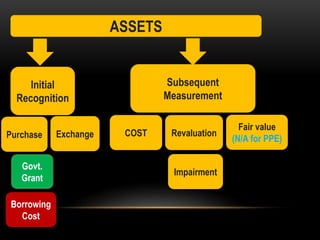

The document discusses models for recognition and subsequent measurement of assets, including:

- Cost model measures assets at historical cost less depreciation, with no upward value adjustments.

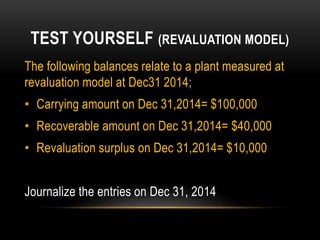

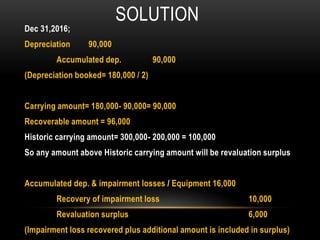

- Revaluation model initially records assets at cost but increases value when the asset appreciates.

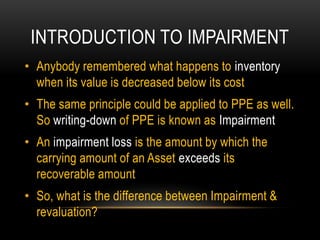

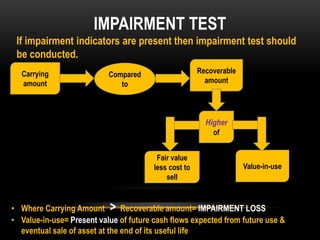

It also covers impairment indicators, testing, calculating impairment losses, and reversing impairment losses under both models. Impairment occurs when an asset's carrying amount exceeds its recoverable amount.