This document presents a project work on ratio analysis as a tool for financial analysis. It discusses ratio analysis as a technique for evaluating a company's financial condition and performance by calculating and comparing various financial ratios. The document defines key terms related to ratio analysis and outlines its objectives and procedures. It also classifies common financial ratios into five main categories: leverage ratios, liquidity ratios, profitability ratios, turnover/asset utilization ratios, and valuation ratios. Examples of important ratios under each category are provided.