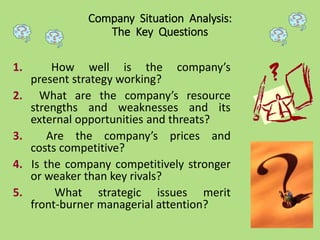

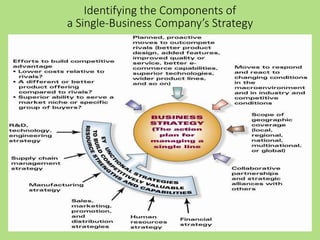

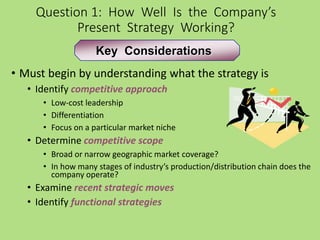

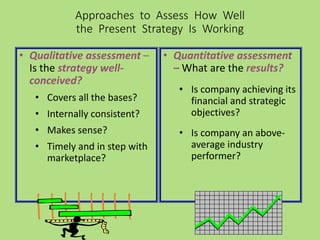

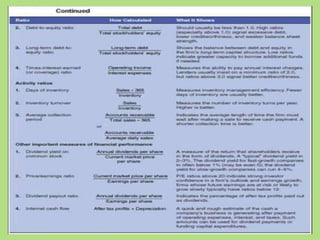

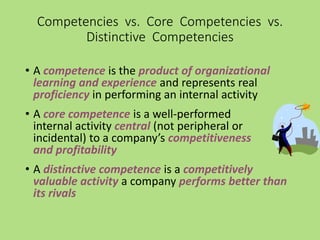

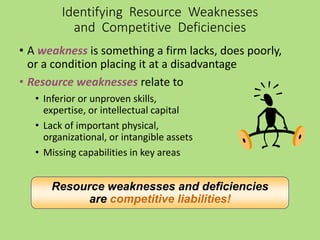

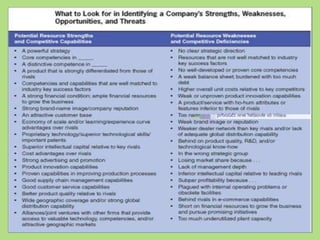

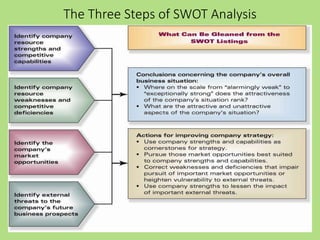

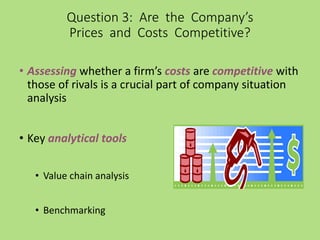

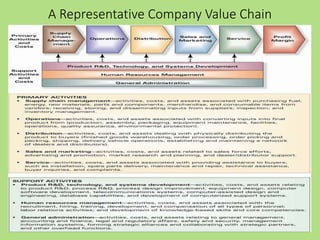

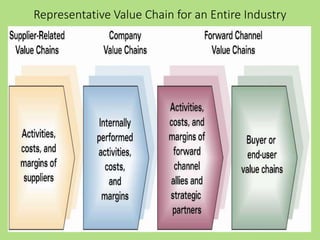

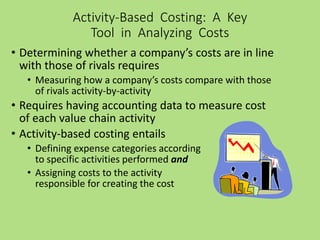

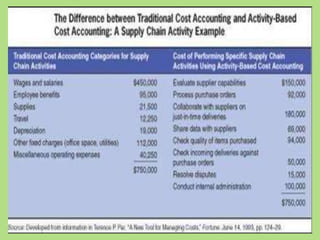

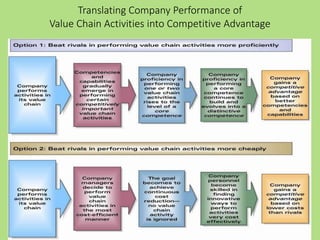

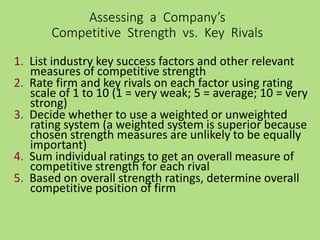

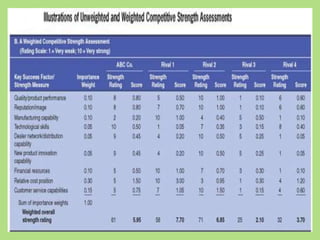

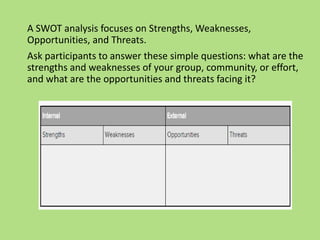

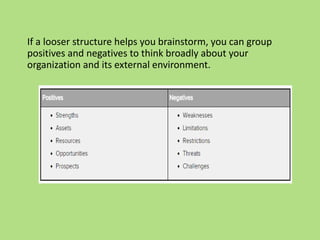

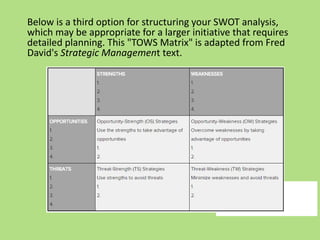

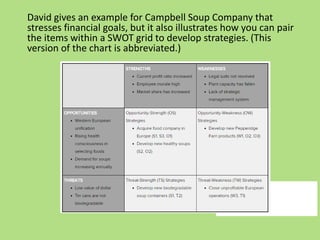

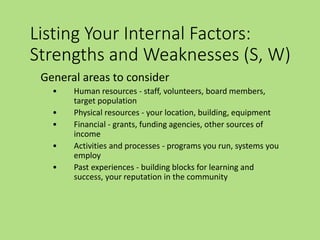

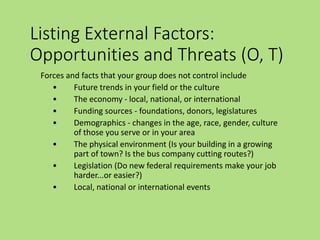

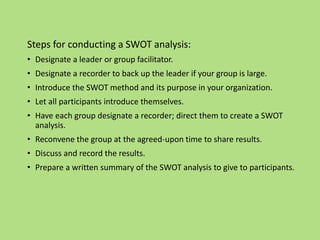

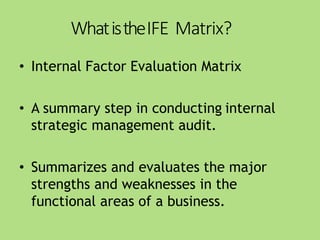

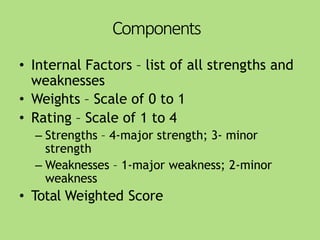

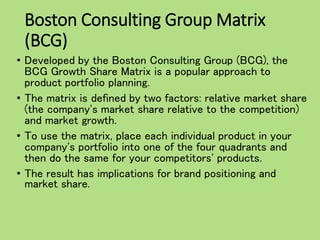

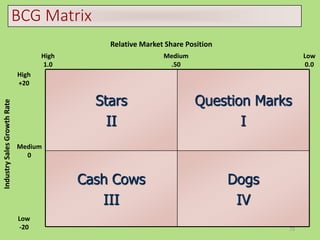

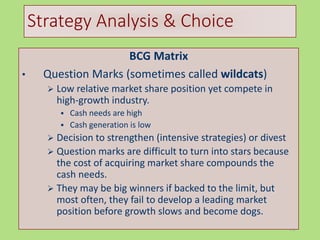

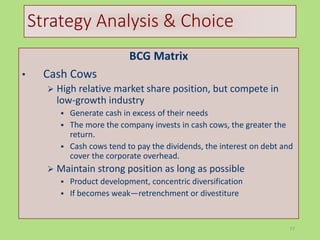

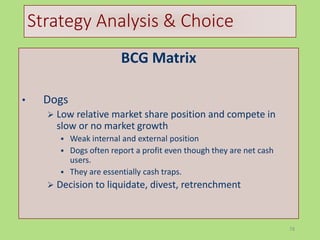

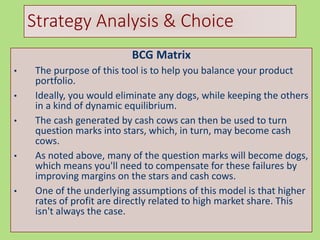

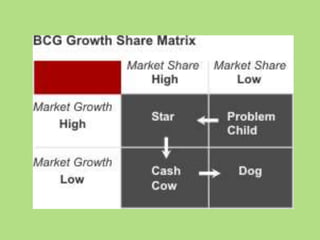

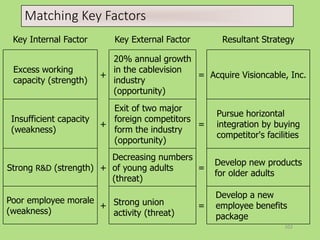

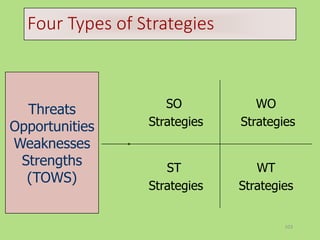

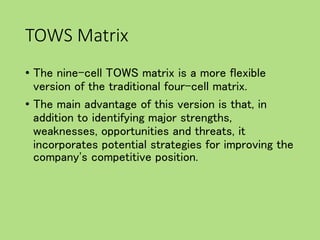

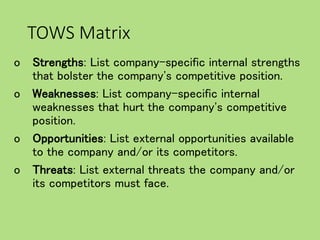

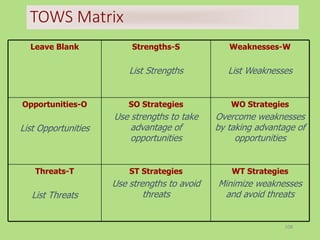

The document provides an overview of analyzing a company's internal environment and strategy. It discusses the key questions to ask, including how well the current strategy is working, the company's strengths/weaknesses/opportunities/threats (SWOT analysis), whether prices and costs are competitive, how the company compares to rivals, and what strategic issues need attention. It also covers tools like value chain analysis, benchmarking, and the BCG matrix to evaluate different aspects of the company's strategy and competitive positioning. The overall aim is to conduct a thorough internal analysis of the business to inform strategic decision making.