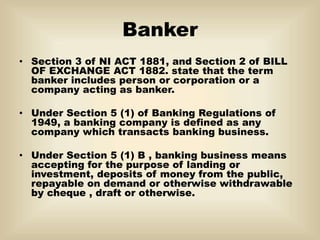

The document discusses the banker-customer relationship. It defines a banker as someone who receives deposits and honors cheques/drafts subject to fund availability. A customer is anyone who has an account with the bank.

The key relationships between a banker and customer are:

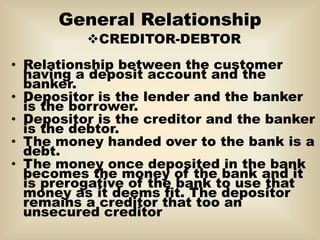

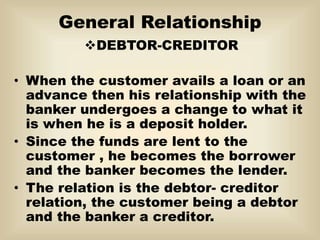

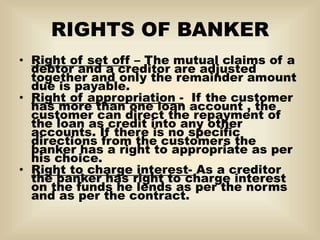

1) Creditor-debtor, with the customer as creditor when making deposits, and debtor when taking loans

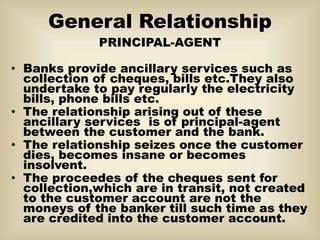

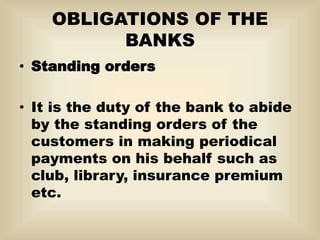

2) Principal-agent, when the bank provides services like bill payments on behalf of the customer

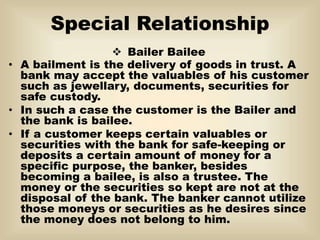

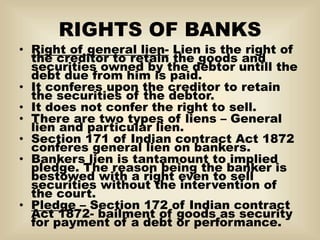

3) Other special relationships can include bailee-bailor for safe deposit boxes, pawnee-pawner for assets pledged as collateral.

The bank has obligations to maintain customer confidentiality, honor checks