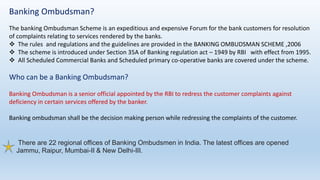

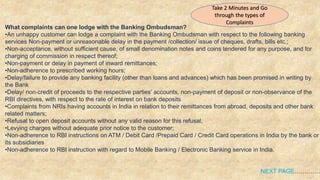

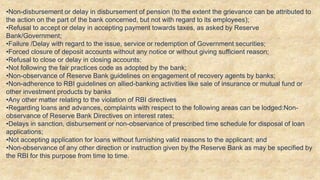

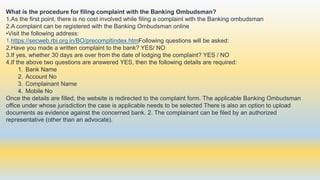

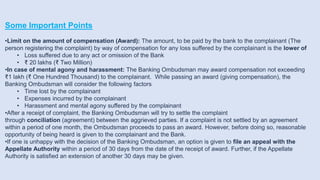

The Banking Ombudsman Scheme provides an inexpensive and transparent mechanism for resolving complaints relating to services provided by banks. The Banking Ombudsman is a senior official appointed by the RBI to impartially address customer complaints against their bank. Complaints that can be lodged include issues with loans, deposits, cheques, remittances, and other banking services. The procedure for filing a complaint is online or written and must be submitted within 30 days of responding to the bank. Compensation awarded is limited to a maximum of Rs. 20 lakhs for financial loss and Rs. 1 lakh for mental agony.