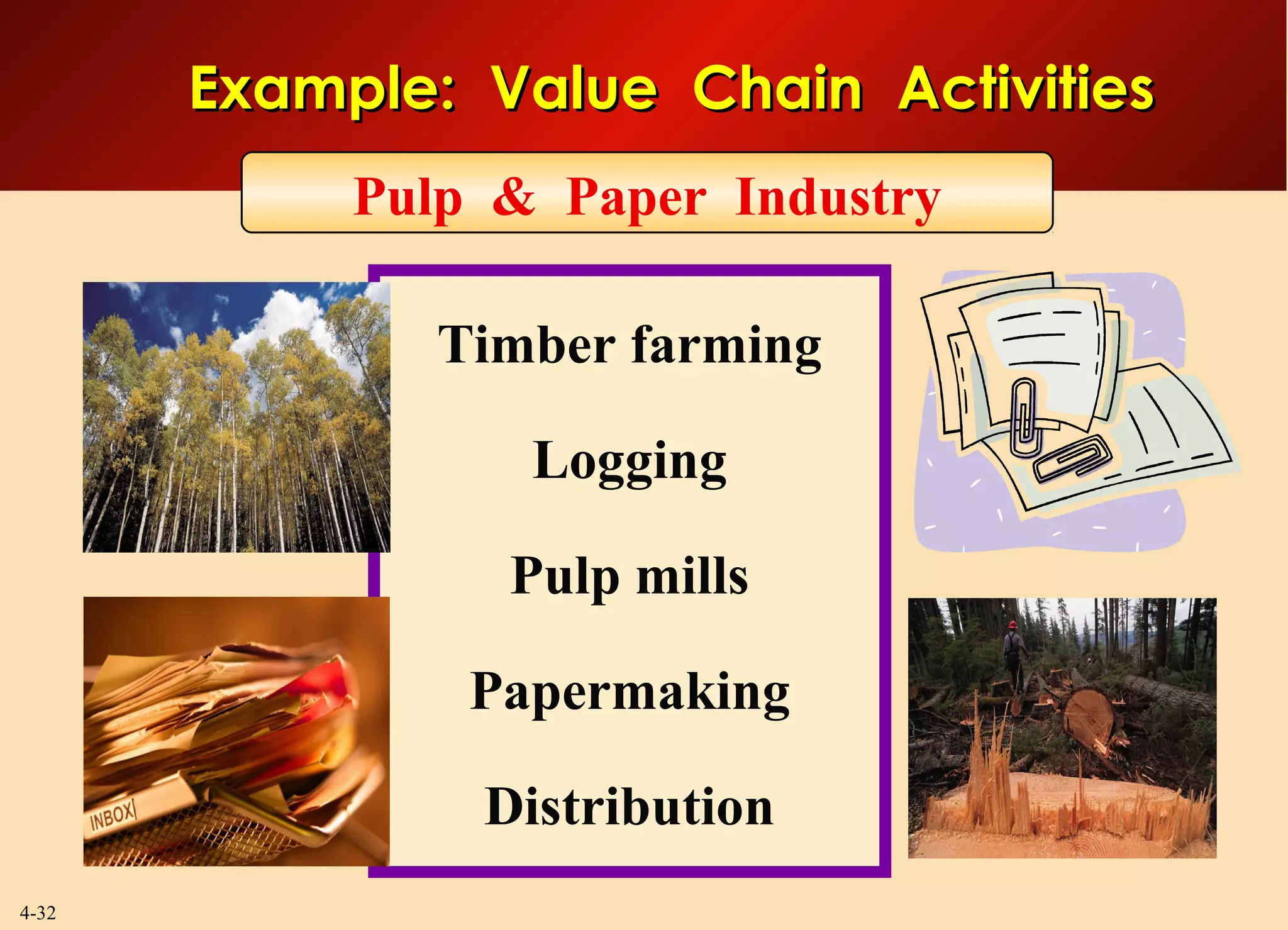

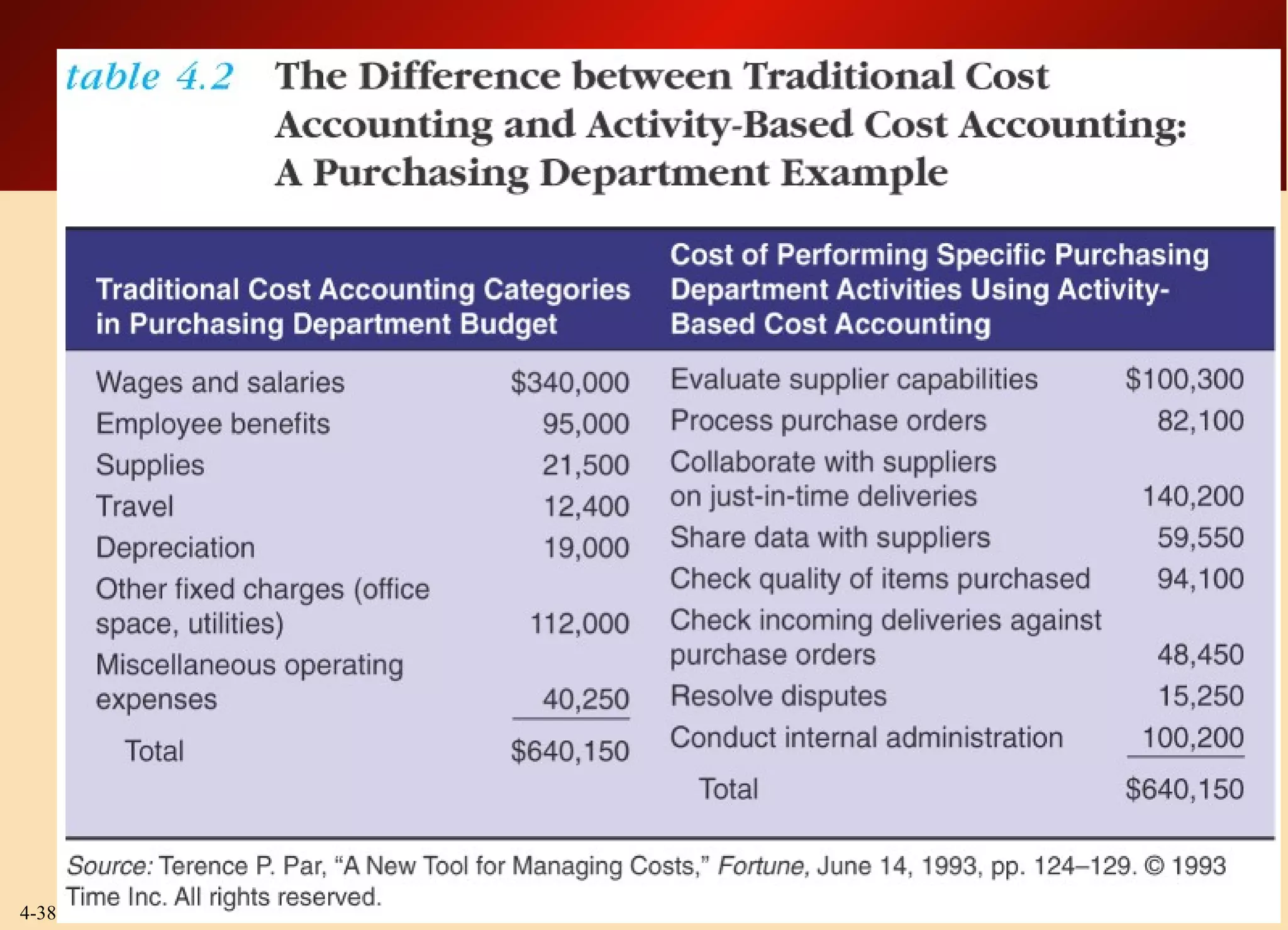

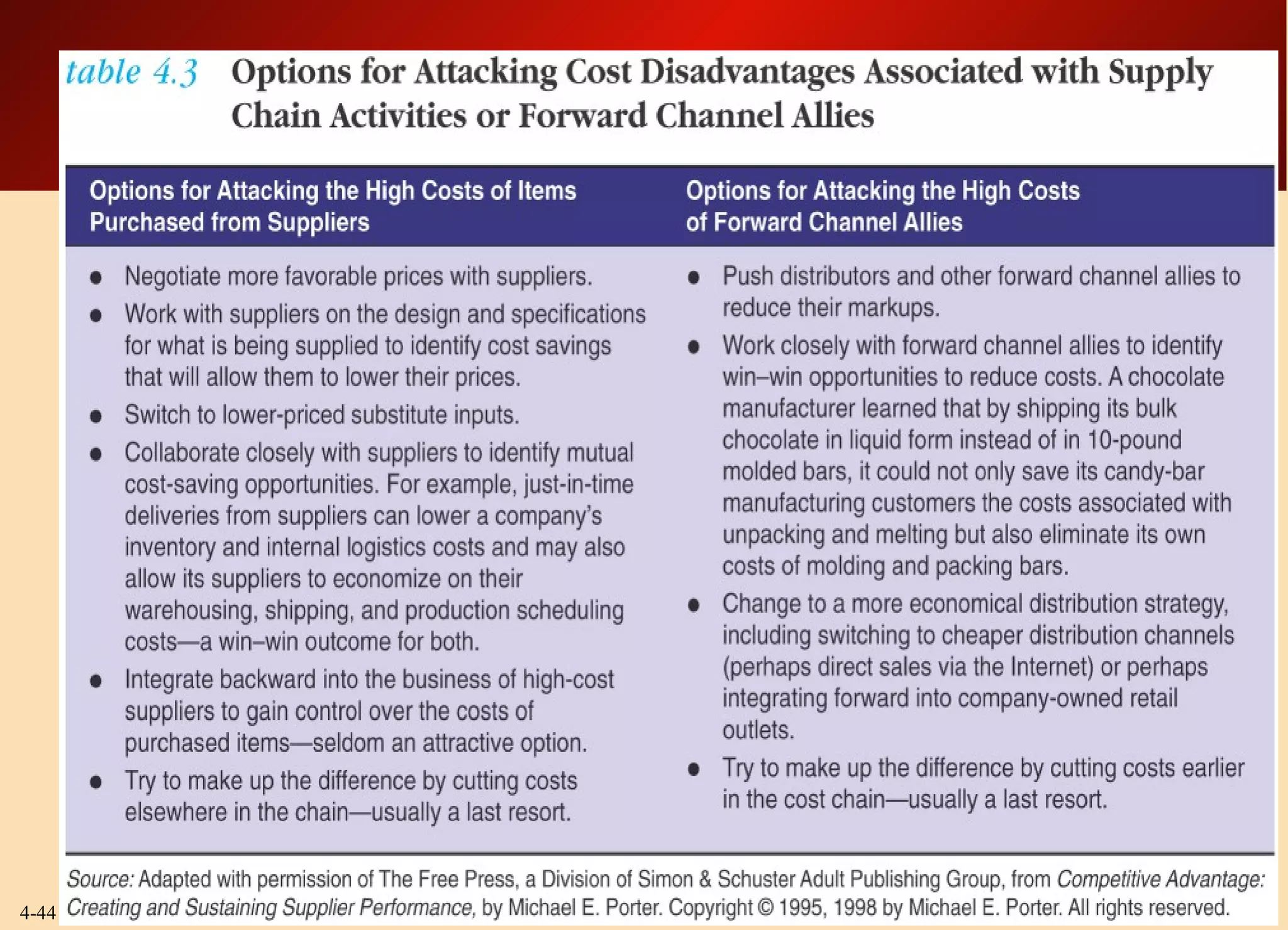

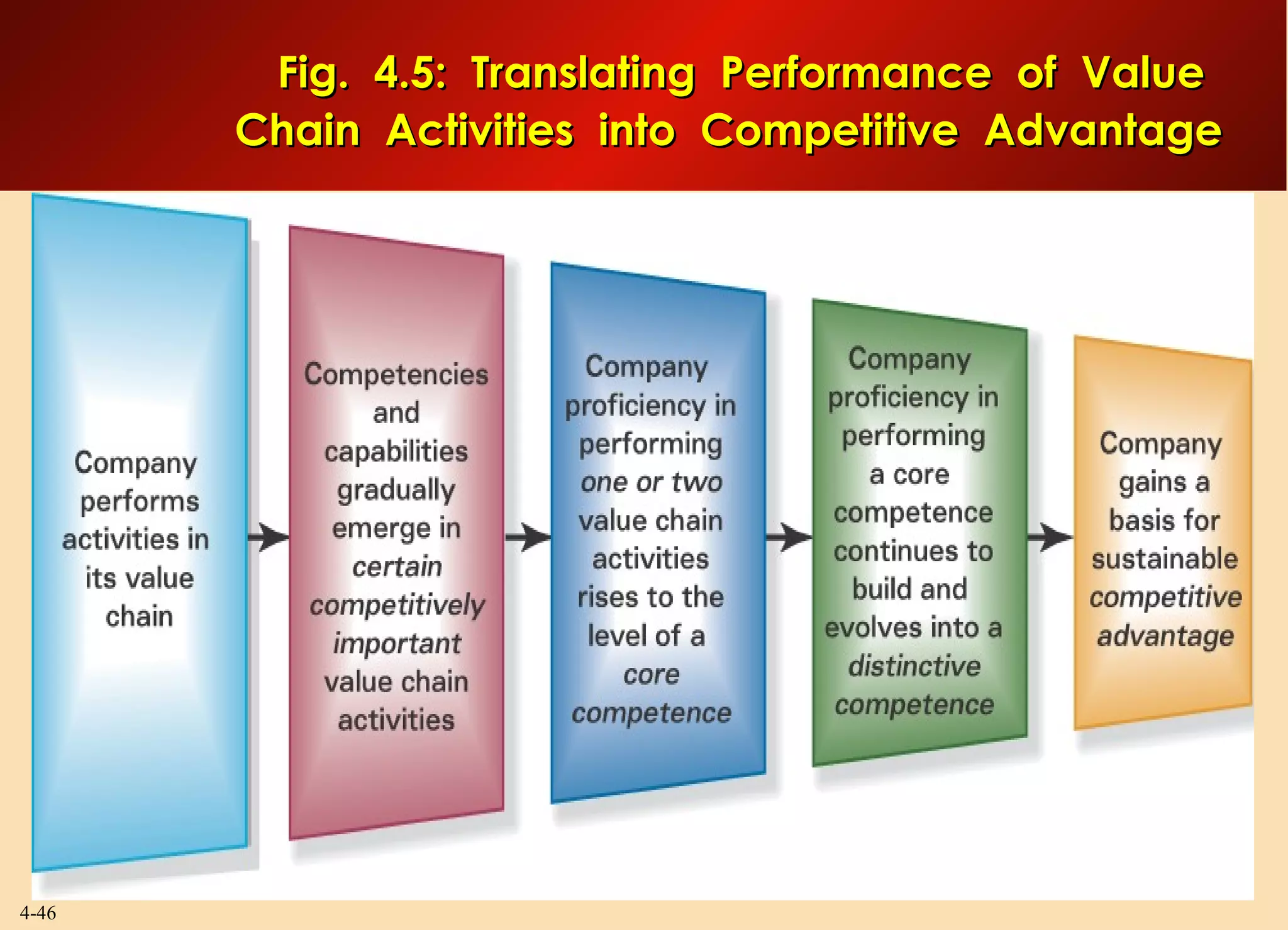

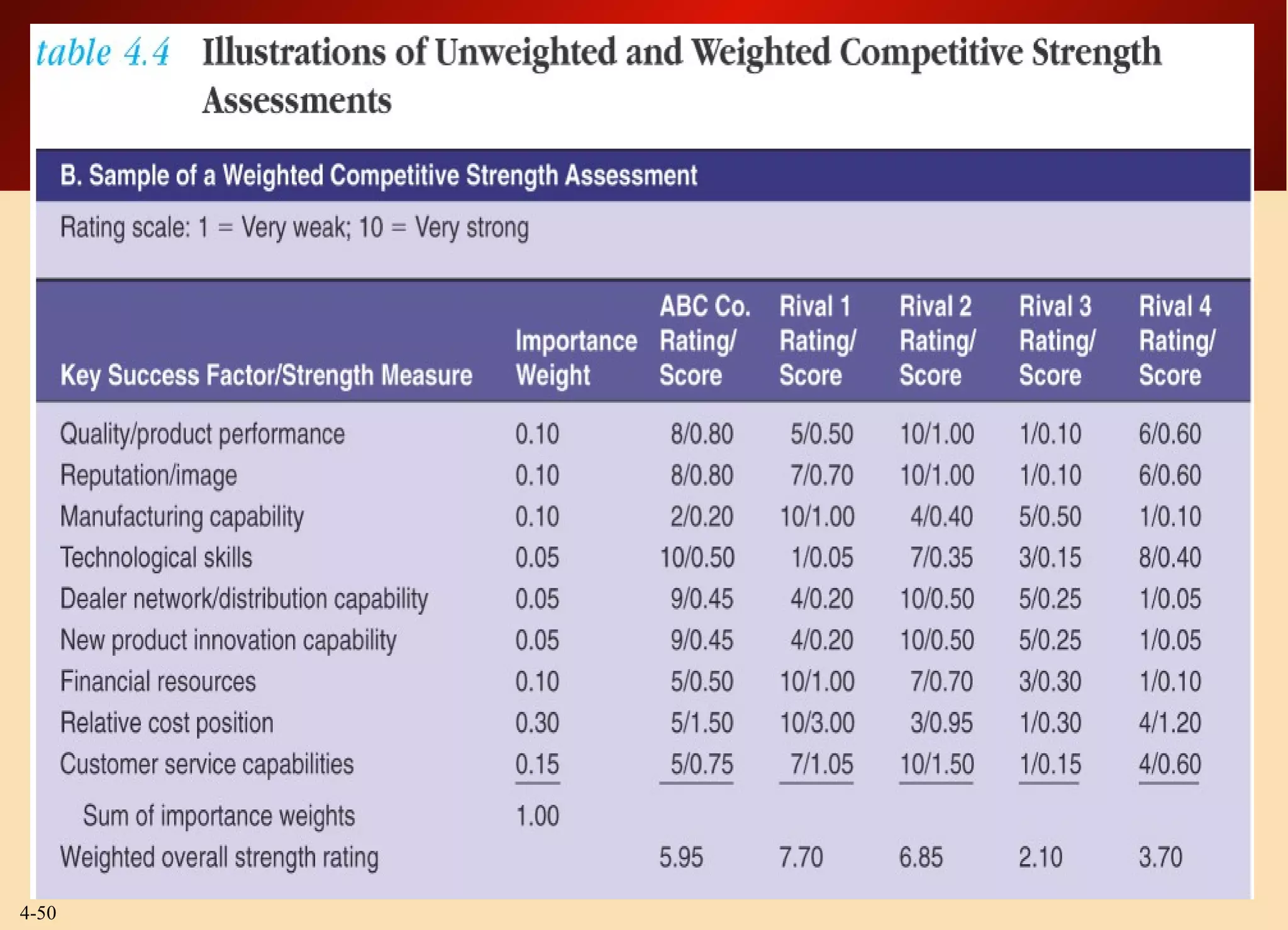

The document discusses analyzing a company's resources and competitive position. It outlines 5 key questions to assess a company's situation: 1) How well is the present strategy working? 2) What are the company's strengths, weaknesses, opportunities, and threats? 3) Are prices and costs competitive? 4) Is the company stronger or weaker than rivals? 5) What strategic issues require attention? It provides approaches to evaluate each question, including using value chain analysis and benchmarking to analyze a company's costs and determine competitiveness.