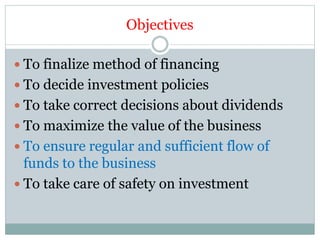

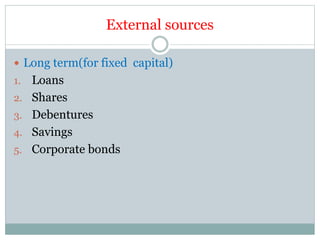

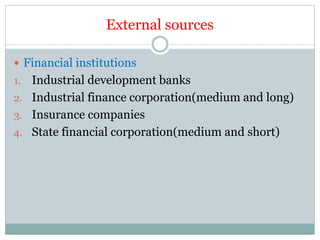

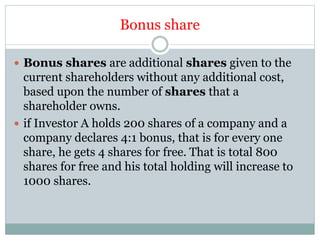

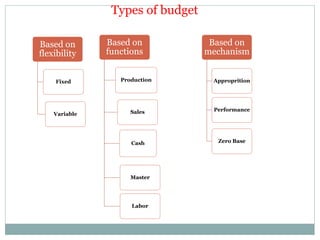

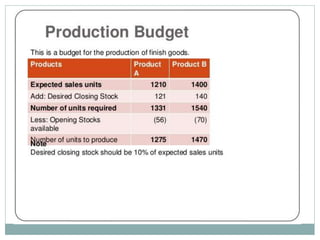

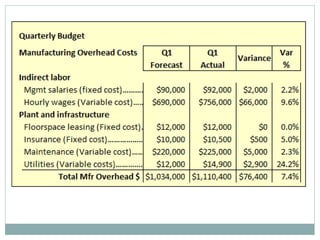

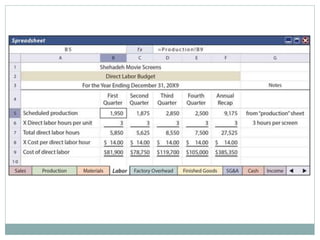

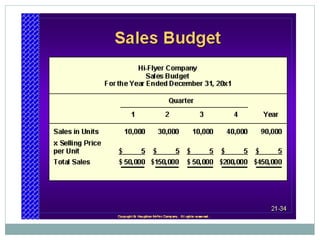

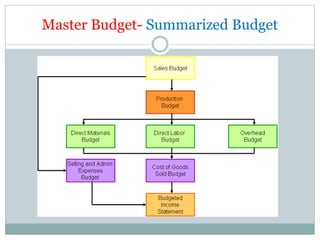

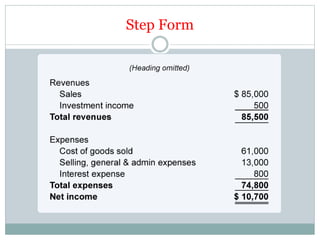

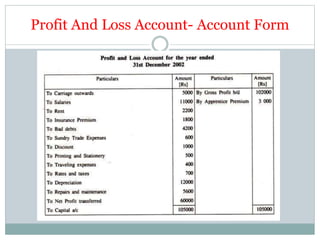

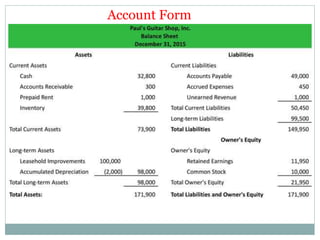

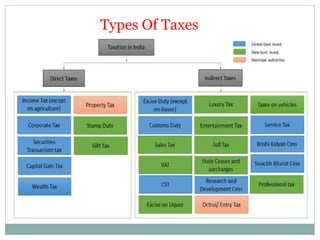

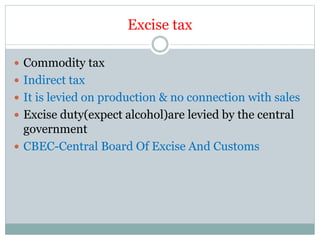

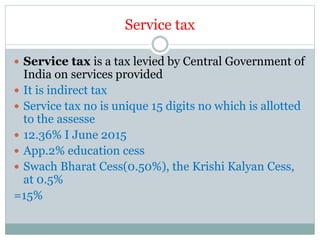

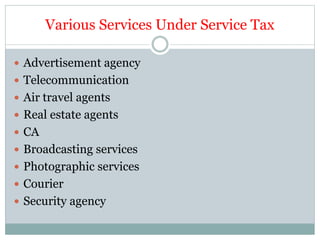

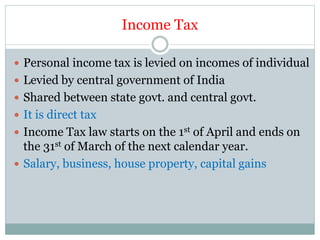

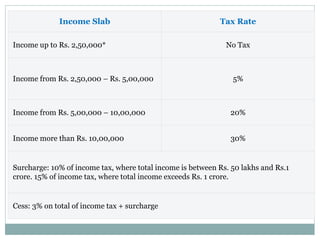

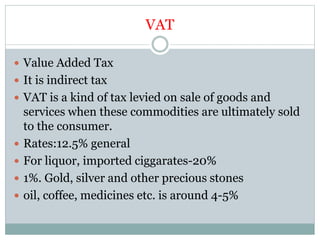

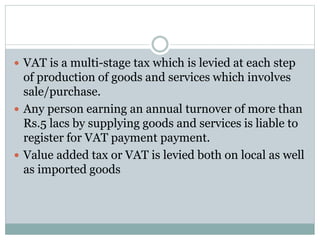

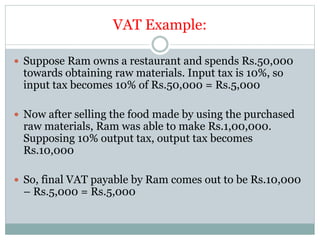

The document provides an overview of financial management, emphasizing the importance of effective fund procurement and utilization within an organization. It outlines the objectives, functions, types of capital, sources of raising capital, budgeting, accounts, and taxation, with detailed explanations on fixed and working capital, various external funding sources, and types of taxes. Additionally, it includes definitions and examples of financial statements, budget types, and the distinctions between different tax categories.