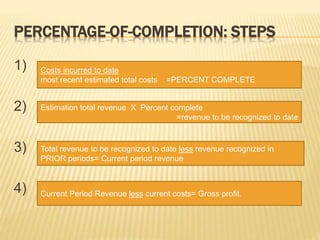

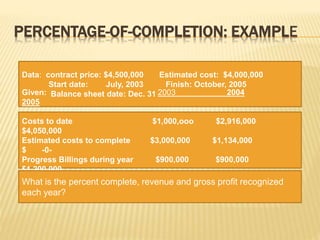

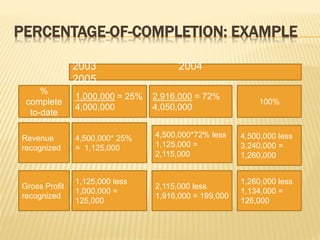

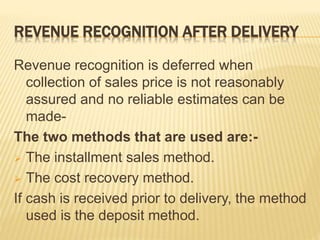

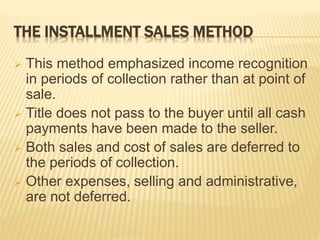

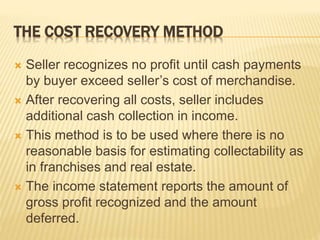

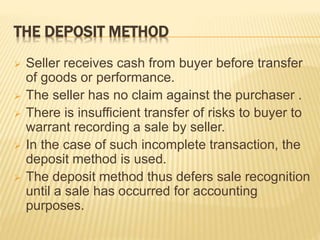

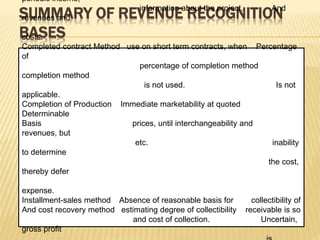

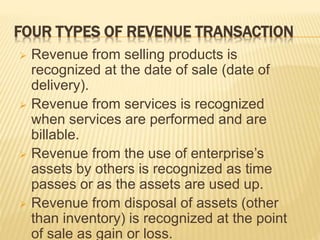

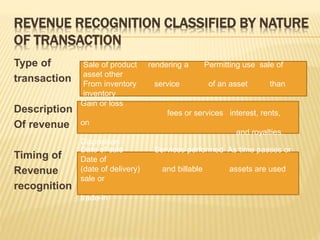

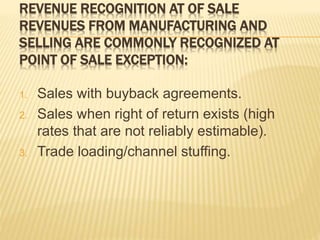

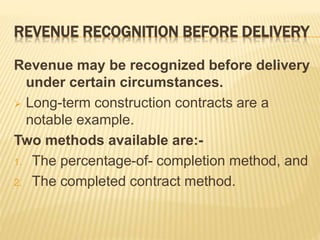

This document discusses revenue recognition principles and methods. It outlines the key requirements for recognizing revenue at the point of sale, before delivery using percentage of completion or completed contract methods, and after delivery using installment sales or cost recovery methods. It also provides examples and steps for calculating revenue and gross profit under the percentage of completion long-term contract method.

![REVENUE RECOGNITION BEFORE DELIVERY

Percentage-of-completion

method

Long-Term construction

accounting method

1) Terms of contract must be

certain , enforceable.

2) Certainty of performance

by both parties.

3) Estimates of completion

can be made reliably.

Completed contract method

1) To be used only when the

percentage method is

inapplicable [uncertain].](https://image.slidesharecdn.com/atpppt-180625064557/85/ACCOUNTING-THEORY-AND-PRACTICE-ppt-9-320.jpg)