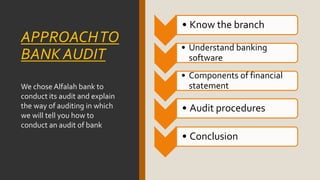

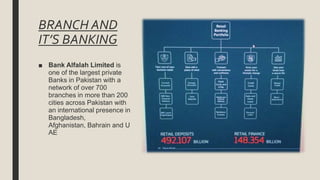

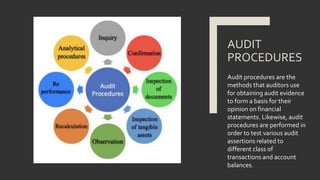

The document outlines a plan for conducting a bank audit, focusing on Bank Alfalah Limited, including types of audits, relevant laws, and audit procedures. It emphasizes the importance of understanding the banking system, financial statements, and using proper software for audits. The conclusion reiterates the auditor's role in assessing the accuracy of financial statements and compliance with legal requirements.