The document discusses the types of audits conducted at banks, including statutory audit, concurrent audit, and RBI audit. It outlines the objectives and key areas reviewed for each type of audit. The statutory audit verifies balance sheet classifications and ensures accurate income recognition. Concurrent audit checks transactions daily to fill gaps between statutory audits, examining revenue, expenses, documentation, and administrative functions. RBI audits assess the overall financial position and management policies to safeguard depositor interests and compliance with regulations. The document also describes the stages of auditing, including acquiring regulatory/industry knowledge, understanding books and records, and obtaining internal reports.

![17

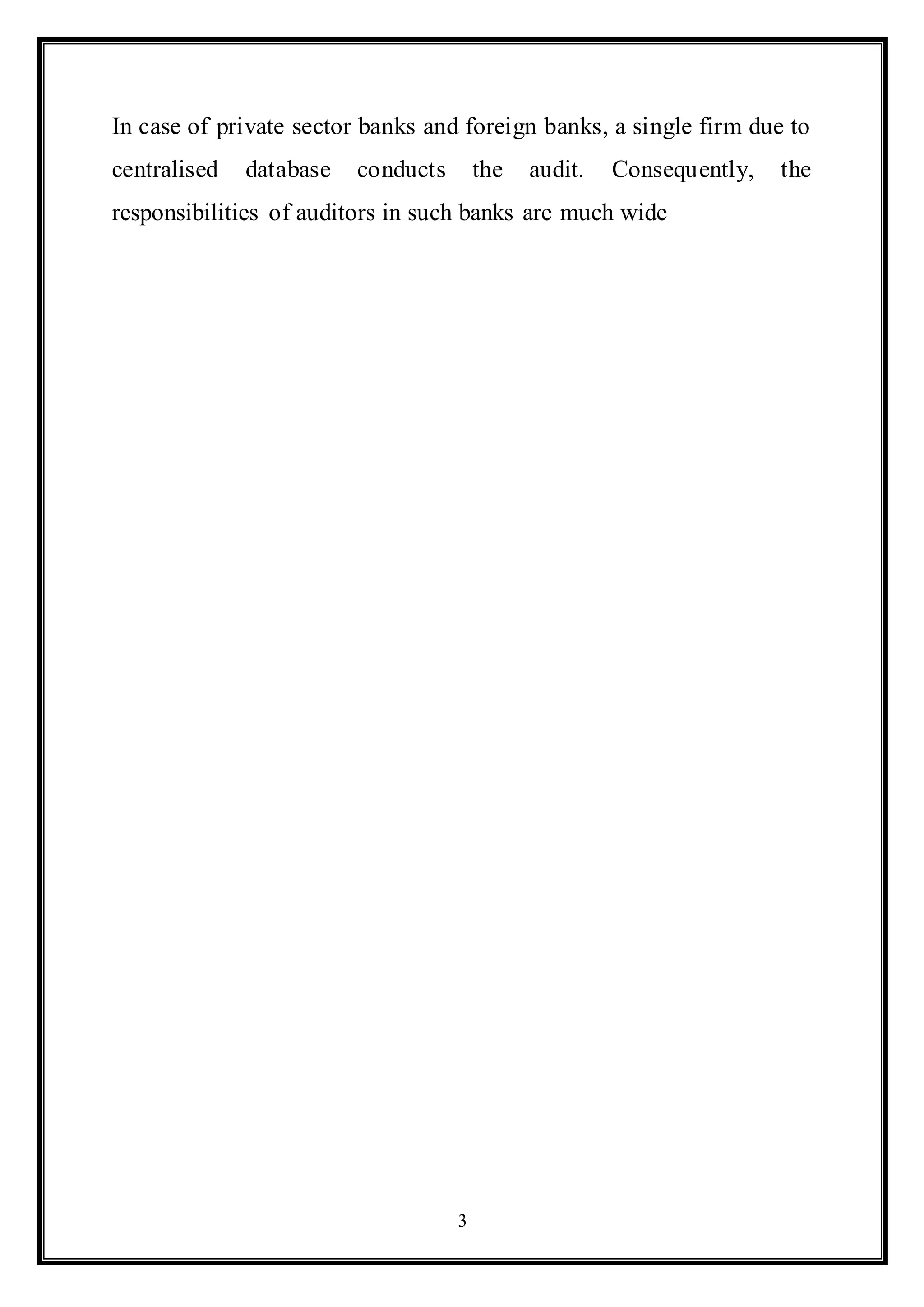

b) Whether or not the transactions of the company which have come

to his notice have been within the powers of the company;

c) Whether or not the returns received from branch offices of

the company have been found adequate for the purposes of his audit;

d) Whether the profit and loss account shows a true balance of profit

or loss for the period covered by such account;

e) Any other matter which he considers should be brought to the

notice of the shareholders of the company.

It may be noted that in in the case of a banking company the auditor

has to specifically report whether, in his opinion, the profit & loss

account and balancesheet of the banking company comply with the

accounting standard referred to in sub- section (3C) of the sec 211 of

the Companies Act, 1956.

It may also be noted the Companies(Auditor’s Report) Order

[CARO] 2003 (Revised in 2005) is not applicable to Banking

Company.](https://image.slidesharecdn.com/auditofbank-161021084714/75/Audit-of-bank-17-2048.jpg)