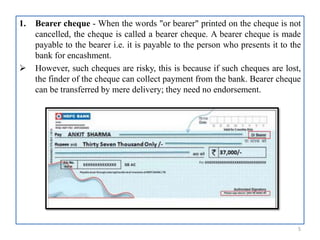

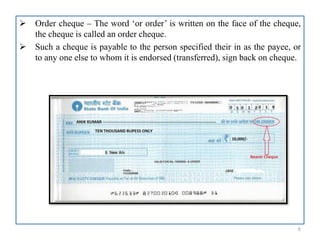

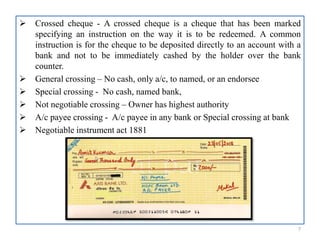

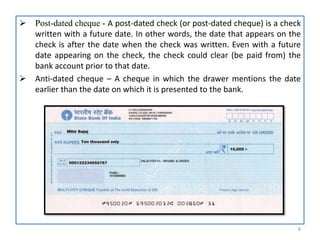

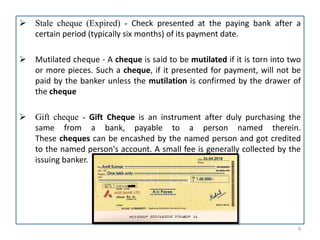

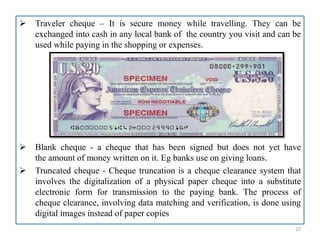

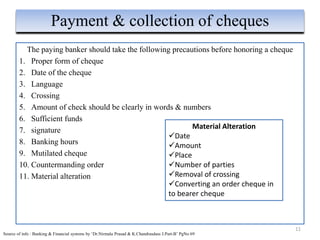

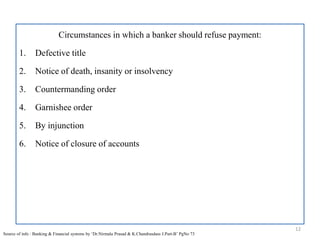

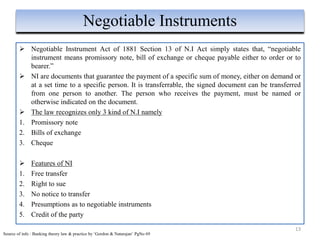

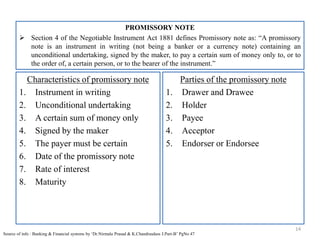

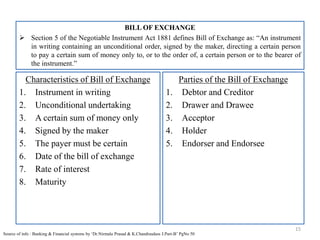

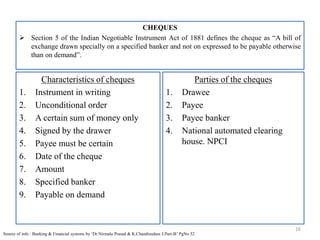

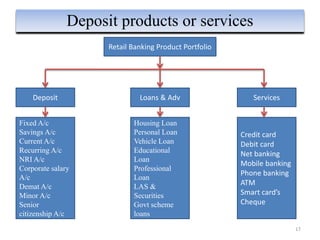

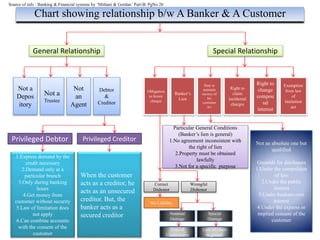

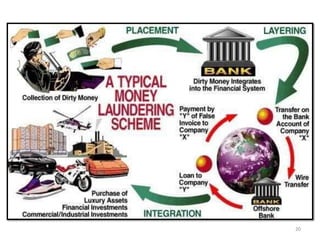

The document provides an overview of the banker-customer relationship, detailing the definitions and types of negotiable instruments like cheques, promissory notes, and bills of exchange as per the Indian Negotiable Instrument Act of 1881. It discusses various cheque types such as bearer, order, and crossed cheques, along with their characteristics and the necessary precautions banks should take when processing them. Additionally, it addresses anti-money laundering definitions, stages of the money laundering process, and the impacts of such practices on financial institutions and the economy.