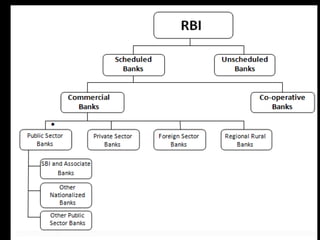

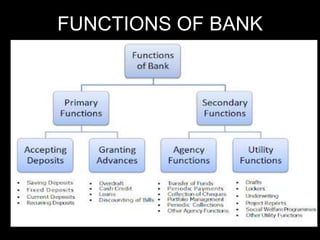

The document provides an overview of the Indian banking system. It discusses the structure of the system, which includes the Reserve Bank of India (central bank), scheduled commercial banks (public sector banks, private sector banks, foreign banks, regional rural banks, cooperative banks), and their roles. It also summarizes the primary functions of banks, which are accepting various types of deposits from the public and granting loans and advances. Secondary functions of banks include performing agency functions like funds transfer and collection services, as well as general utility functions.