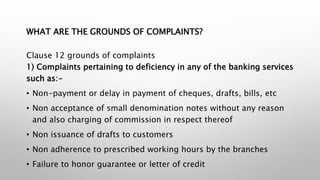

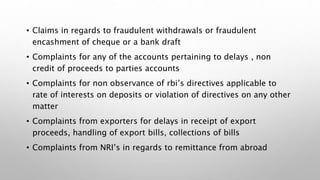

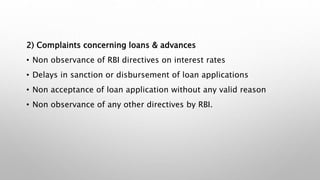

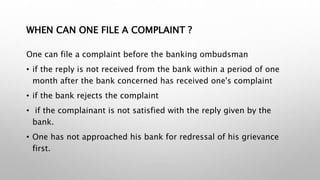

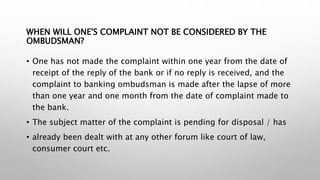

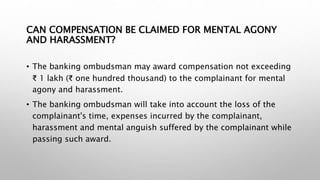

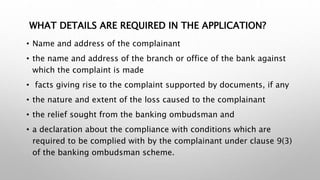

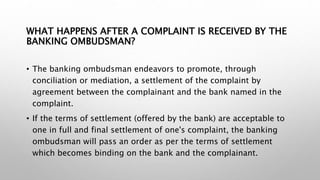

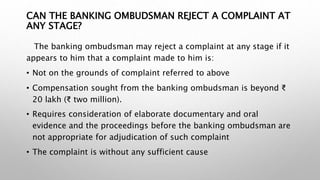

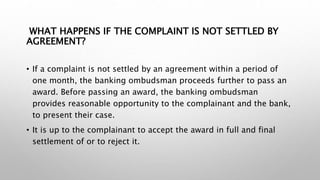

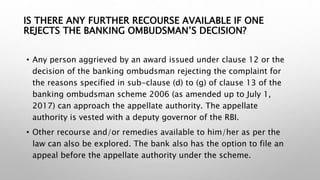

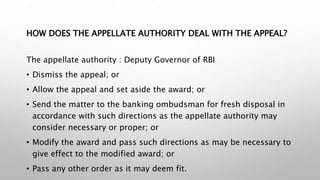

The Banking Ombudsman Scheme, established by the Reserve Bank of India in 1995, serves as a quasi-judicial authority to resolve customer complaints about banking services. It provides an accessible and cost-free platform for complaints related to various banking issues and is applicable to all scheduled commercial banks and regional rural banks. The procedure for filing a complaint is straightforward and allows for compensation, with the possibility of appealing to a higher authority if the complaint is not satisfactorily resolved.