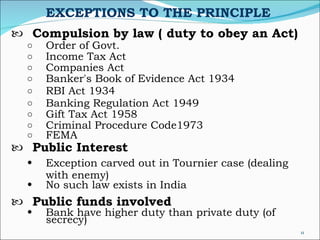

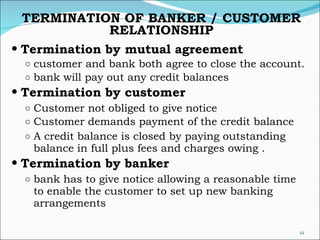

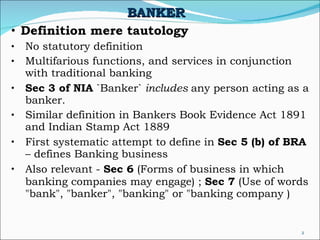

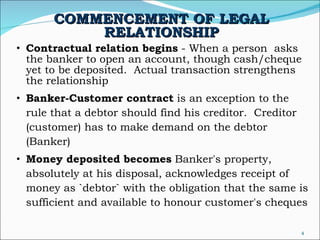

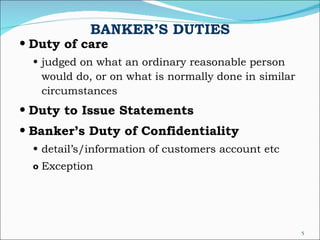

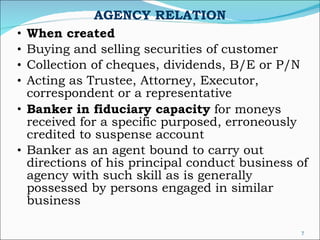

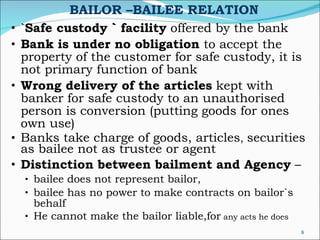

The document discusses key definitions and concepts related to banking law in India. It defines terms like "banker" and "customer" and outlines how the legal relationship between them is established. It also examines the various roles and duties of a banker, including as a debtor, trustee, agent, and bailee. The document also discusses exceptions to the general duty of confidentiality bankers owe to customers, as well as how the banker-customer relationship can be terminated.

![CUSTOMER Customer not defined To constitute customer there must be some recognisable course or habit of dealing between him and the bank The transaction were in the nature of regular banking business To constitute a customer there must be some measure of continuity and custom A person becomes a customer of a bank as soon as he is accepted as such by the banker Frequency of transaction not essential A customer is a person whose moneys have been accepted by the bank on the footing that the banker will honour up to the amount standing to his credit irrespective of his connection being short or long standing [Central Bank v Gopinathan Nair, AIR 1970]](https://image.slidesharecdn.com/chapter10-banker-customerrelationship-100630034509-phpapp02/85/Chapter-10-banker-customer-relationship-3-320.jpg)

![BANKER AS A TRUSTEE Main relation between Banker and Customer – Debtor and Creditor [reversal when bank grants OD facilities] Remittances made to bank to purchase shares, before buying stipulated no. of shares, bank failed- unspent money bank holding in trust Banker received money from one party on behalf of another (later not a customer), bank enquired about purpose and intimated money meanwhile being kept in suspense, banker is a trustee Banker must not be party to appropriation of funds inconsistent with the character in which customer holds them](https://image.slidesharecdn.com/chapter10-banker-customerrelationship-100630034509-phpapp02/85/Chapter-10-banker-customer-relationship-6-320.jpg)

![TOURNEIR PRINCIPLES Nature of duty cast upon banker – privity of contract; implied terms of contract When does the duty commence – moment banker-customer relationship is established How long does it exist – does not end merely on closer of account; extends to all other facts that may come to banker's knowledge from any other source Scope of secrecy – information obtained by bank in his capacity as Banker about it Customer [Tourneir v National Provincial Bank of England ( 1924)]](https://image.slidesharecdn.com/chapter10-banker-customerrelationship-100630034509-phpapp02/85/Chapter-10-banker-customer-relationship-10-320.jpg)