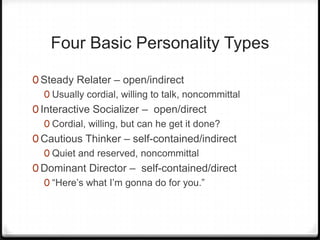

This document provides guidance on effective telephone collection techniques. It discusses understanding company culture and customers, communicating professionally, gathering information from debtors, negotiating payment plans, and following up to ensure agreements are kept. The goal is to resolve issues respectfully while representing the company's interests.

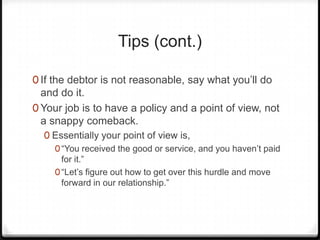

![What If They Don’t Want

to Pay?

0 “Our policy is to put past-due accounts on credit

hold [and . . .].”

0 “This may impact your future shipment schedule.”

0 “Customer delinquency is reported to the major

credit bureaus.”

0 “Unless we can resolve this, we may have to use

other collection methods.”

0 Contact your sales rep.

0 Escalate the claim as necessary.](https://image.slidesharecdn.com/telephonetechnique-18oct2012-121025145011-phpapp01/85/Telephone-technique-18-oct-2012-29-320.jpg)