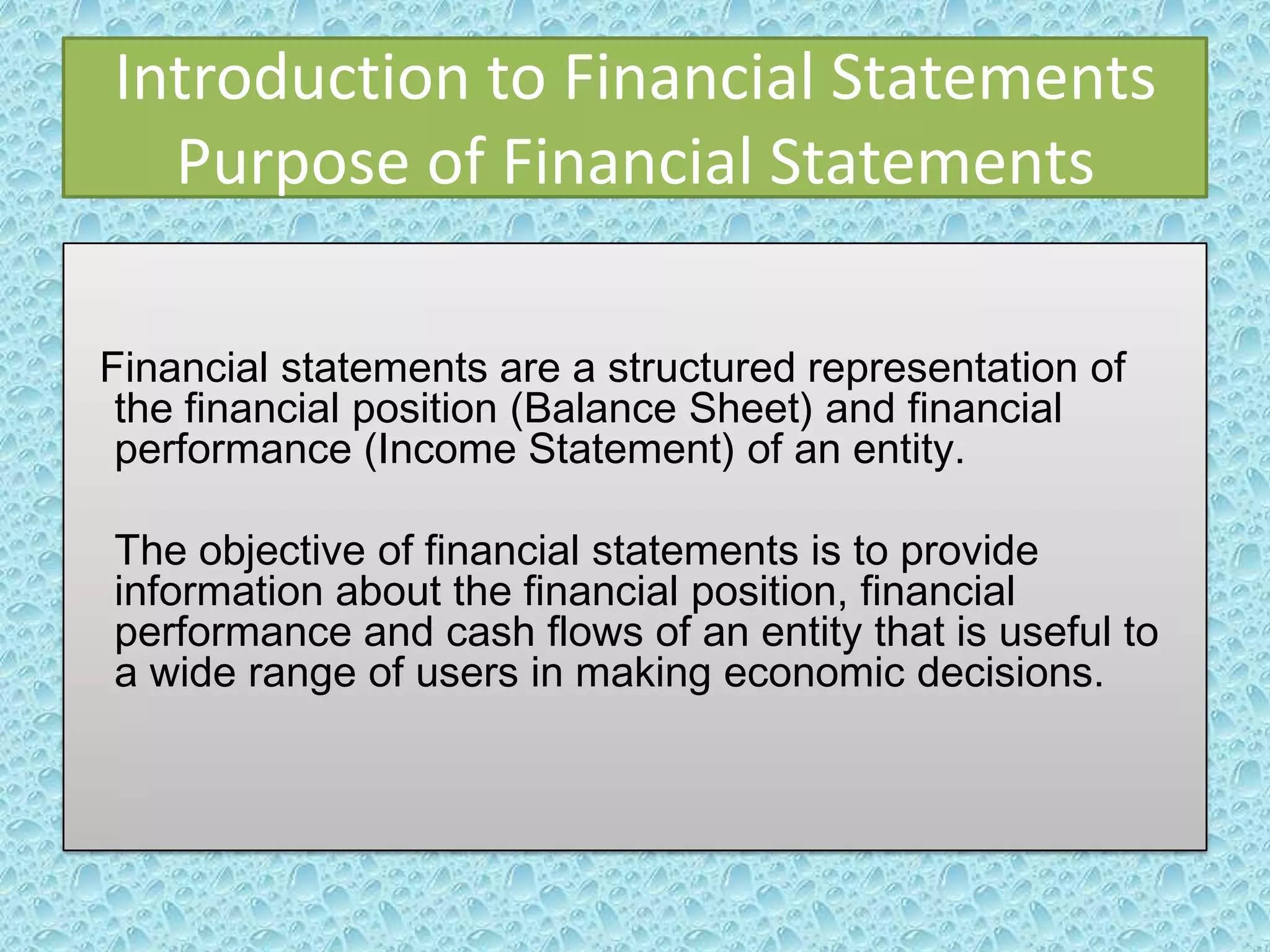

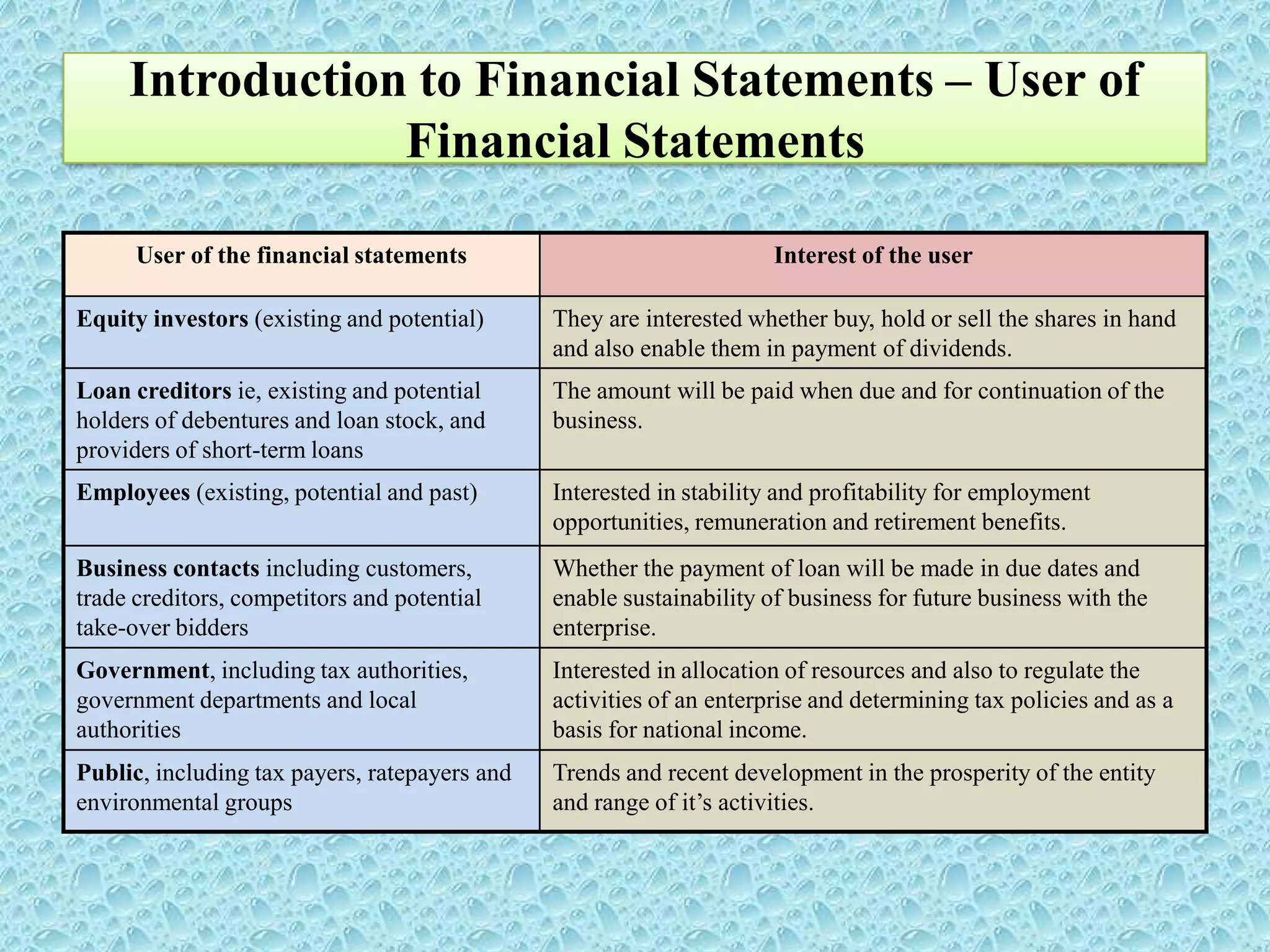

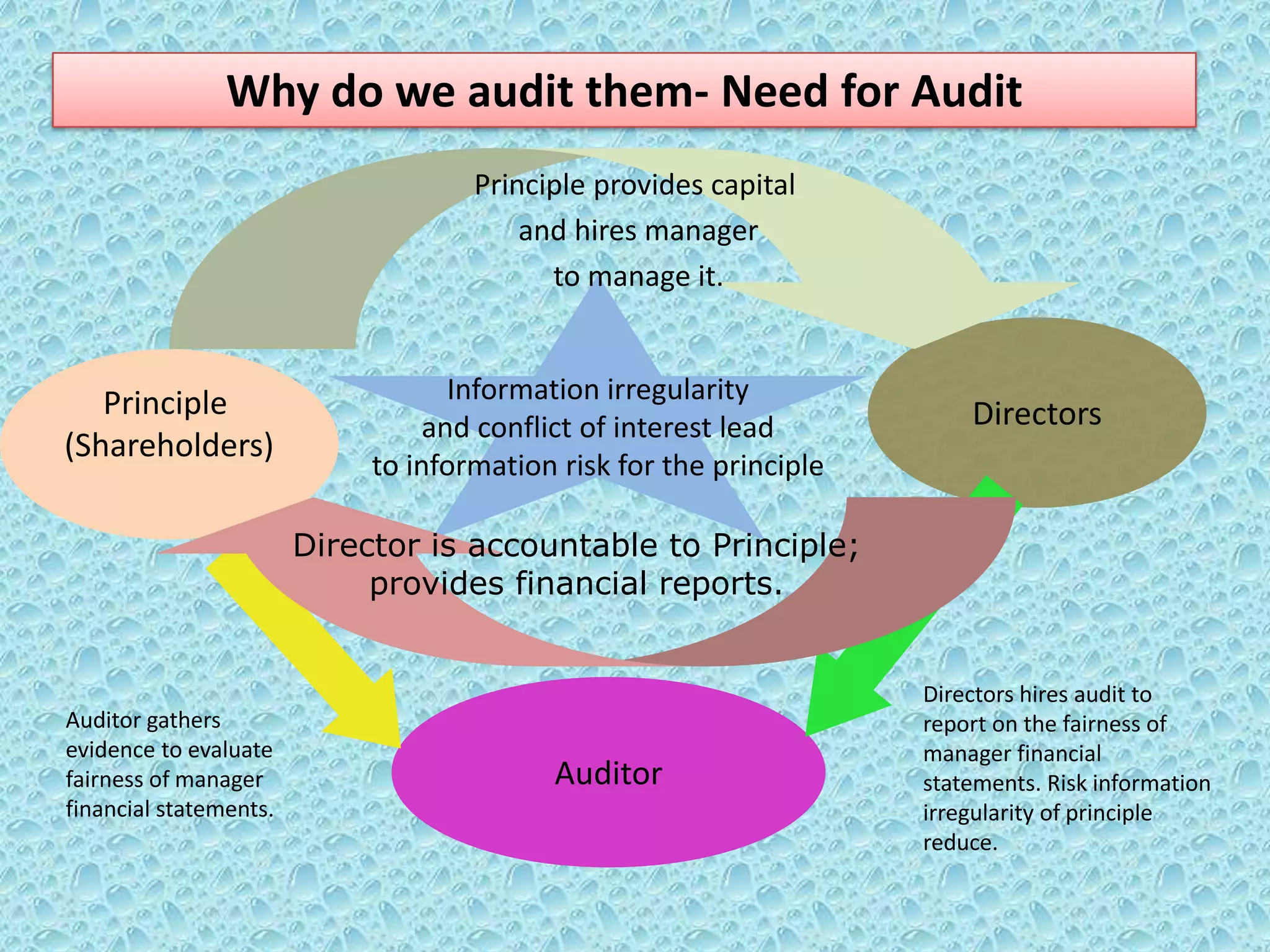

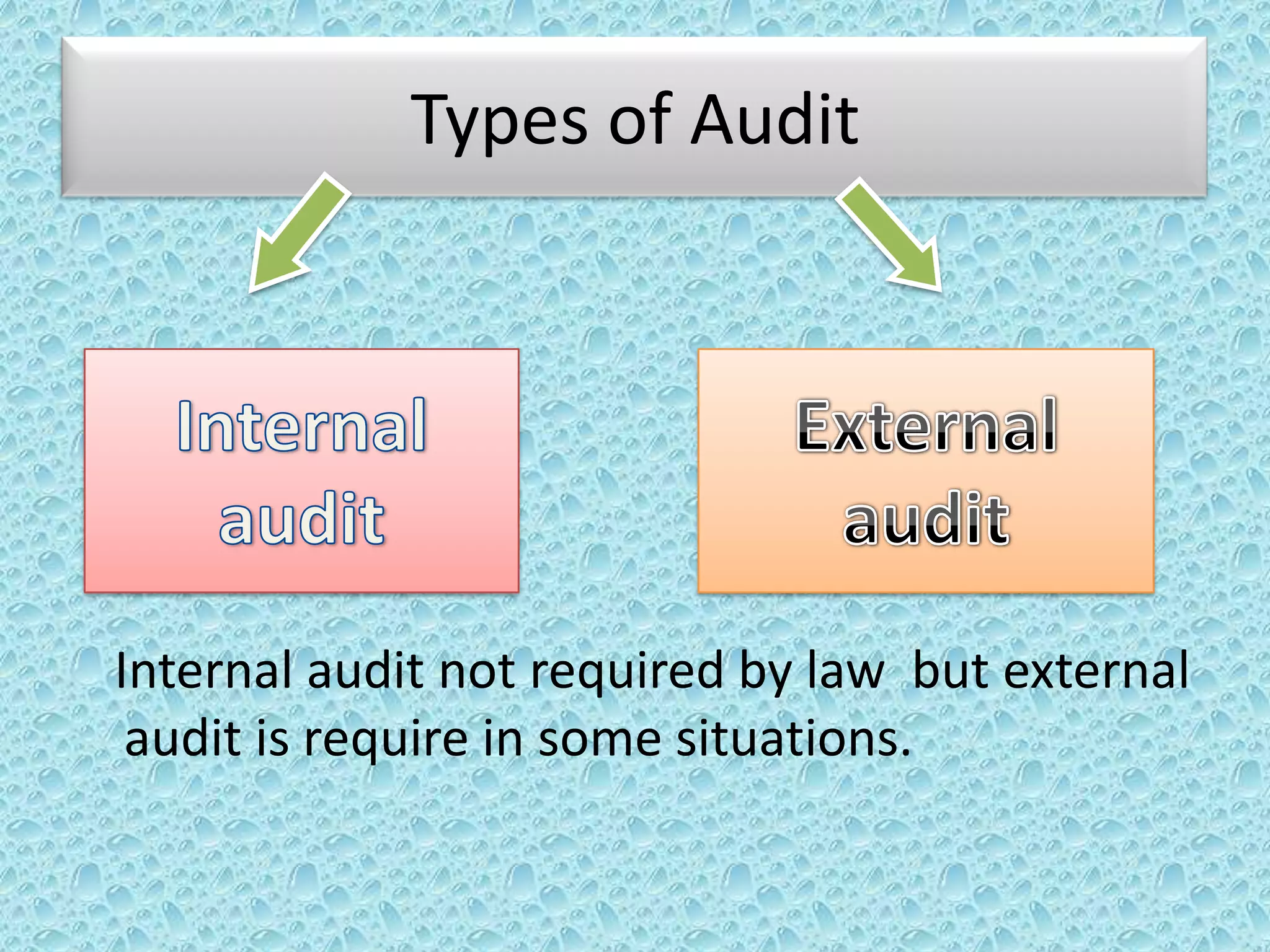

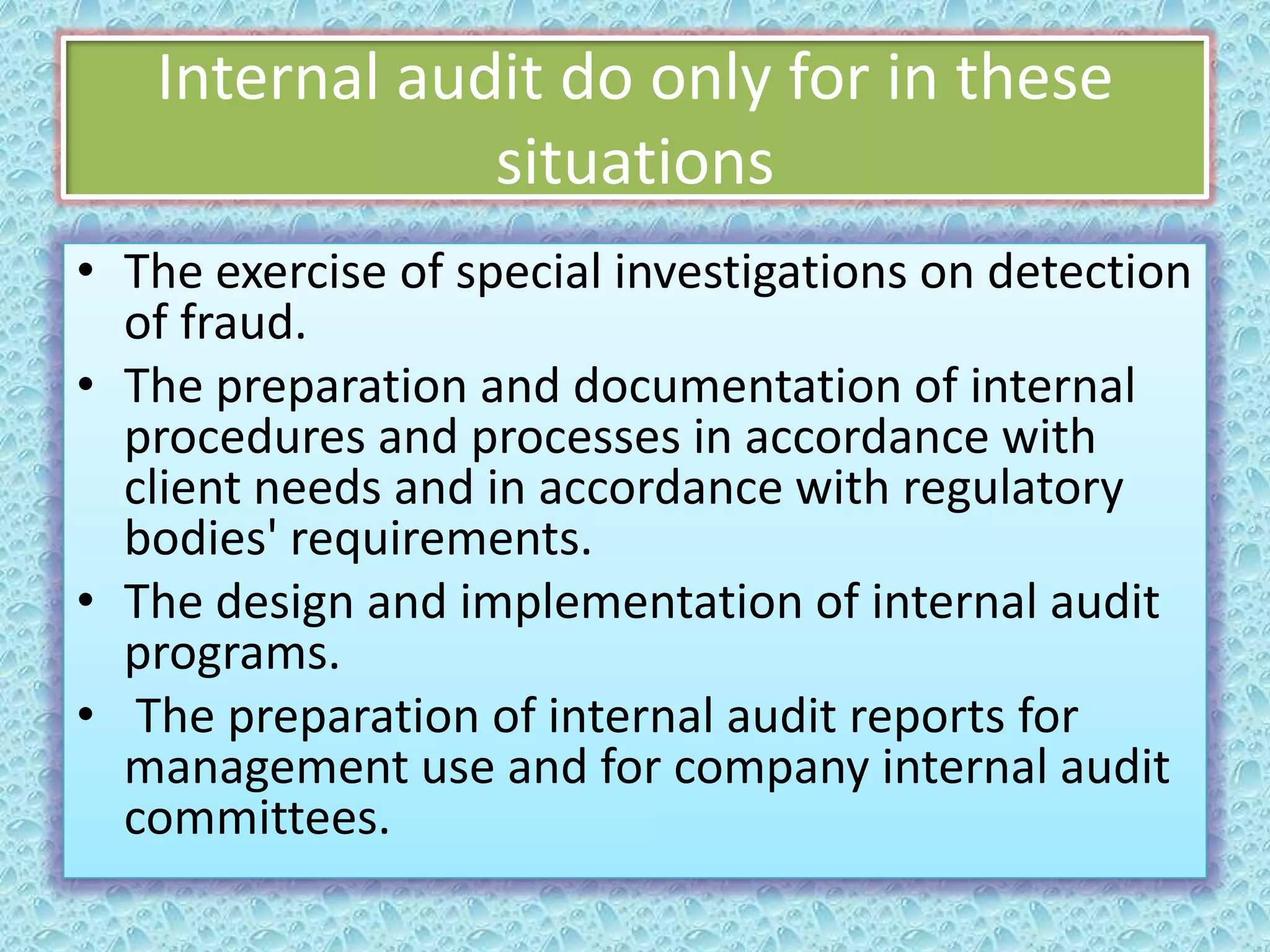

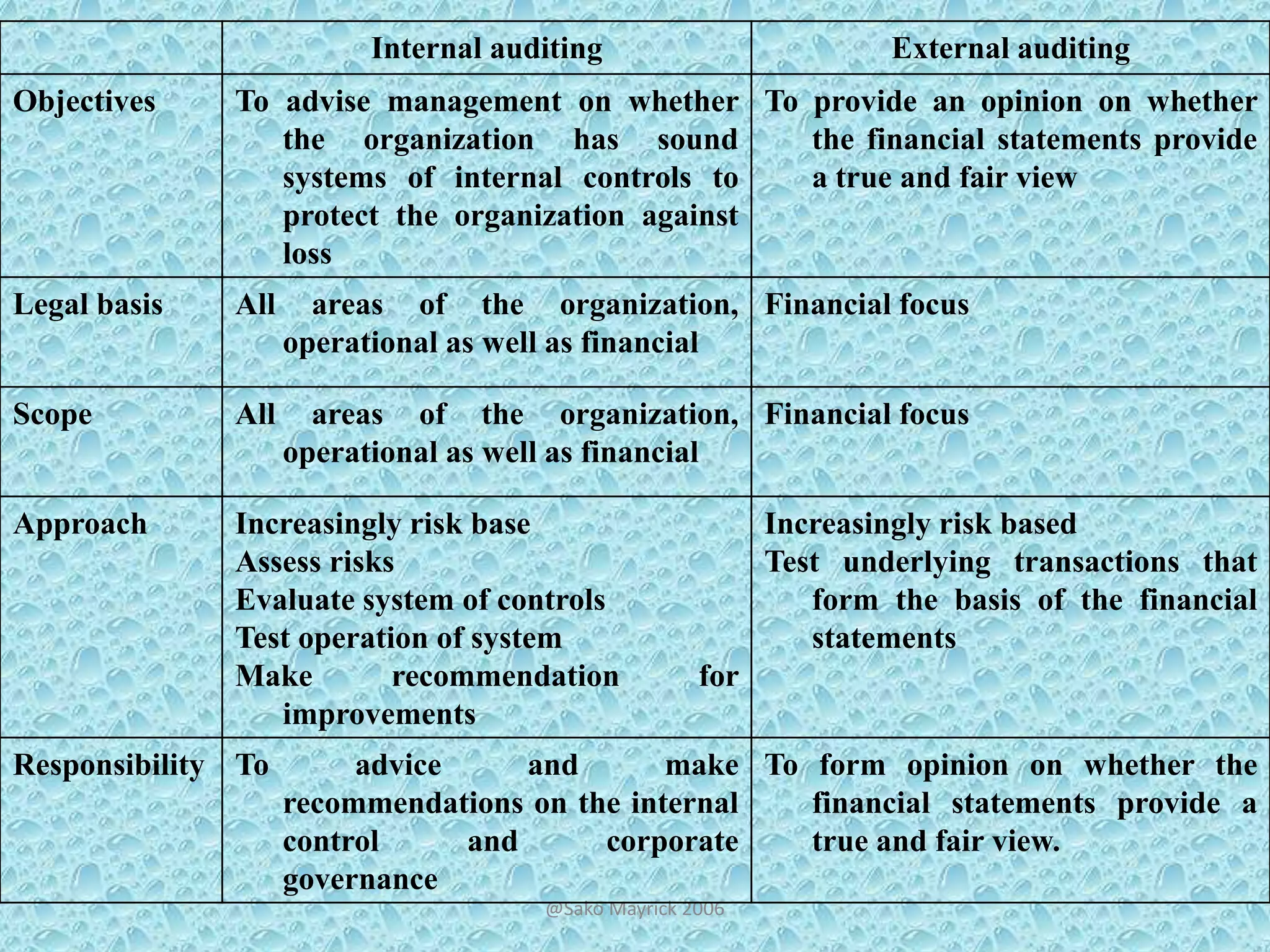

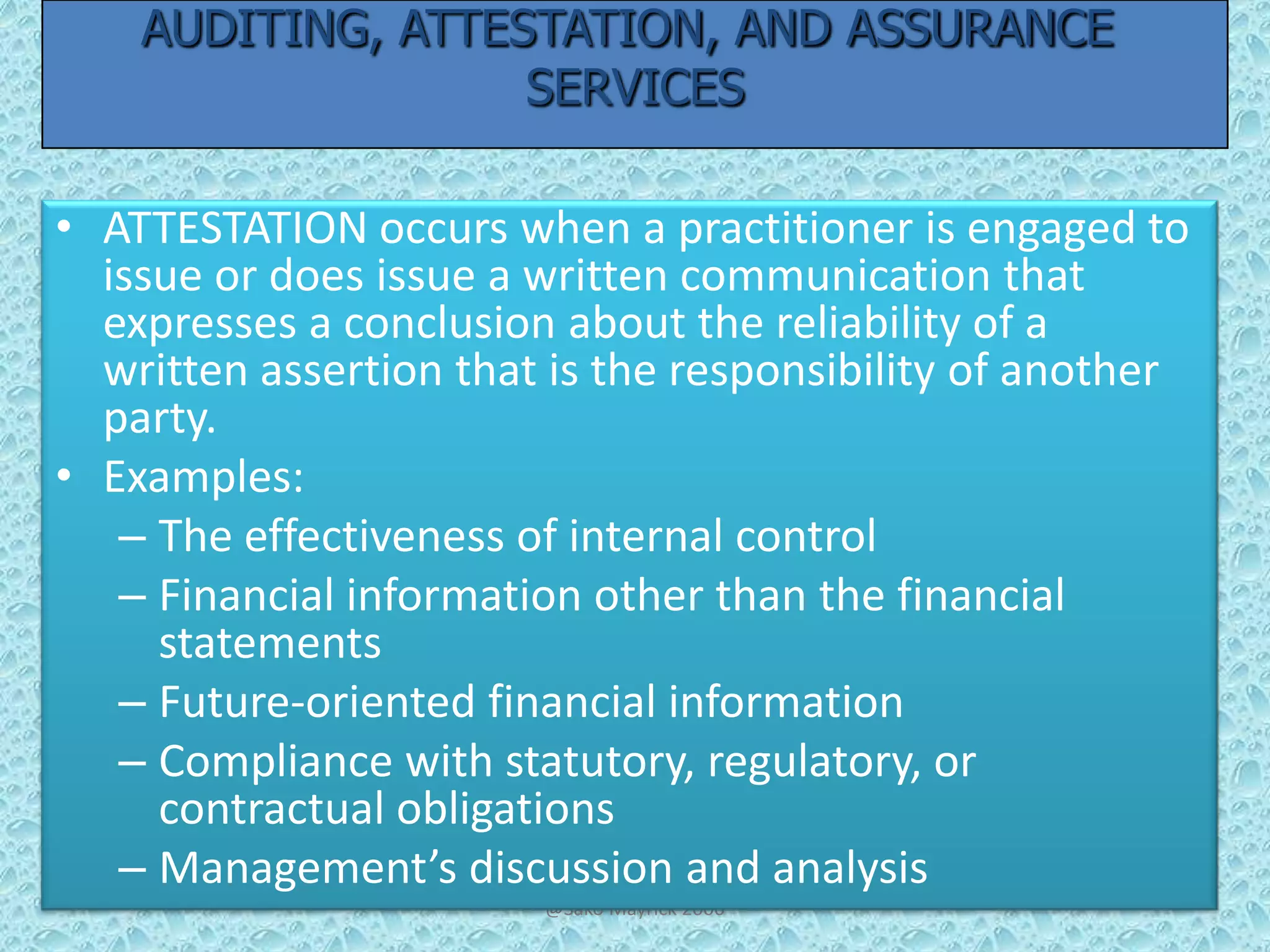

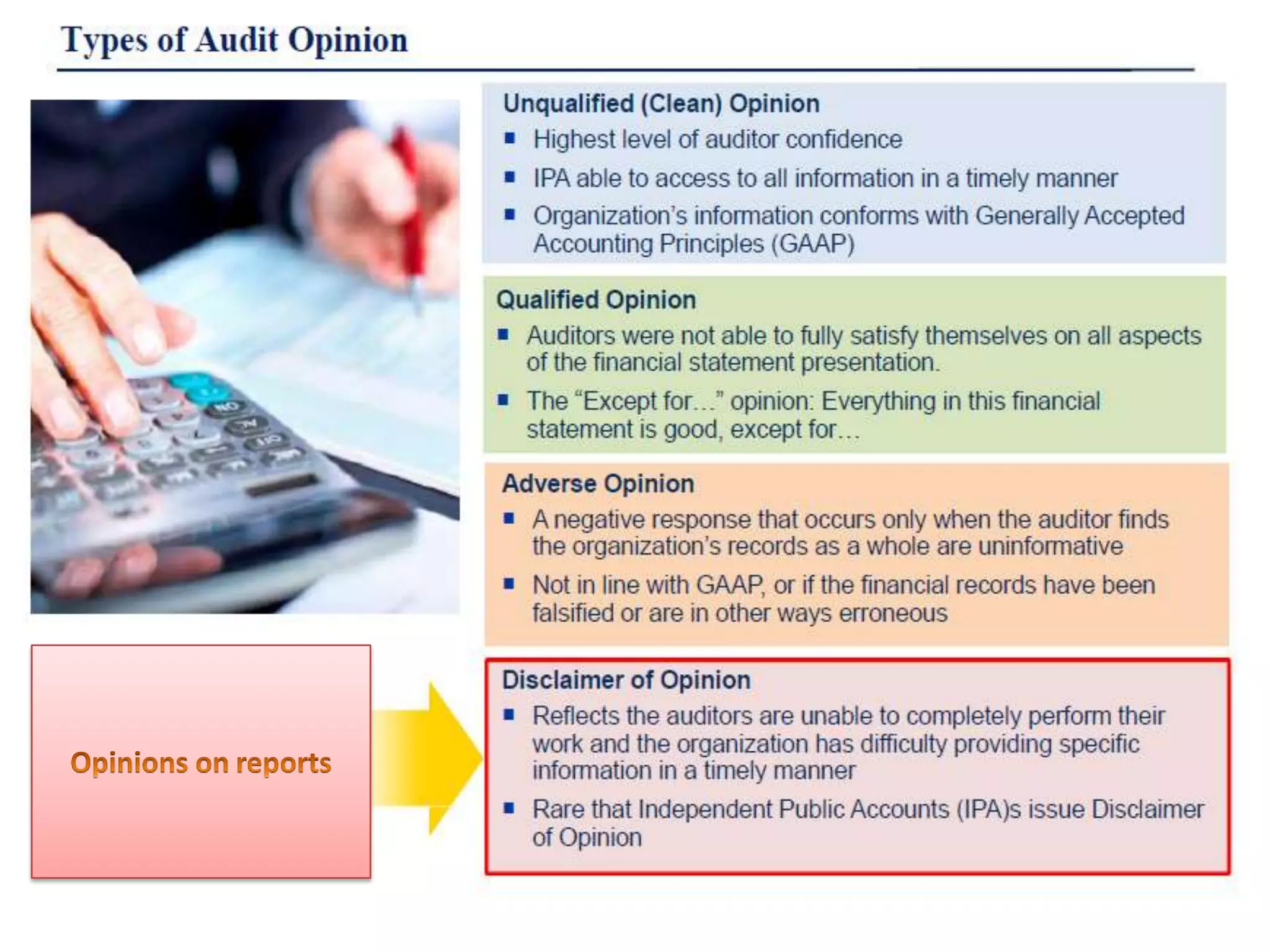

The document provides an introduction to financial statements and auditing. It discusses the purpose of financial statements, which is to provide useful information to users for economic decision making. It outlines the main users of financial statements and their interests. It also explains the need for auditing. Auditing verifies that financial statements are true and fair, and complies with reporting standards. It ensures the principal, or shareholders, have reliable information from the directors about the company's financial position and performance.