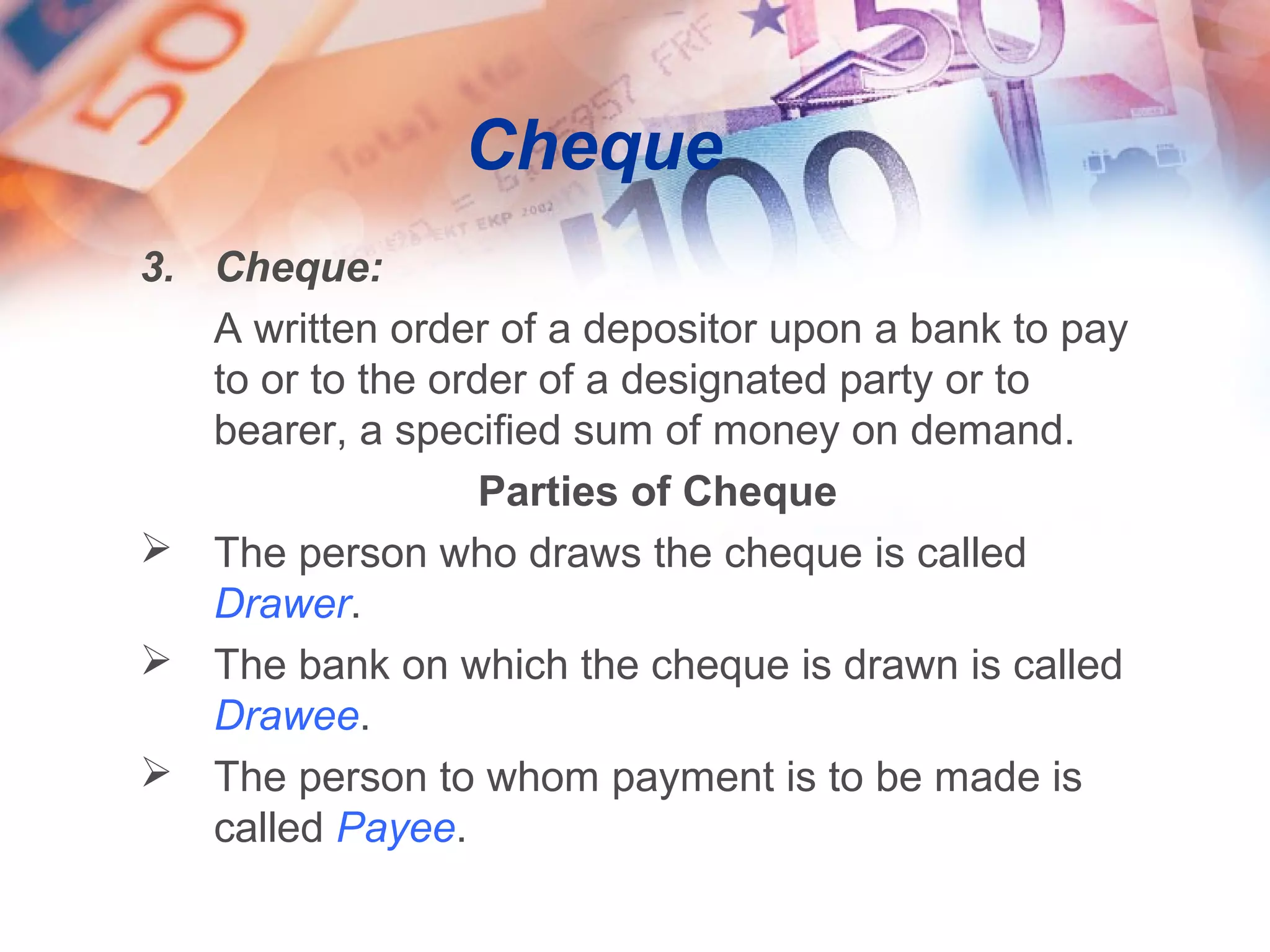

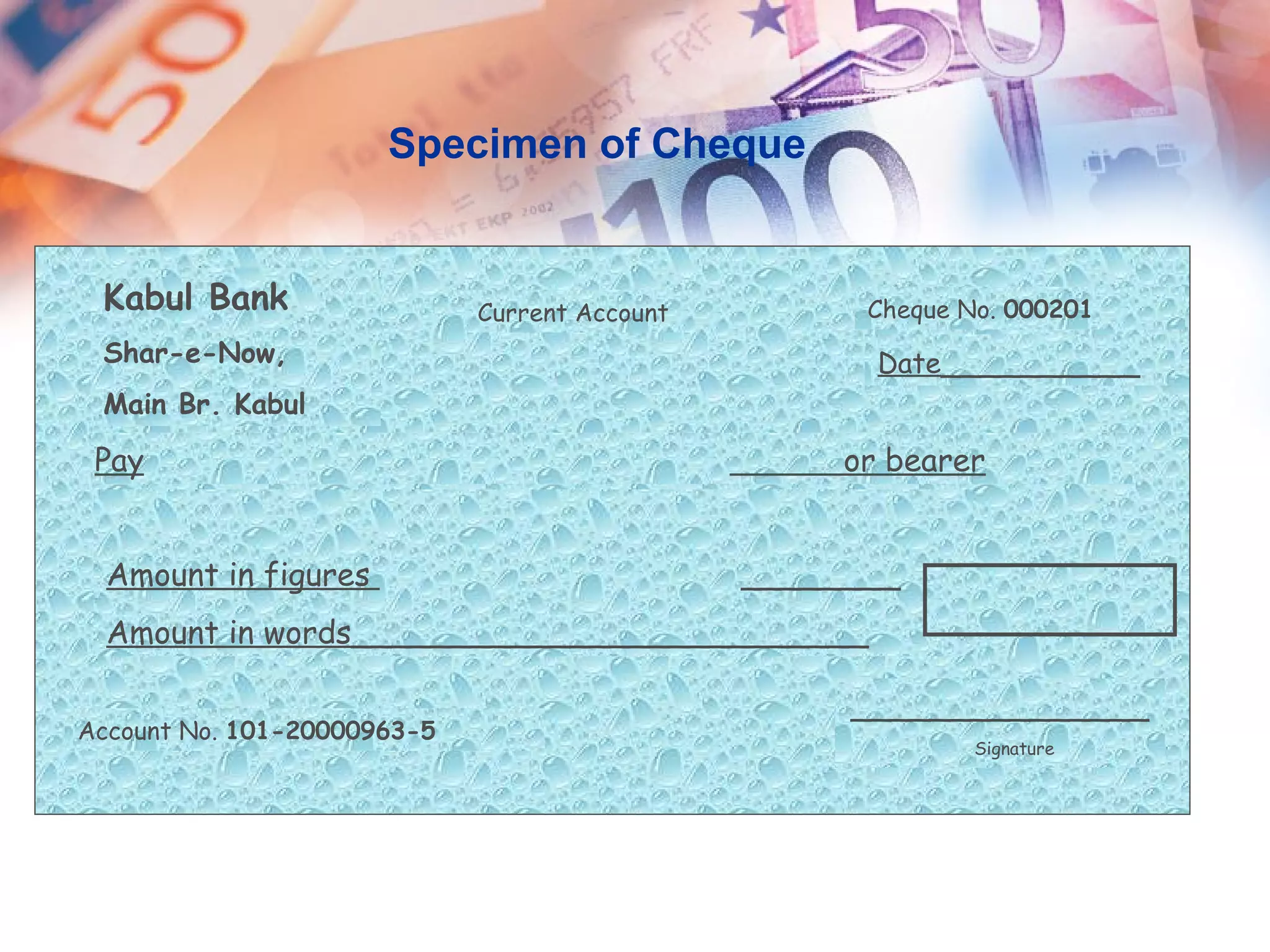

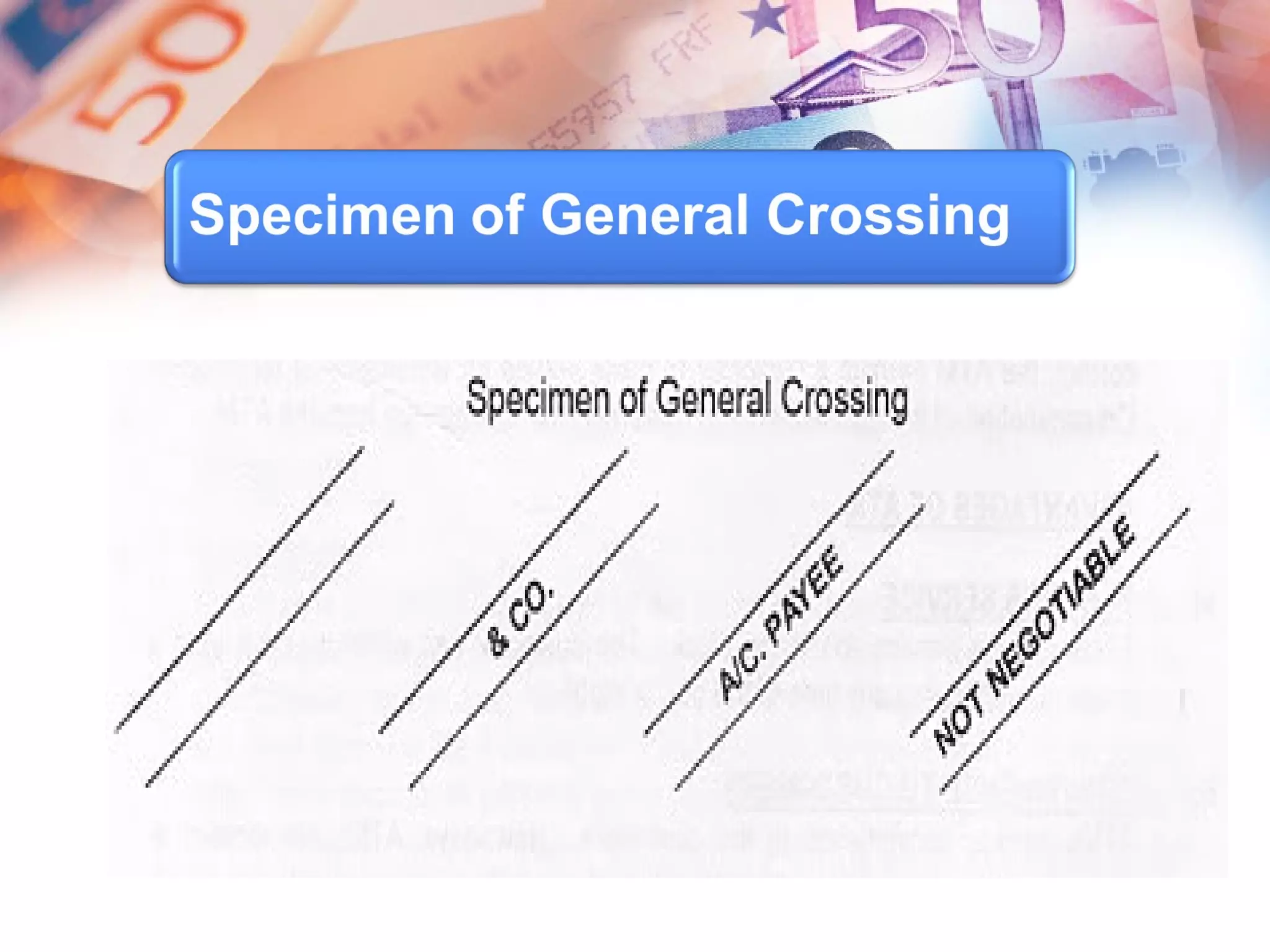

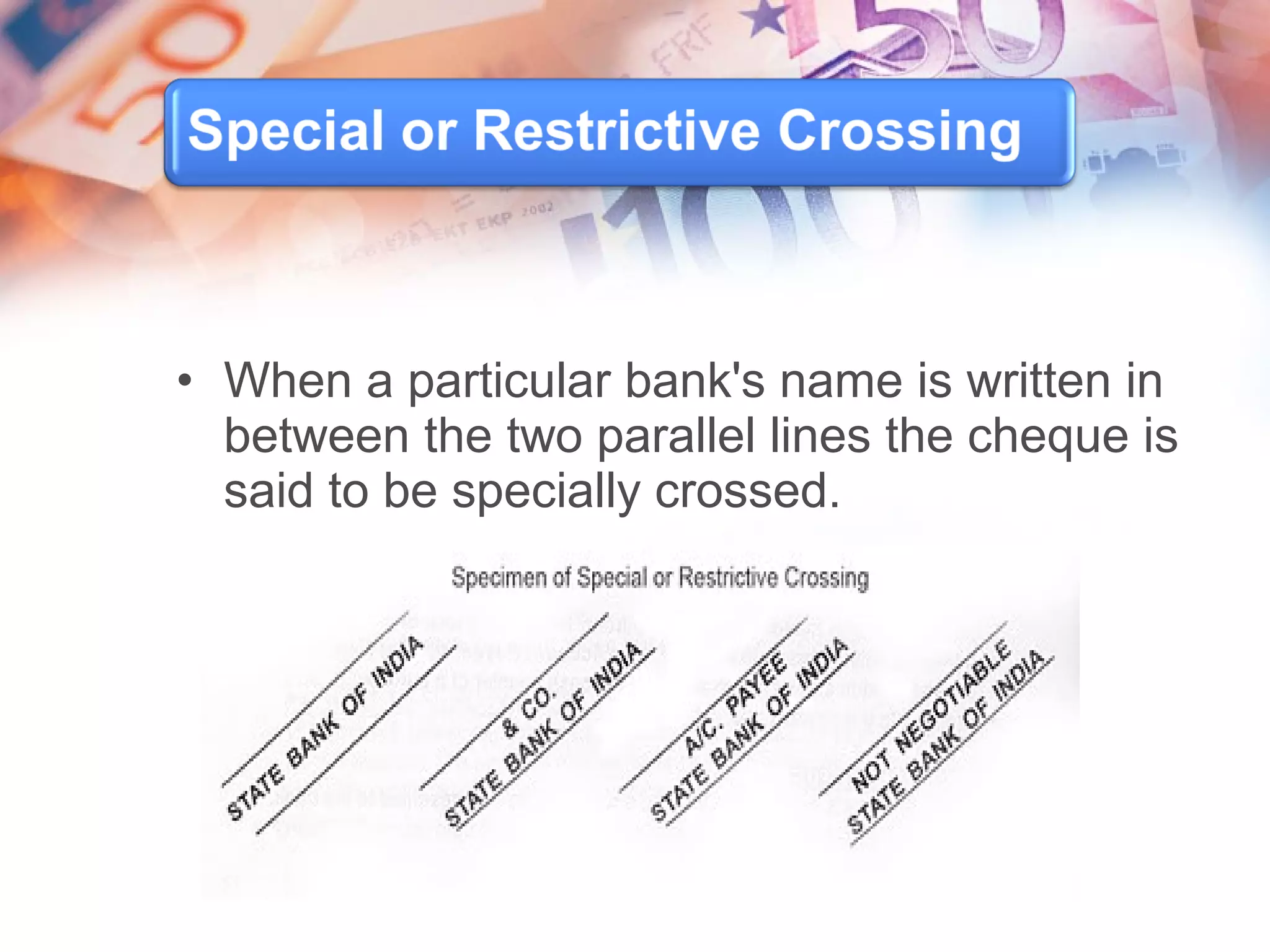

The document provides a comprehensive overview of cheques, including their definition, parties involved (drawer, drawee, payee), and essential requisites like being in written form and signed by the drawer. It outlines various types of cheques, such as open and crossed cheques, along with their payment processes and conditions under which they must be honored by banks. Additionally, it discusses mistakes in cheque payments and the circumstances under which banks can recover mistakenly paid funds.