This document provides an overview of debt collection, including:

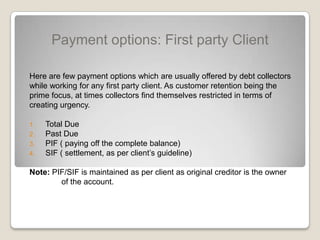

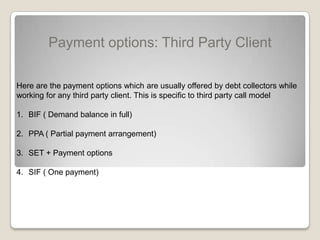

1. Defining debt collection and describing the types, including first/third party collections and different types of debts.

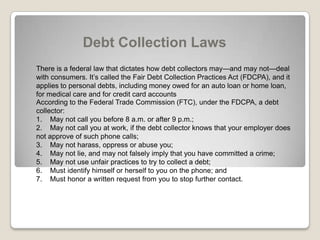

2. Outlining key laws governing debt collection practices in the US, such as the Fair Debt Collection Practices Act.

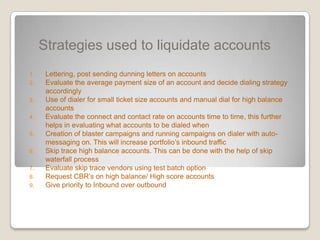

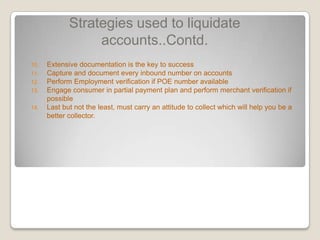

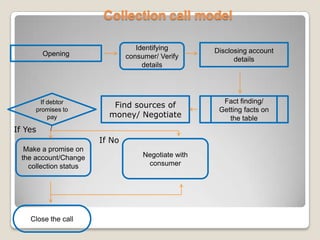

3. Describing strategies used by collectors to liquidate accounts, such as lettering, skip tracing, engaging consumers in payment plans, and maintaining documentation.