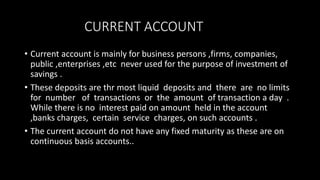

There are four main types of bank accounts: current accounts for businesses, savings accounts for individuals to earn interest on deposits, recurring deposit accounts that allow fixed monthly deposits over a set period of time, and fixed deposit accounts where a lump sum is deposited for a fixed period at a higher interest rate. Each account type has different eligibility requirements, interest rates, restrictions on withdrawals or deposits, and penalties for early closure.