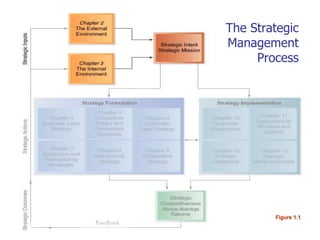

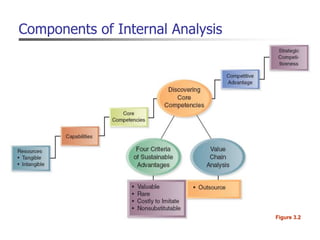

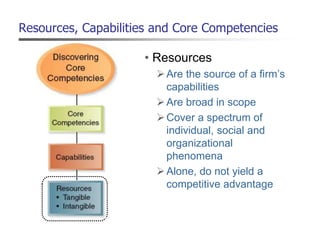

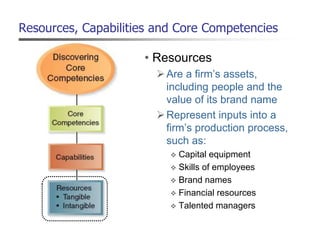

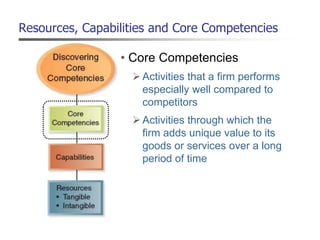

The document discusses resources, capabilities, and core competencies. It defines them as:

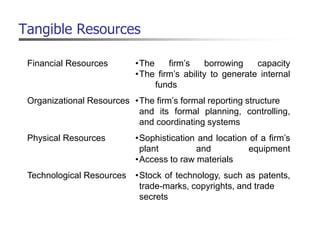

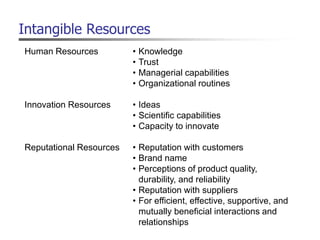

- Resources are a firm's assets that can include people, equipment, financial assets, brand names, and relationships.

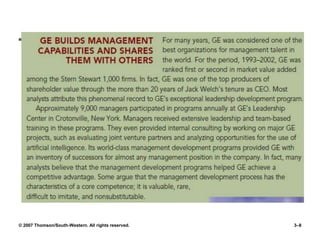

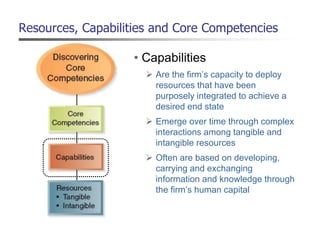

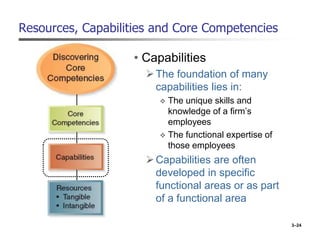

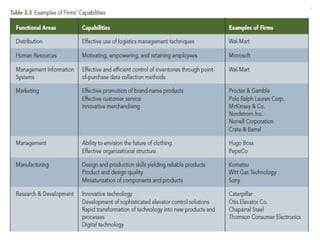

- Capabilities are what a firm can do through complex interactions between its resources. They often rely on employee knowledge and skills.

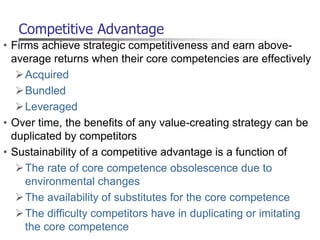

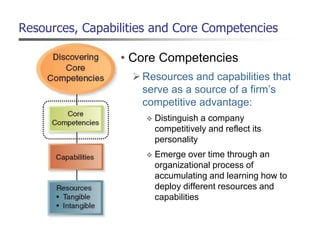

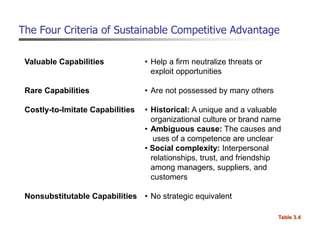

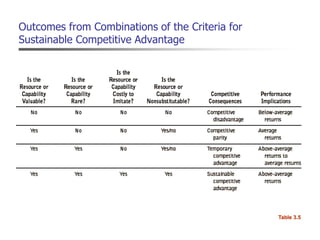

- Core competencies are the resources and capabilities that provide a competitive advantage and are valuable, rare, costly to imitate, and non-substitutable.

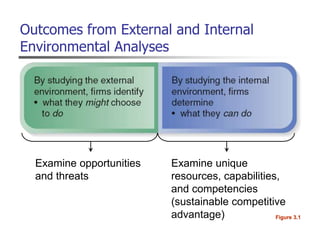

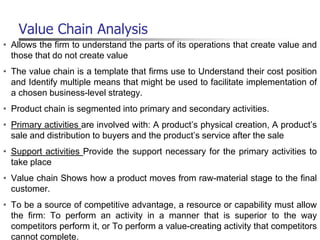

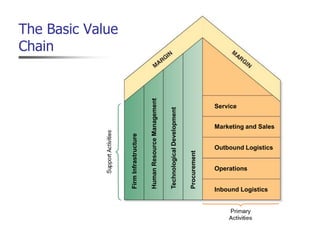

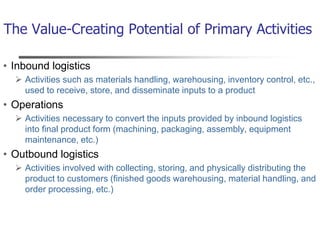

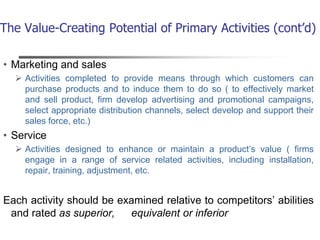

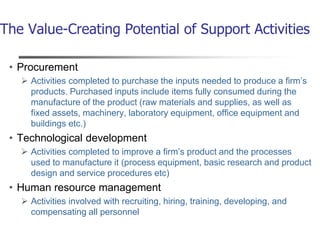

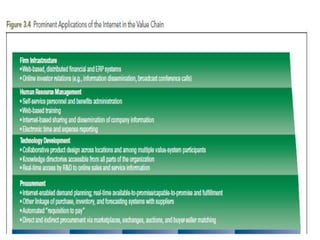

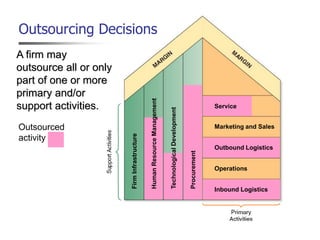

The document also discusses how firms can analyze their value chain to understand what activities create value and how to leverage internal strengths against external opportunities and threats. In 3 sentences or less.