This document discusses contract law and its importance in banking. It covers the following key points:

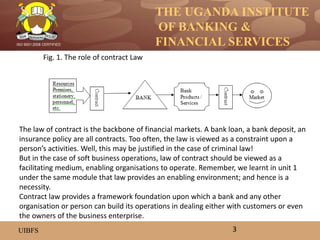

- Contract law is central to banking as banks enter into many contracts with customers for services like opening accounts and providing loans.

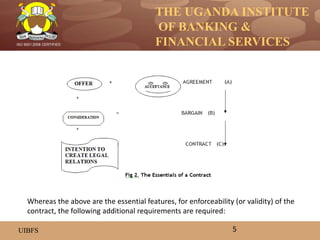

- The essential elements of a valid contract are an agreement between parties involving an offer, acceptance, and consideration.

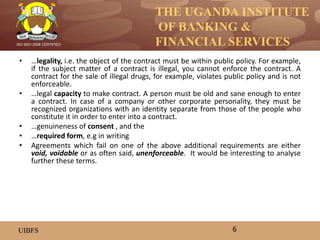

- For a contract to be enforceable it must also meet additional requirements around legality, capacity, consent, and formalities.

- Breach of contract occurs when one party fails to perform according to the terms and the injured party can sue for damages. This is important in banking when mistakes are made processing items like checks.