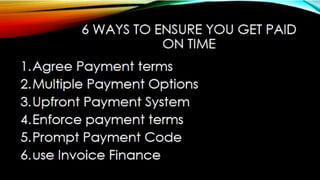

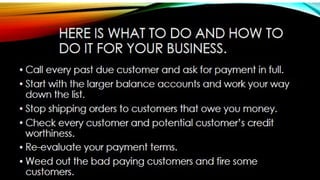

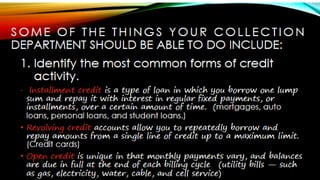

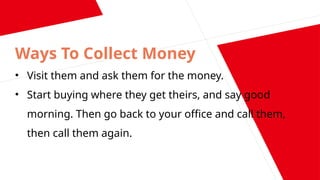

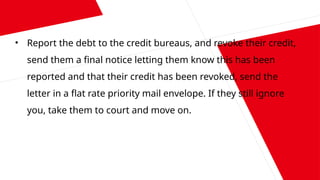

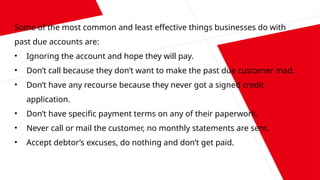

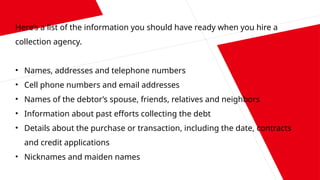

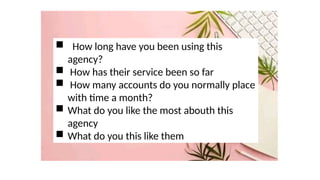

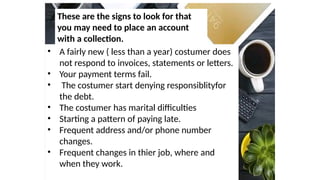

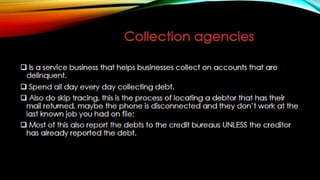

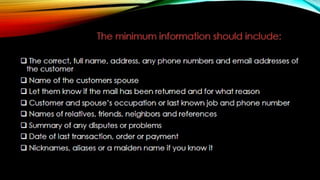

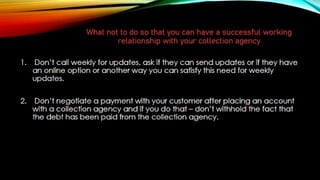

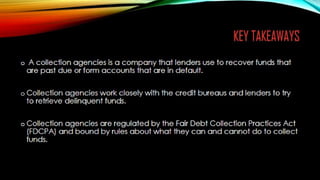

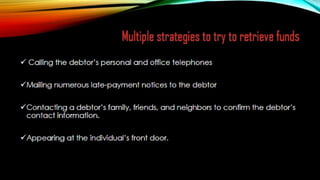

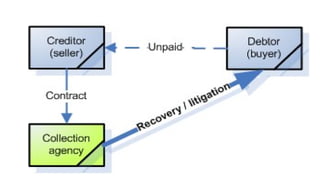

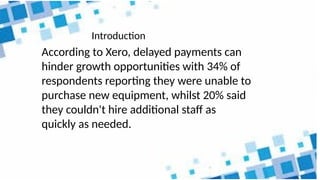

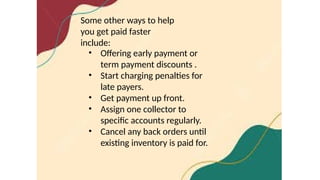

The document outlines effective strategies for debt collection, emphasizing the need for persistence, negotiation skills, and proper communication. It provides insights into when to involve a collection agency and what factors to consider when selecting one, including their qualifications and collection procedures. Furthermore, it discusses the negative impact of late payments on business operations and offers solutions such as establishing clear policies, invoicing promptly, and offering payment incentives.