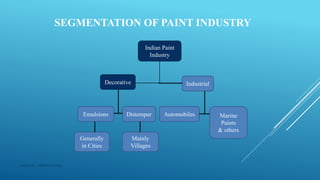

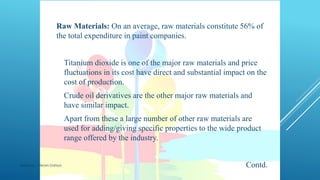

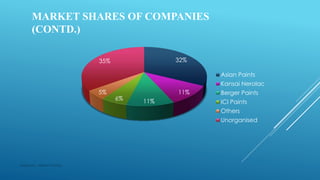

The Indian paint industry has been growing at around 15% annually with a current market size of approximately Rs. 21,000 crores. The per capita consumption in India is 1.5kg compared to the global average of 15kg. The industry is segmented into decorative paints used in homes and industrial paints used in automotive, engineering and other industries. The major players in the decorative paints segment are Asian Paints, Kansai Nerolac, Berger Paints, and ICI Paints which account for over 70% of the market. The paint industry distribution process involves manufacturers supplying products to regional warehouses and then to dealer networks. Key factors influencing the industry include rising incomes, urbanization, financing availability and