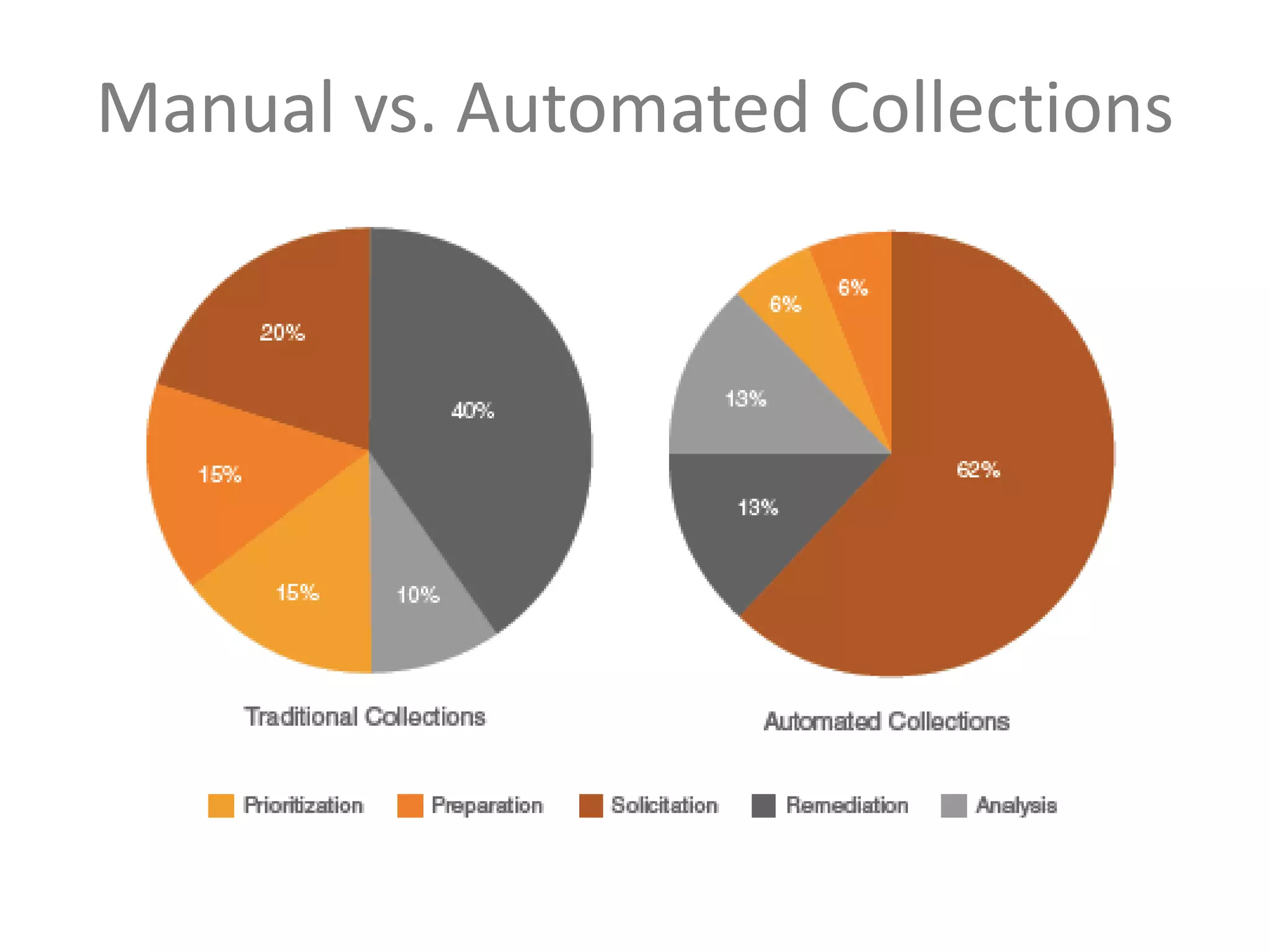

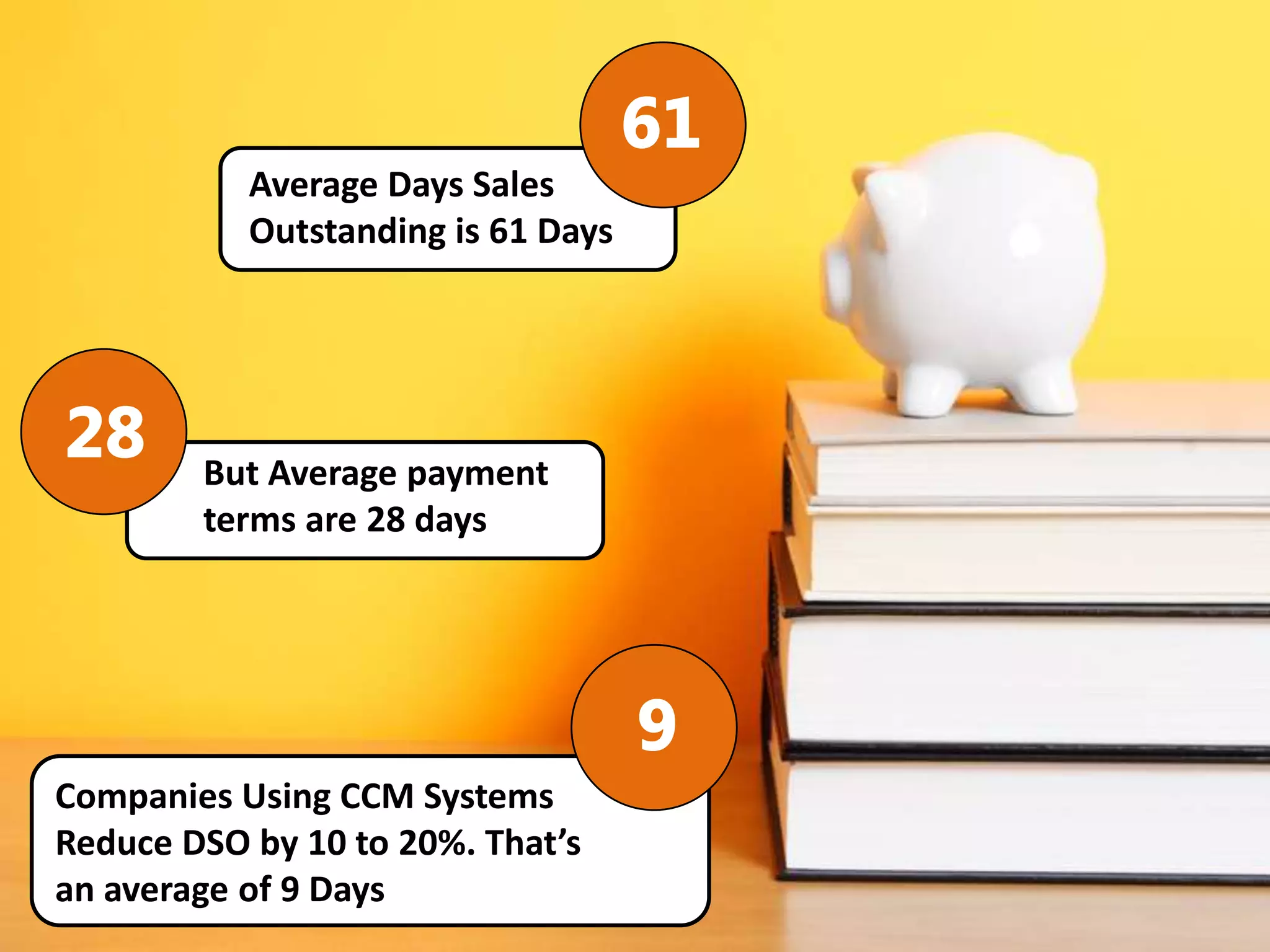

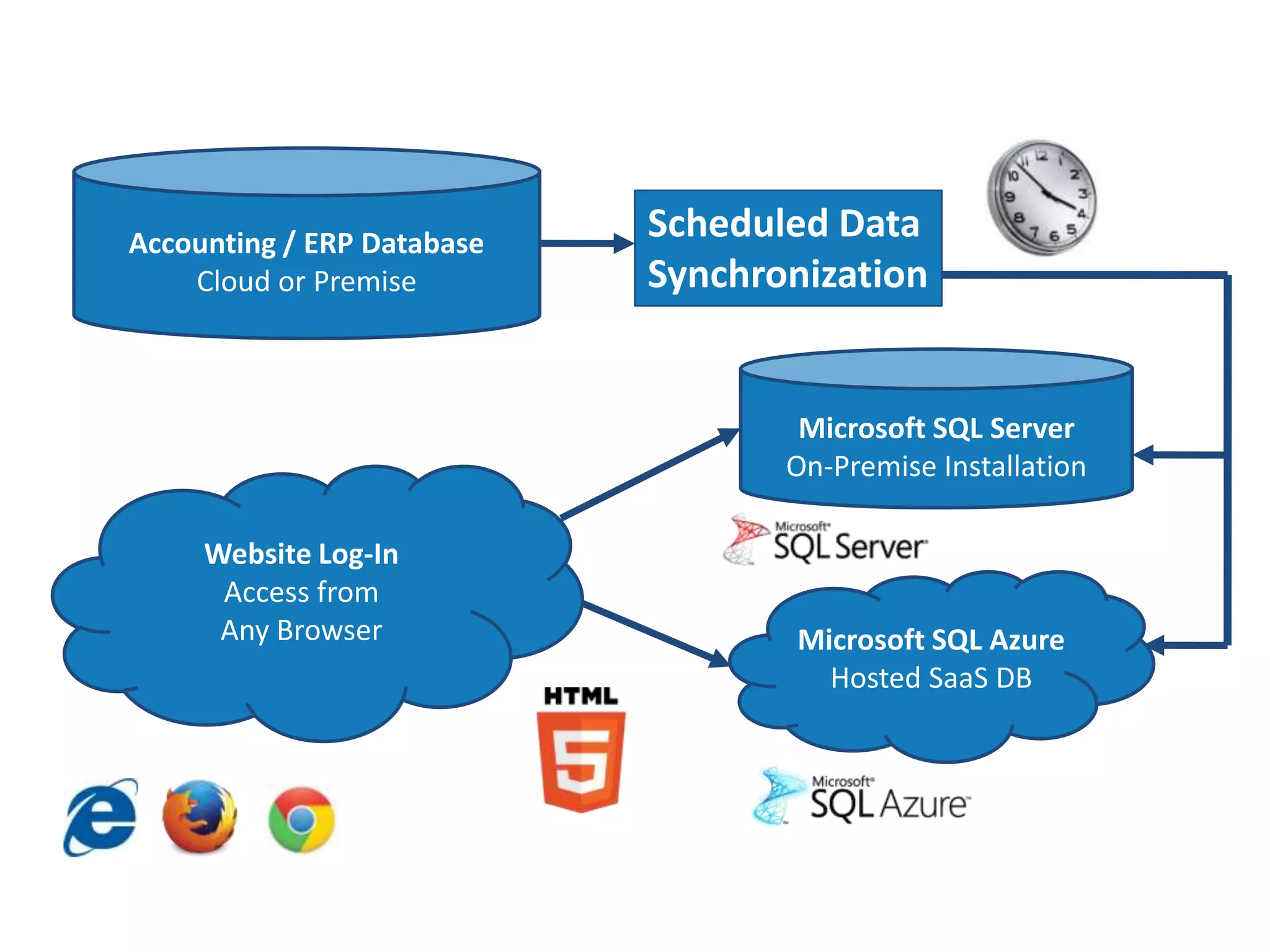

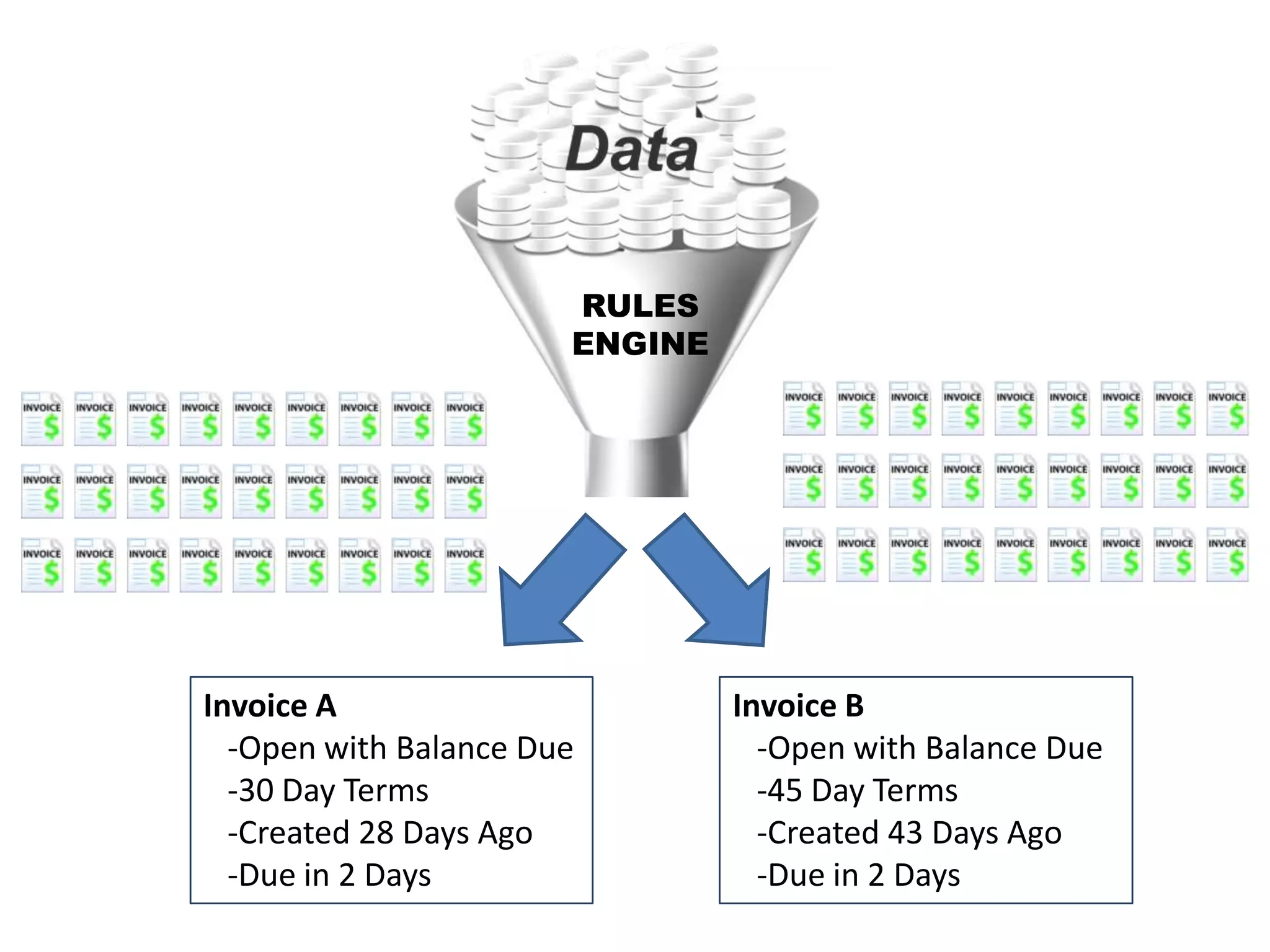

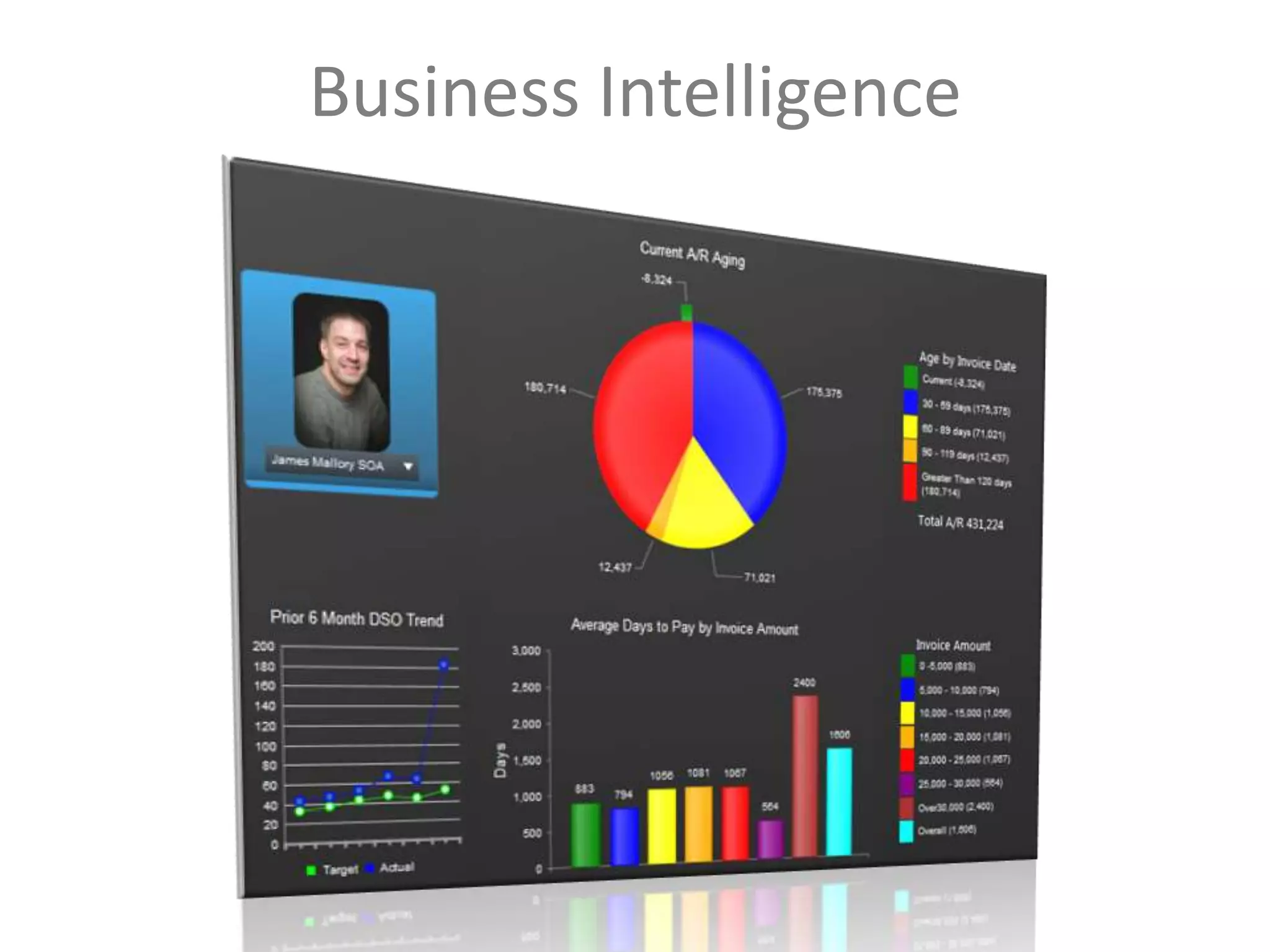

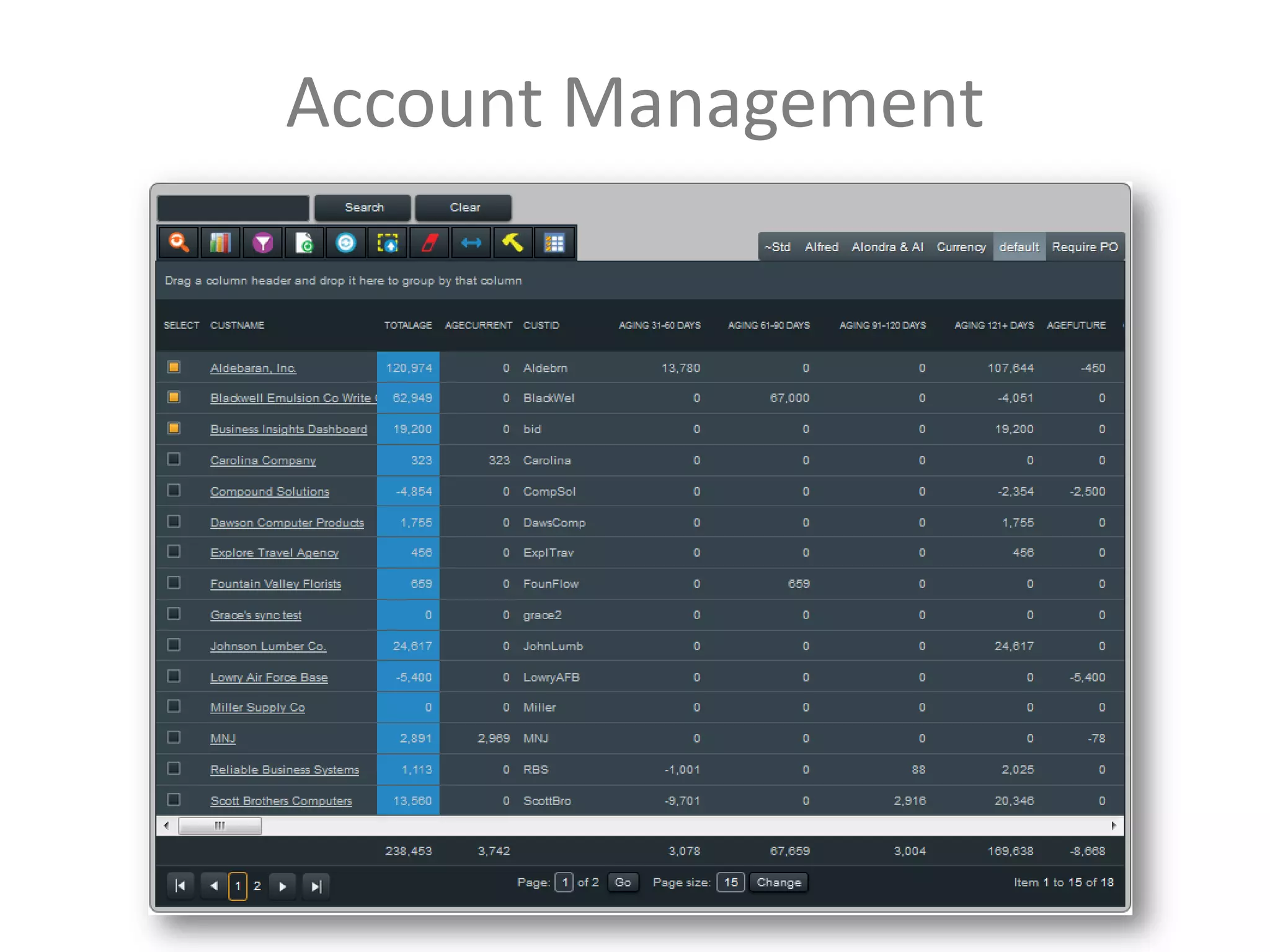

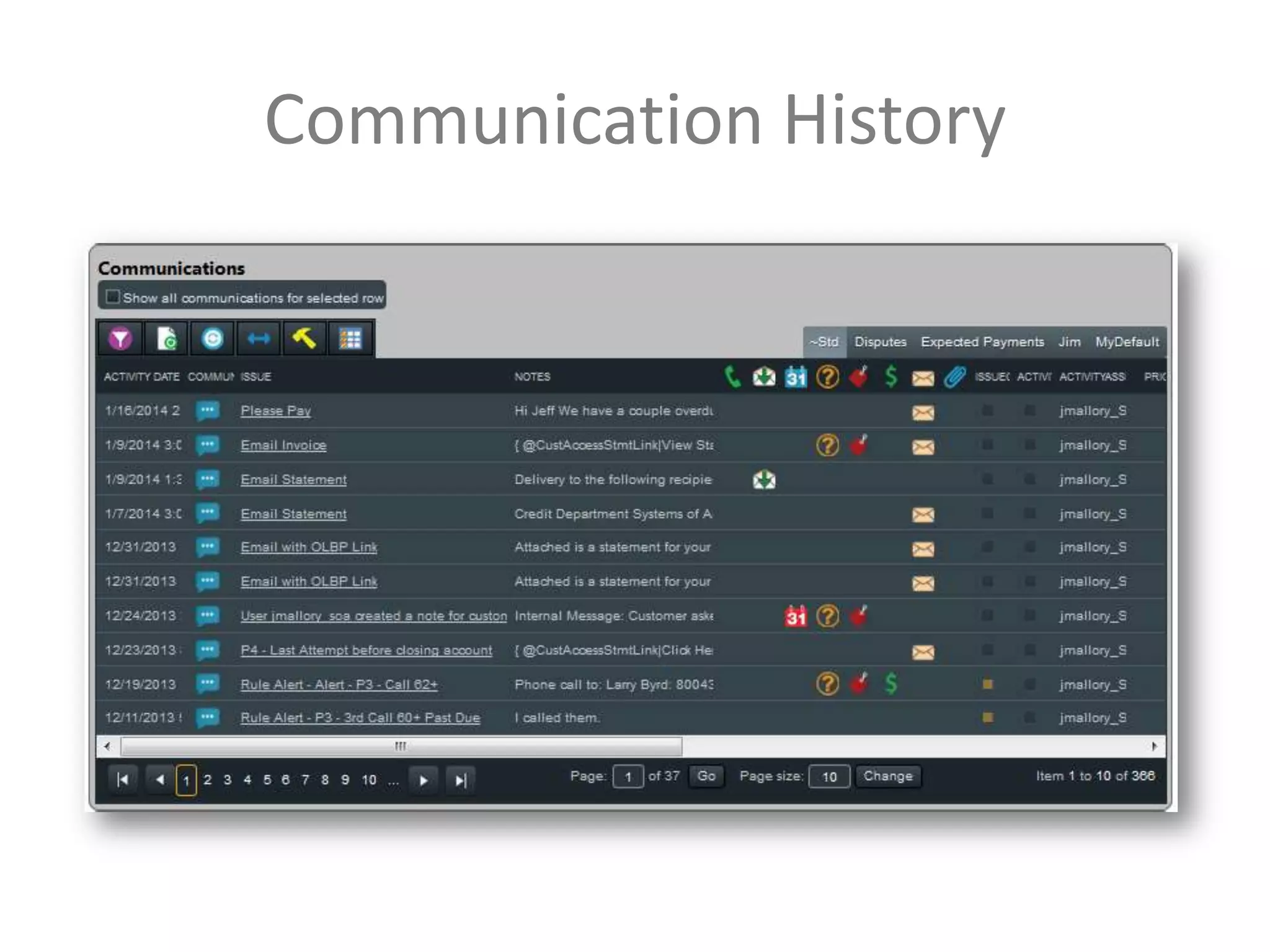

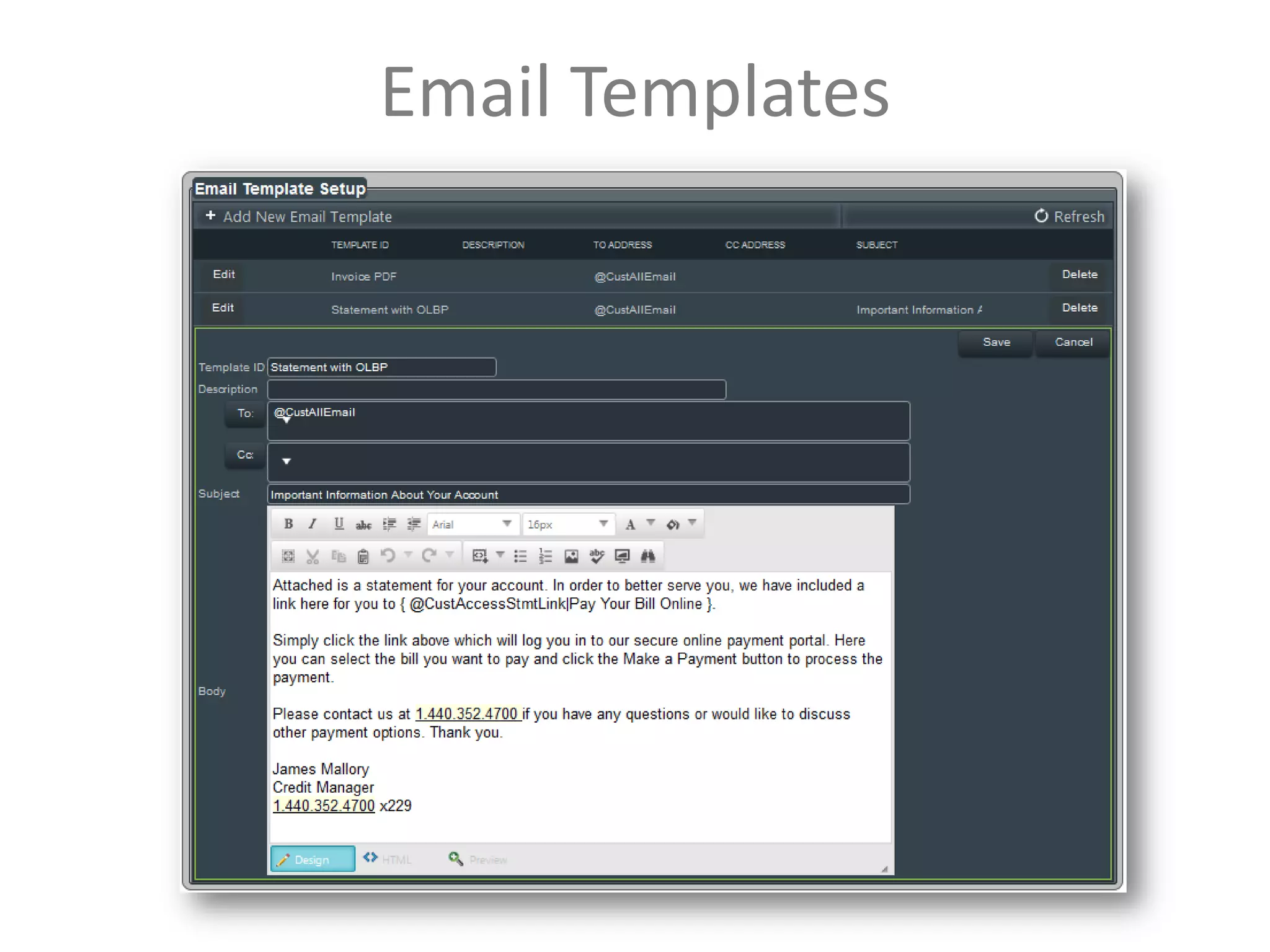

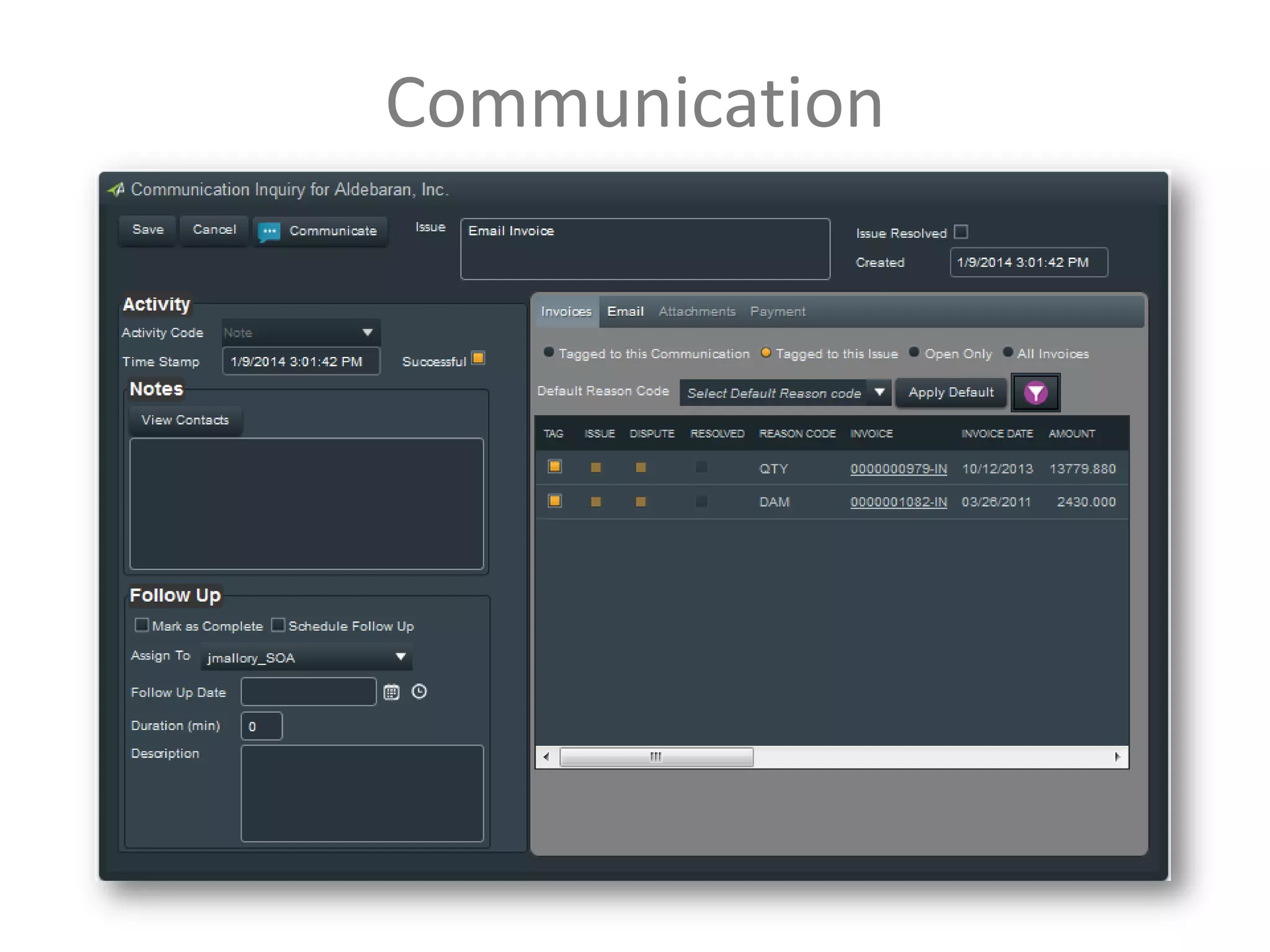

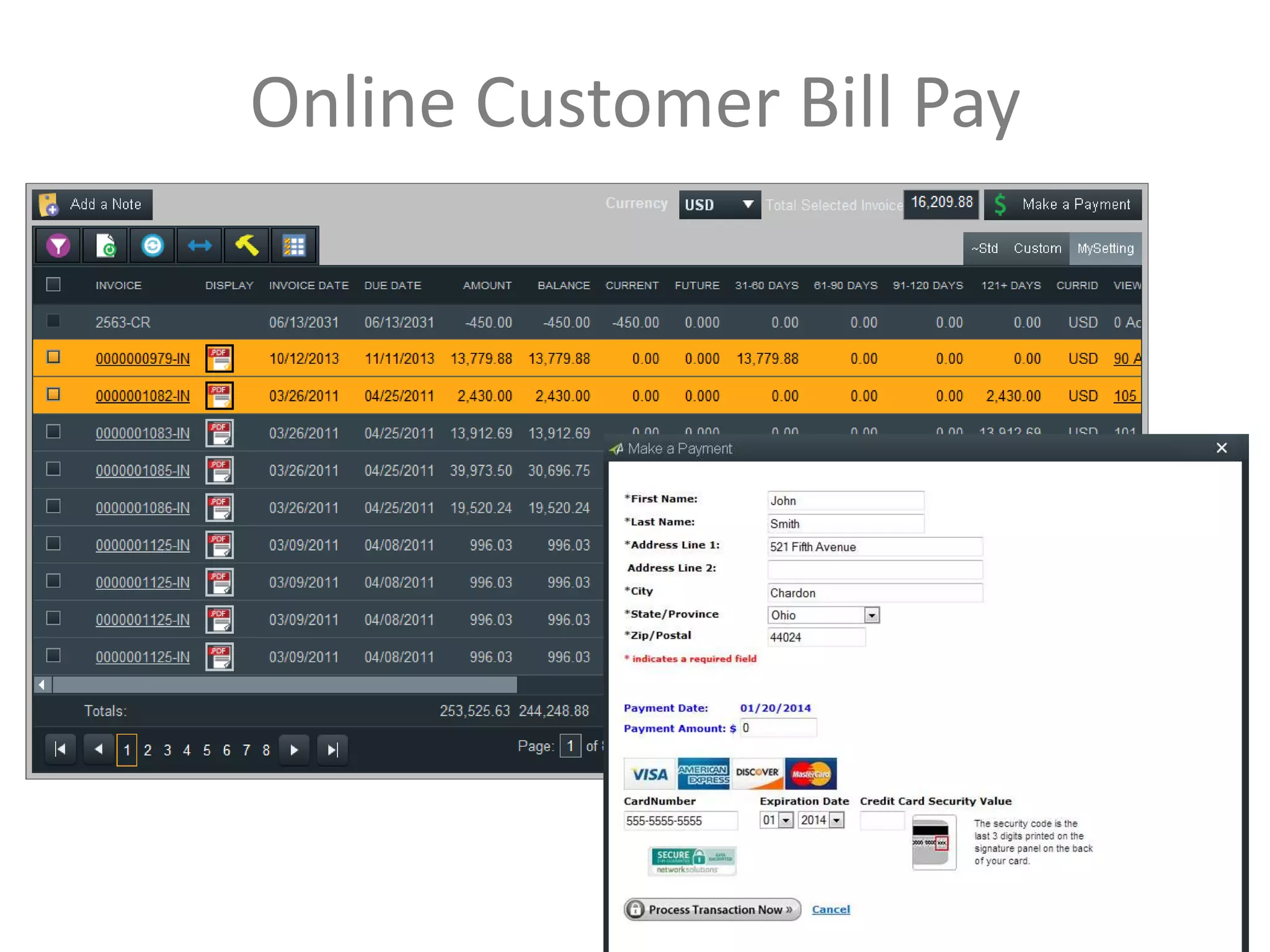

This document promotes an automated accounts receivable (A/R) management and collections solution. It summarizes that accounts receivable is typically one of the largest assets for most businesses but collecting on invoices manually is inefficient. The solution claims to help businesses get paid faster by converting A/R to cash quicker through automated email and phone collections, dispute management, and online customer bill pay. This can help reduce days sales outstanding by 10-20 days on average and save businesses up to $40,000 annually in written-off invoices and finance costs for borrowed working capital.