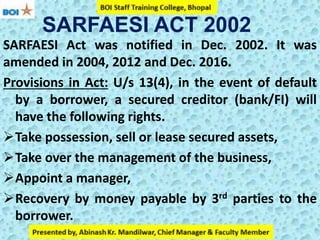

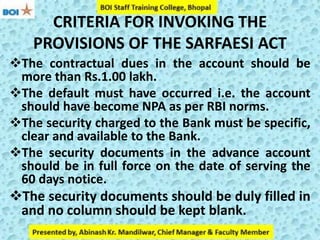

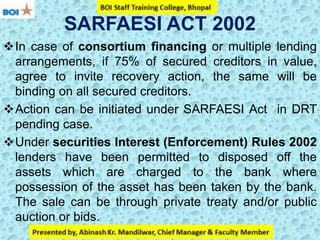

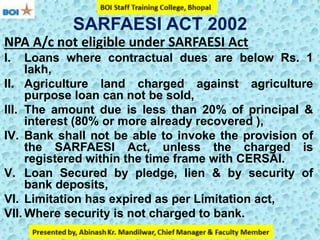

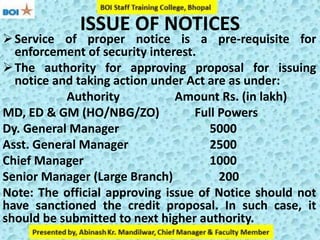

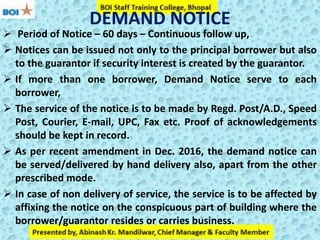

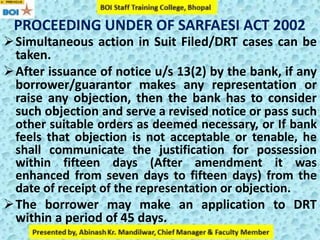

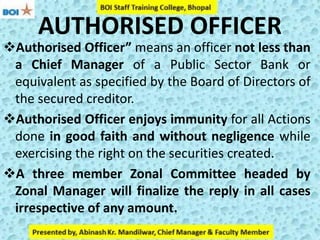

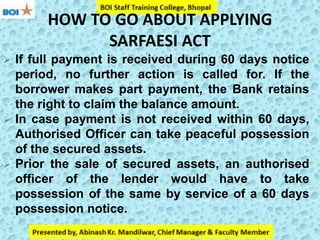

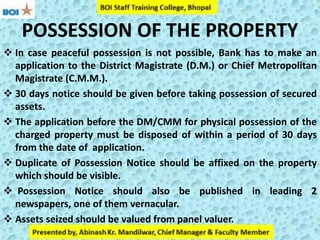

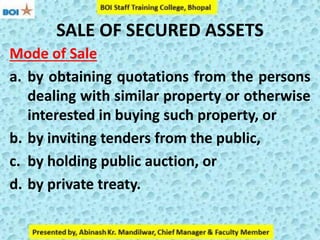

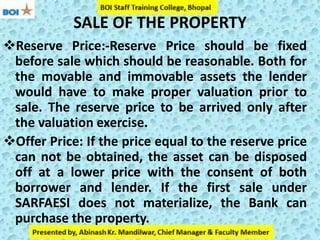

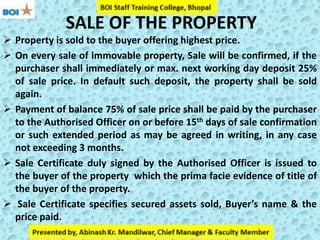

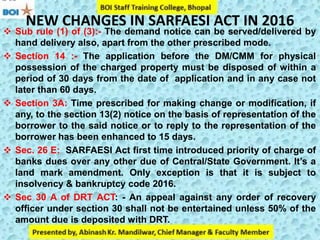

The SARFAESI Act allows secured creditors like banks to enforce security interest for recovery of dues without court intervention. It gives banks the power to take possession of secured assets, sell them, or take over management upon default. The key steps are issuing a 60-day demand notice, taking possession if not paid, appointing an authorized officer, valuating and auctioning the assets. The debtor can raise objections within 15 days of notice or approach DRT within 45 days, otherwise the bank may proceed to sell the assets to recover dues.