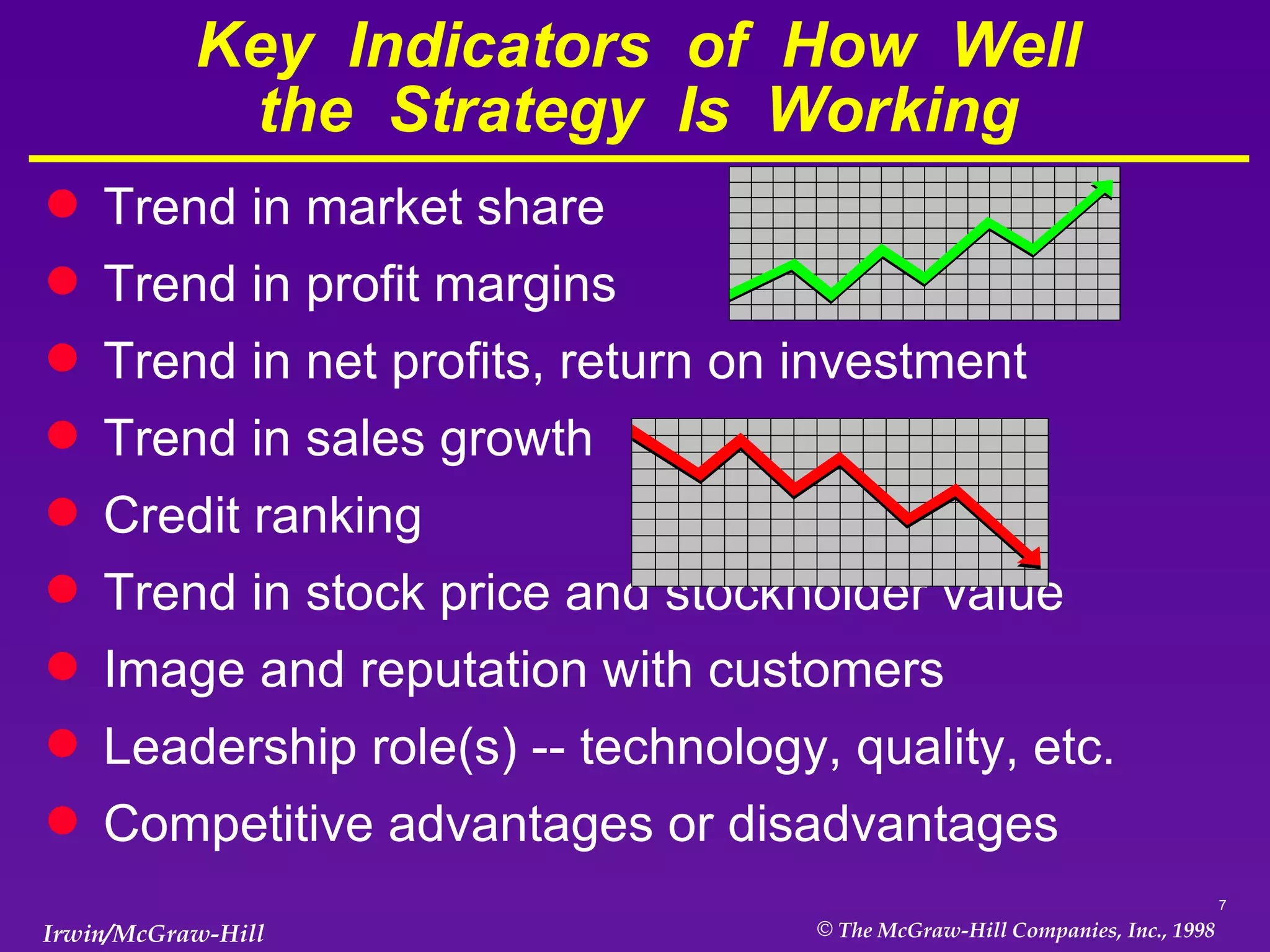

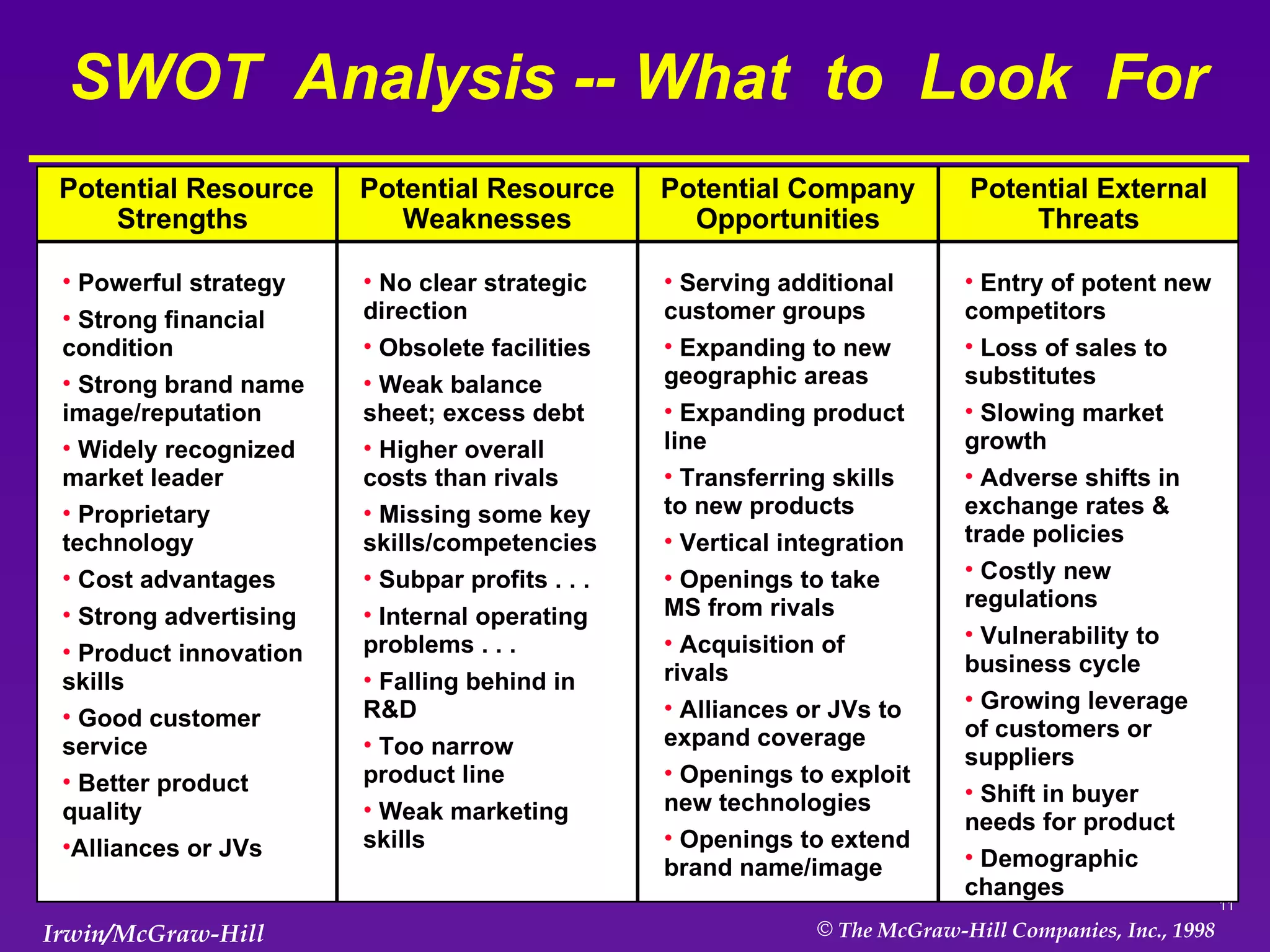

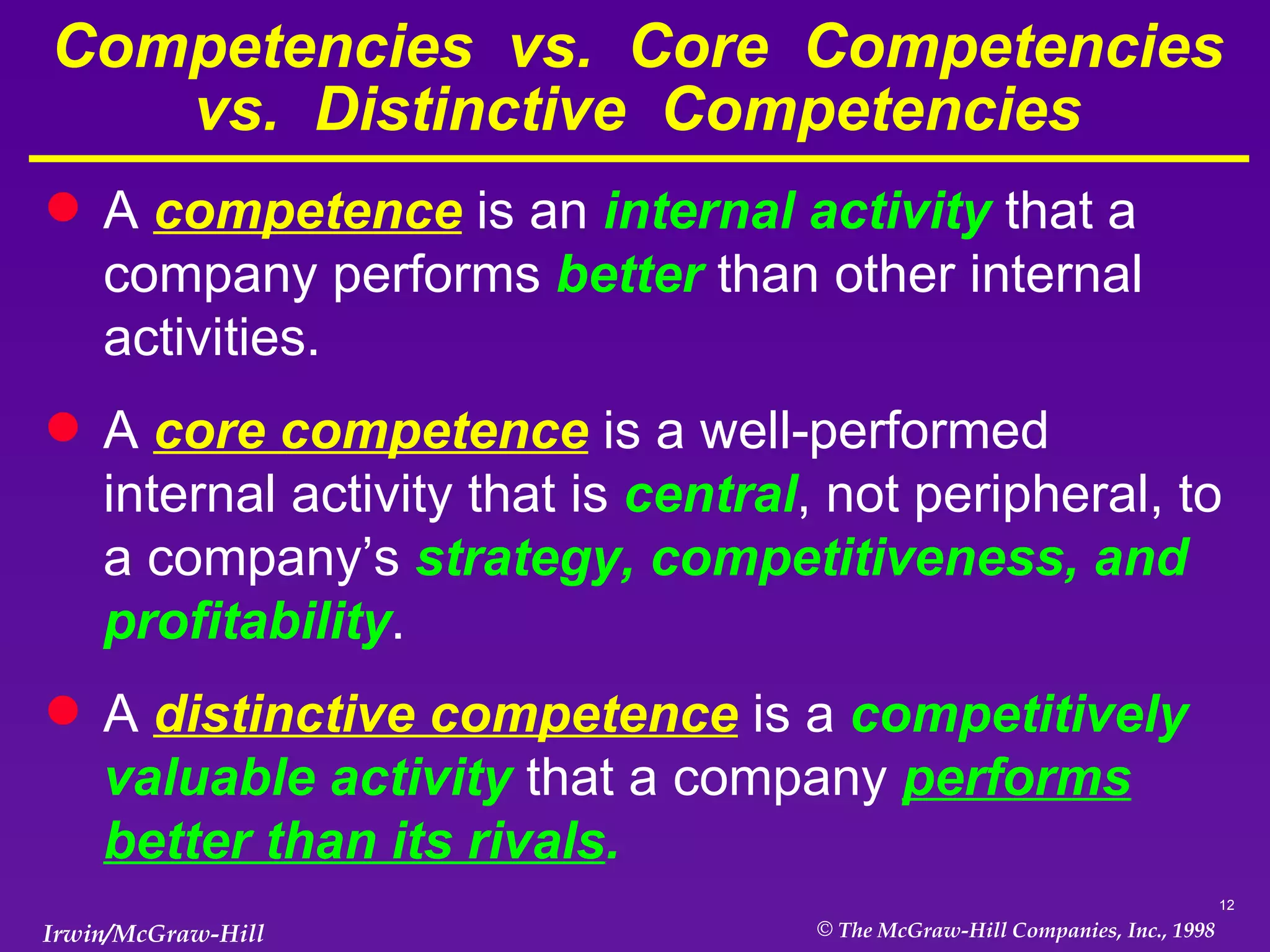

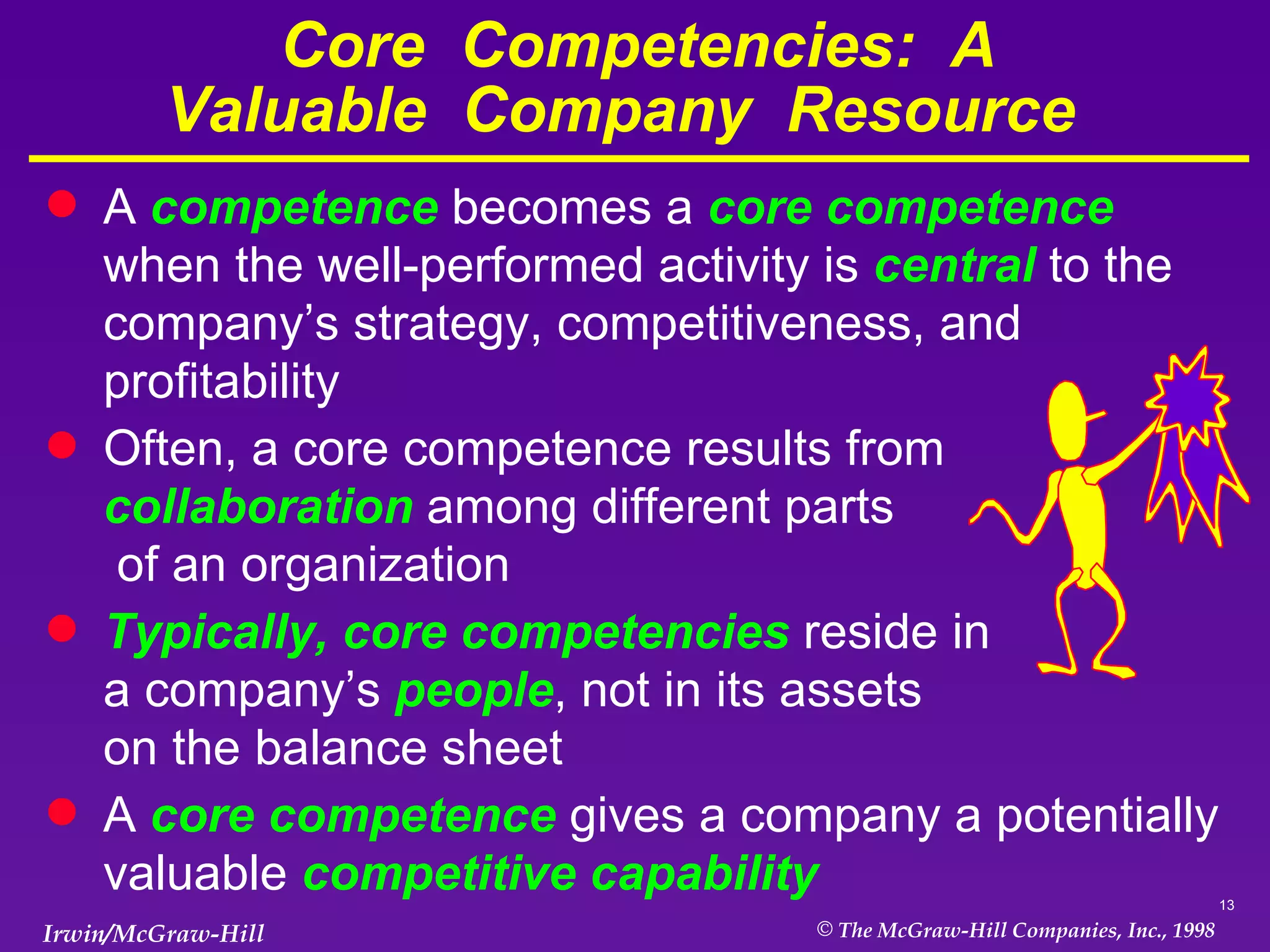

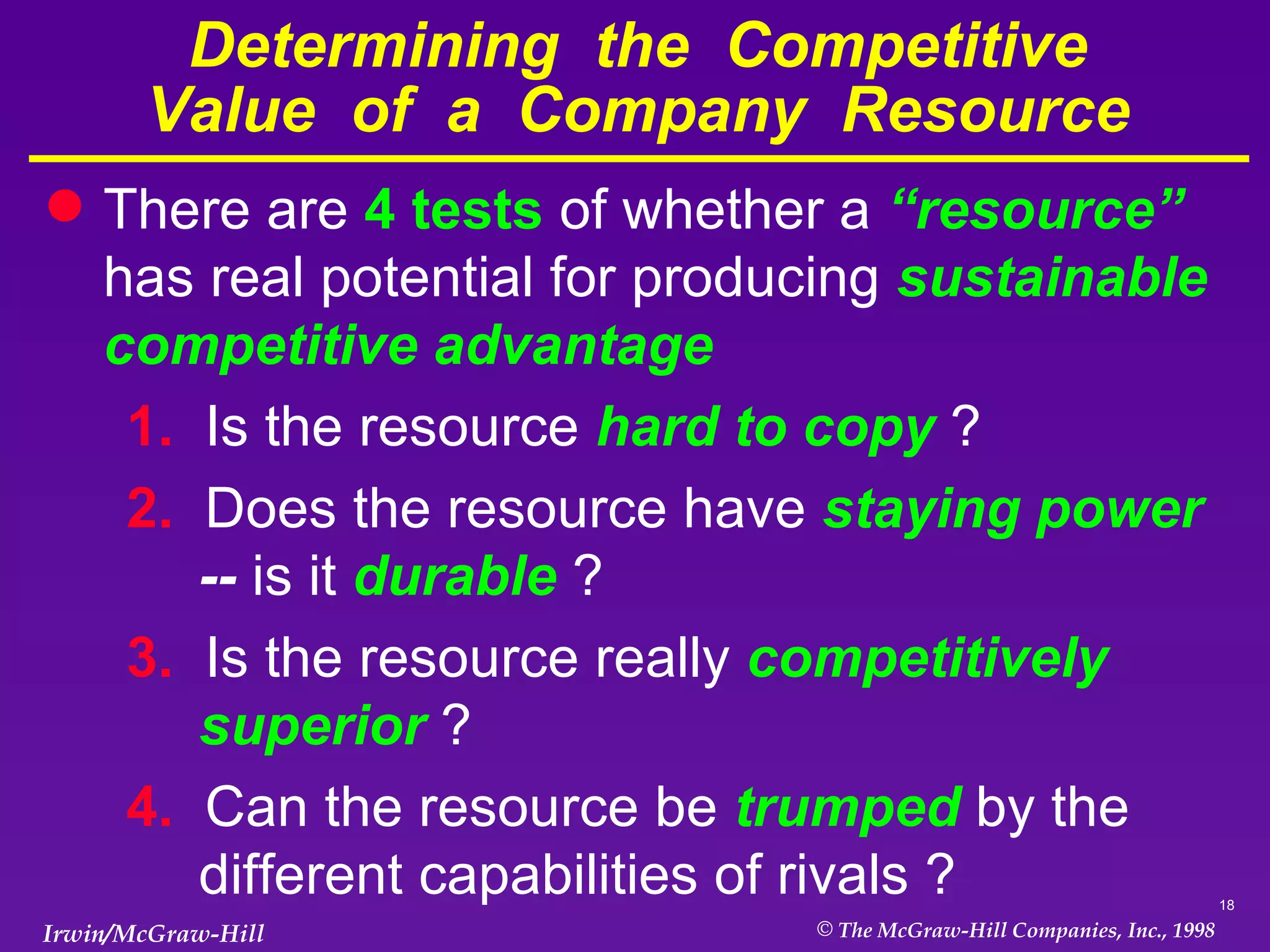

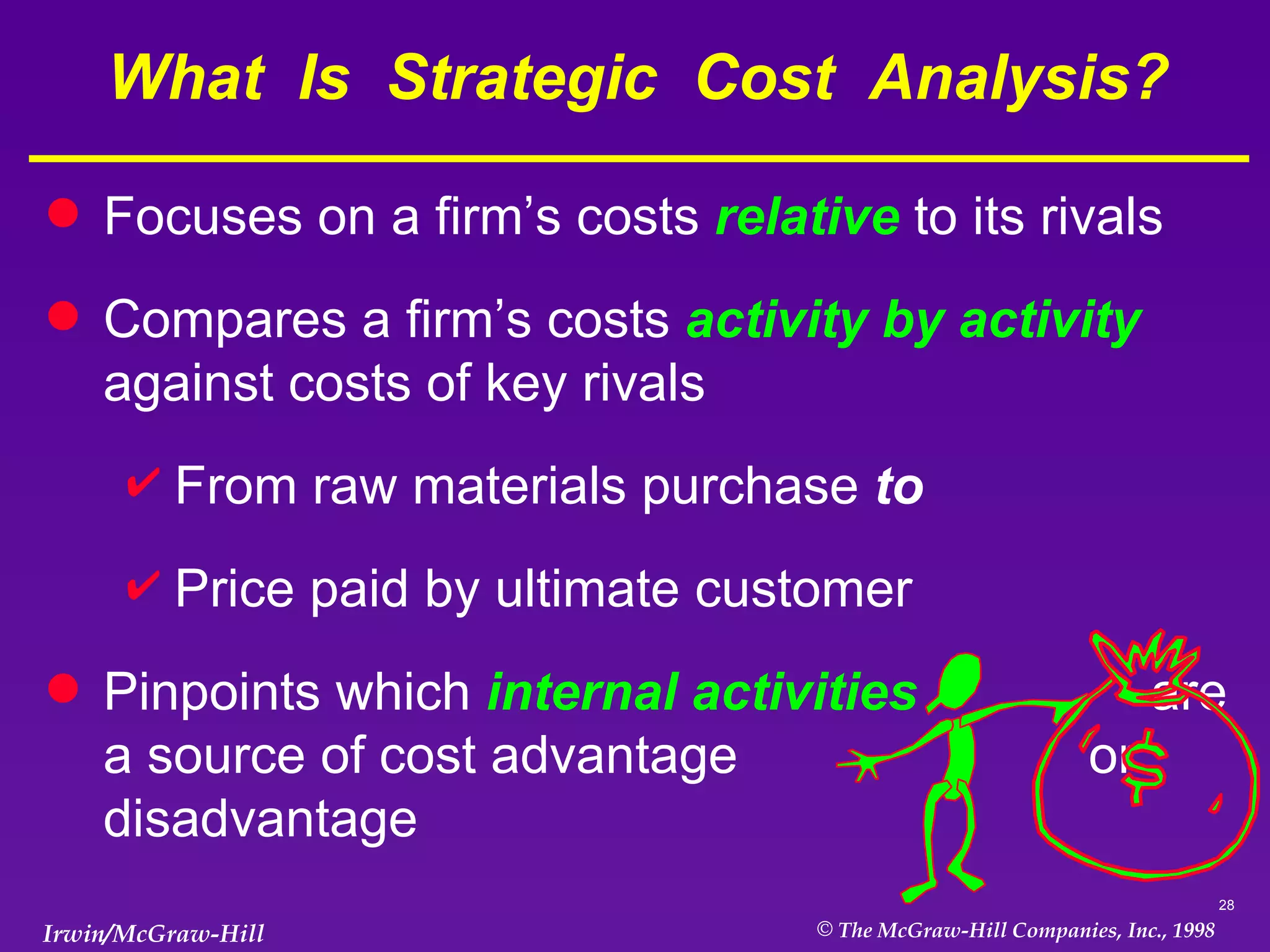

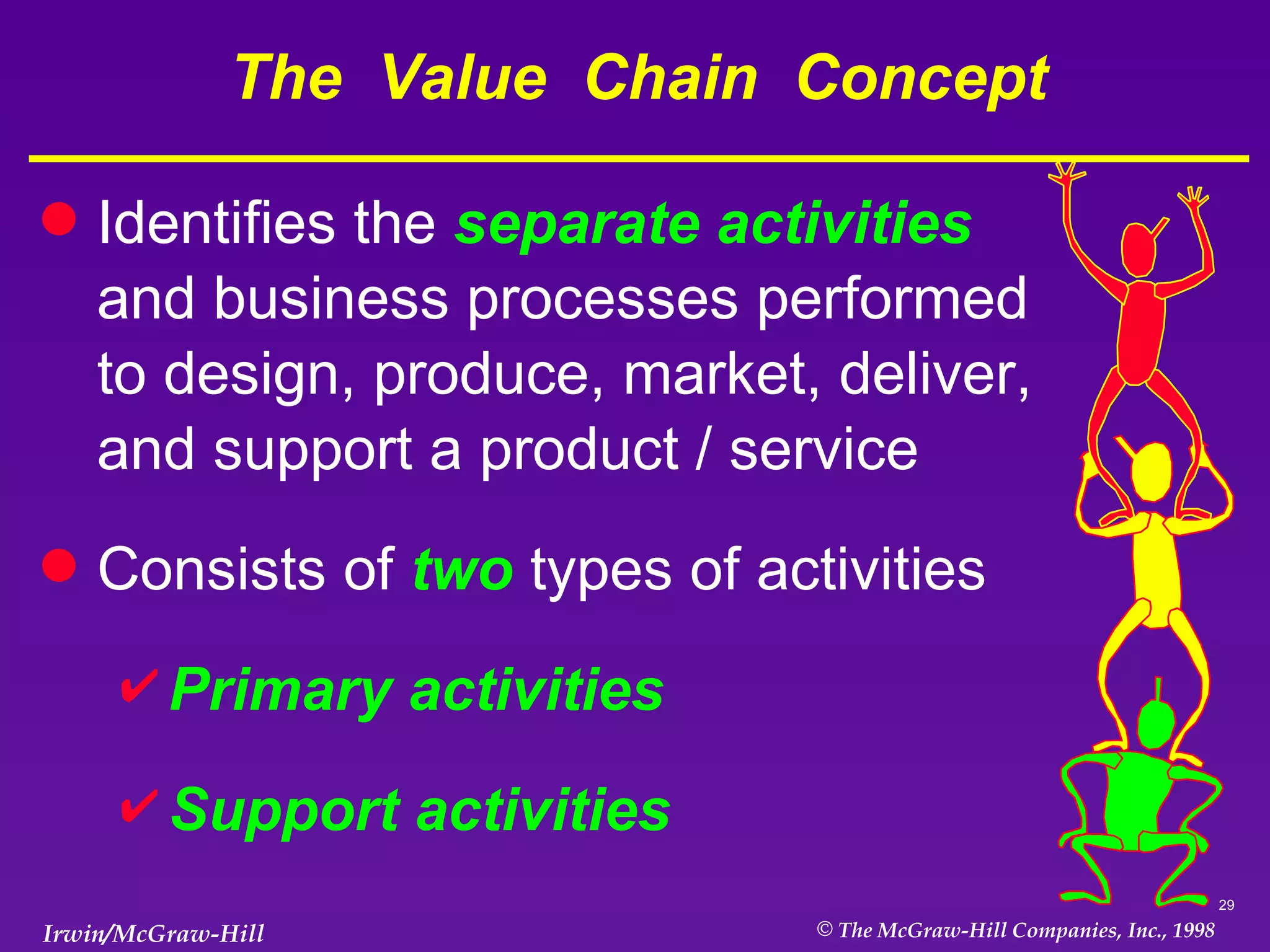

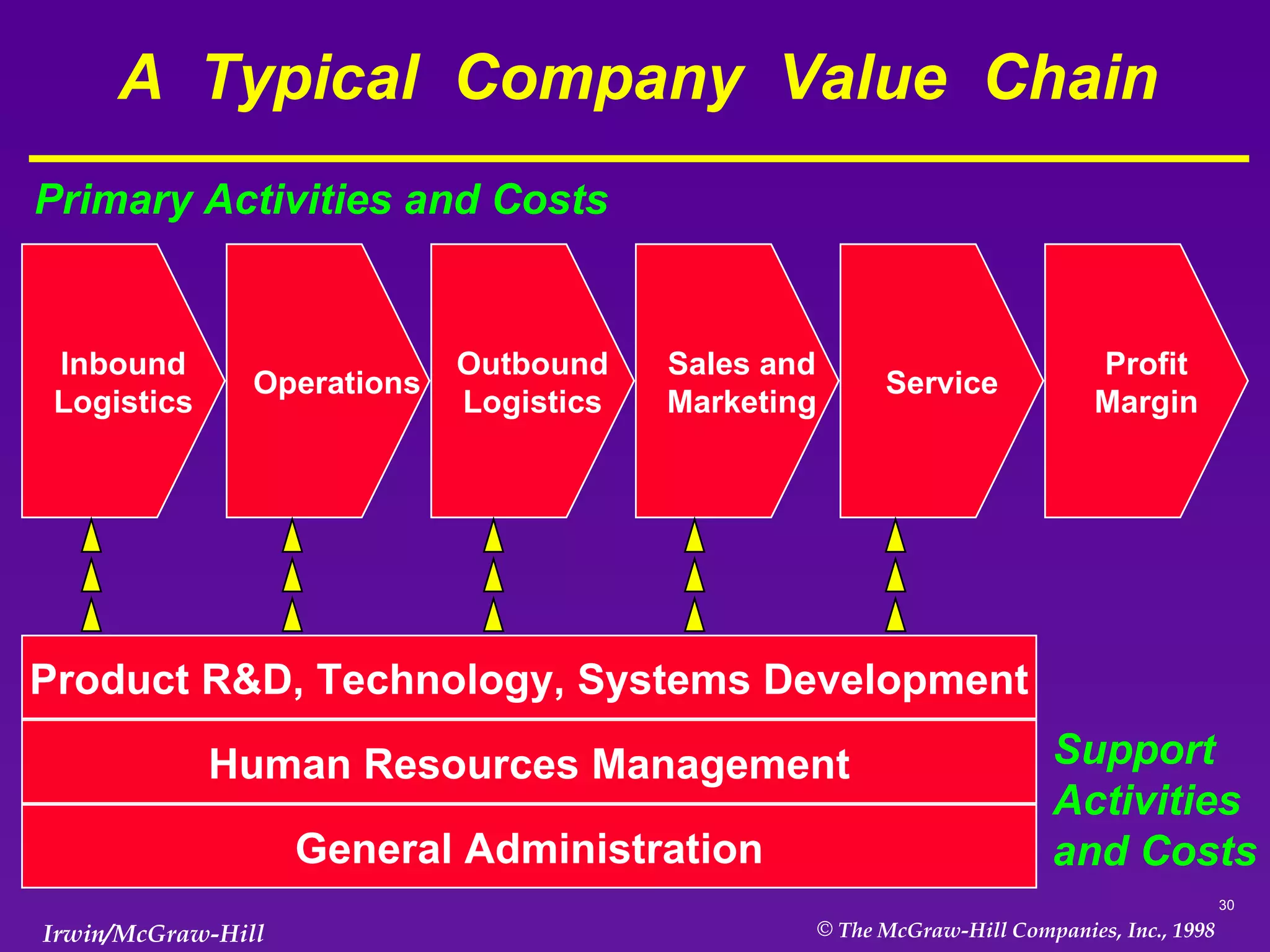

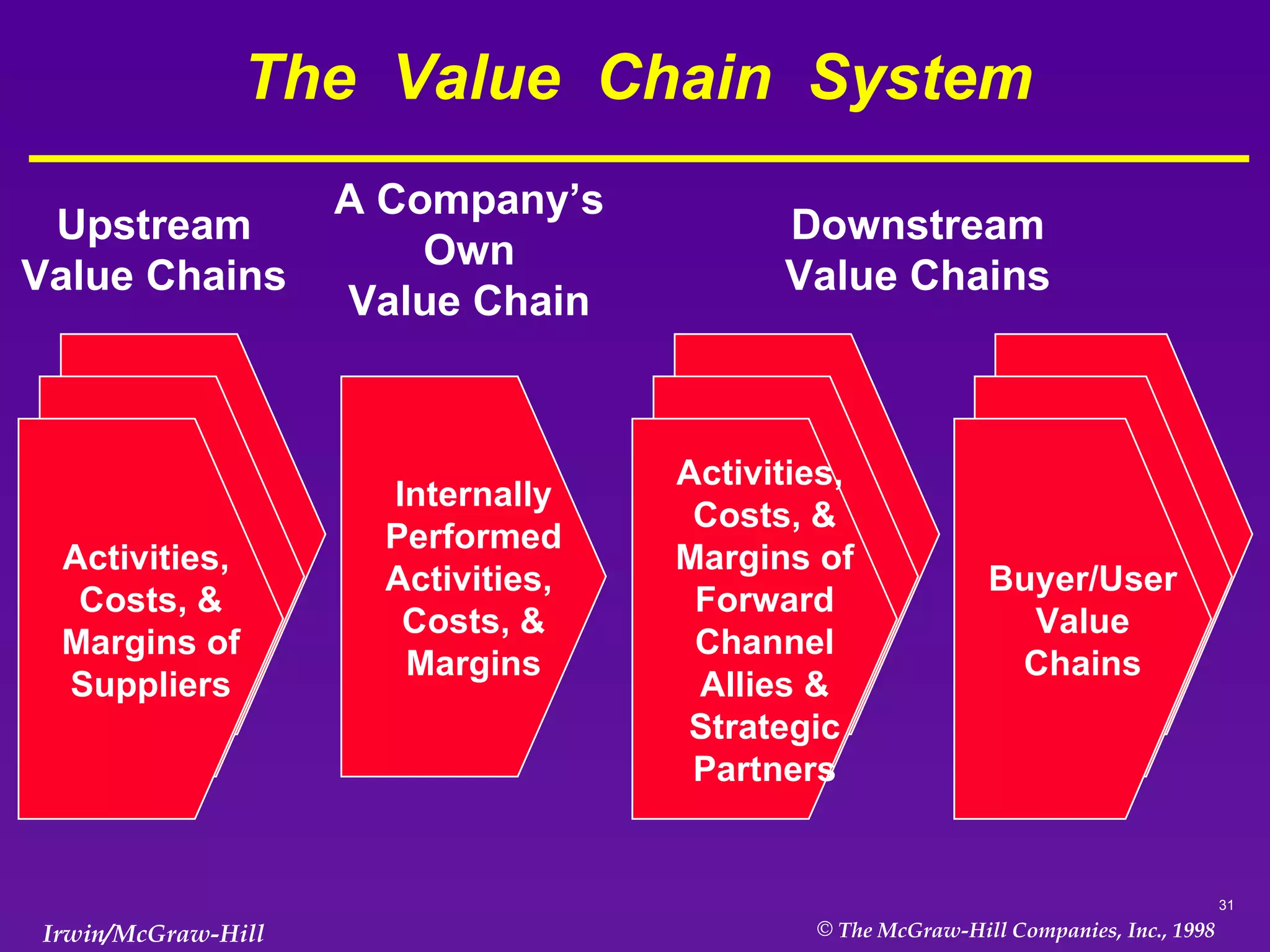

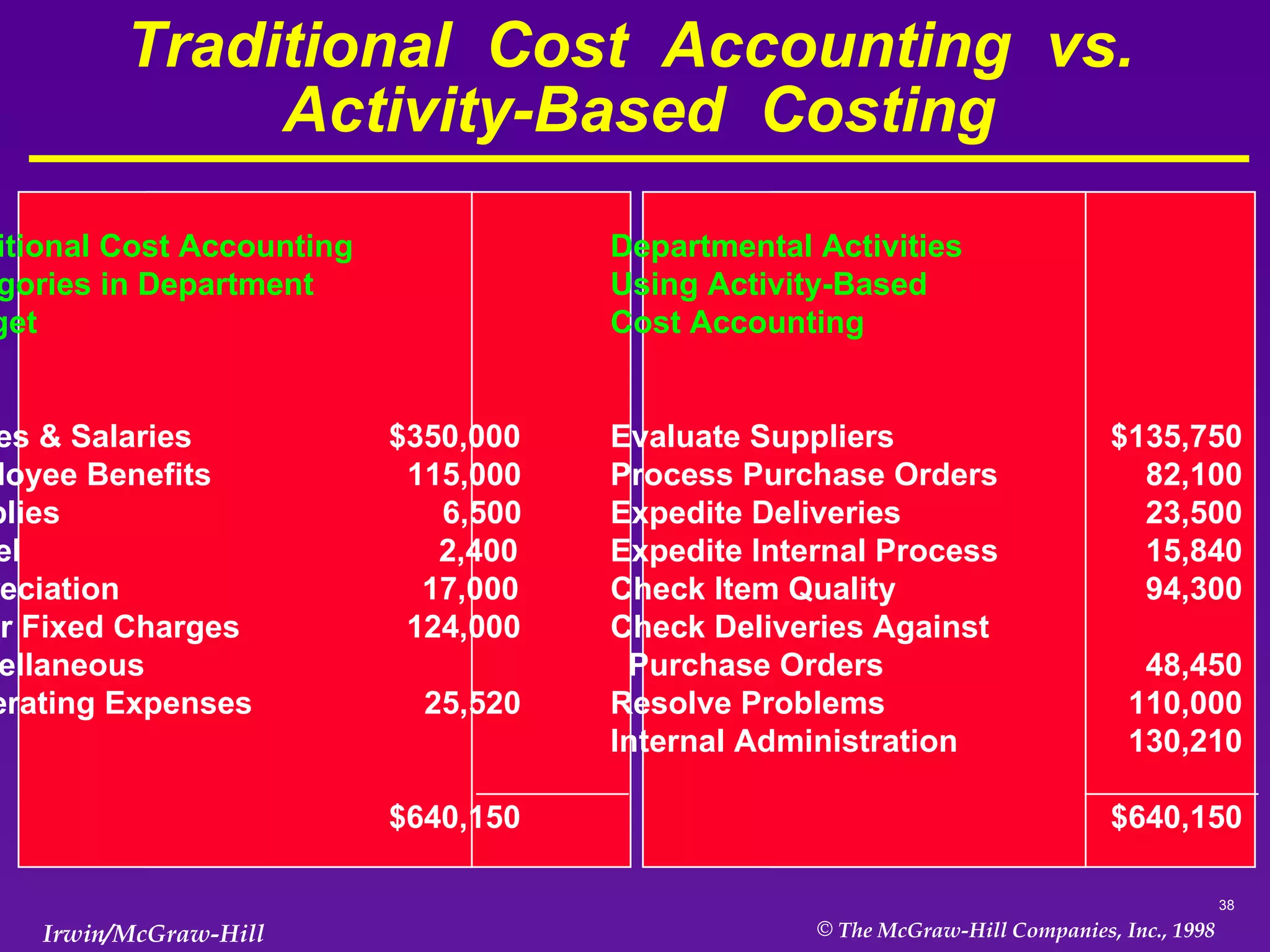

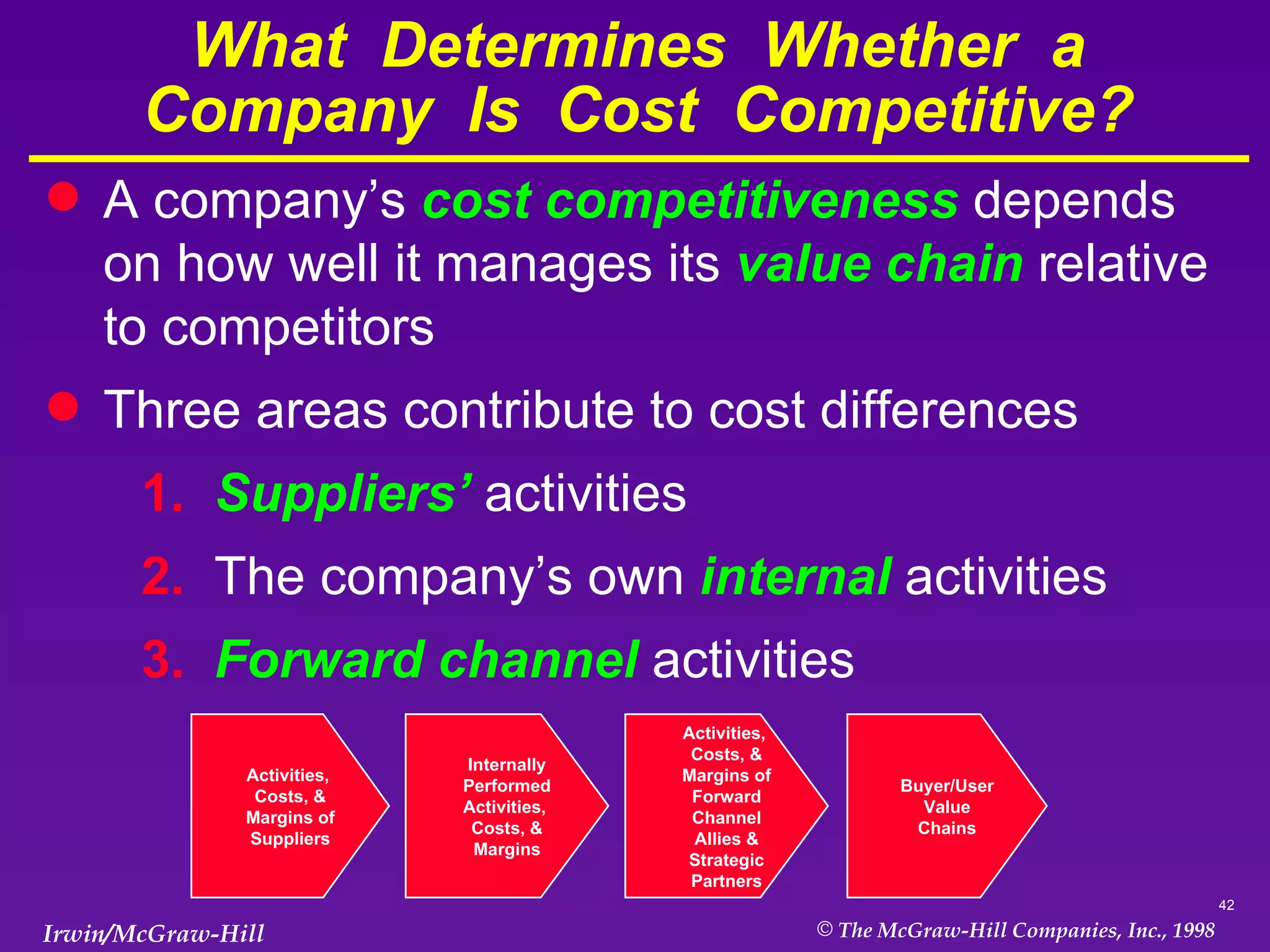

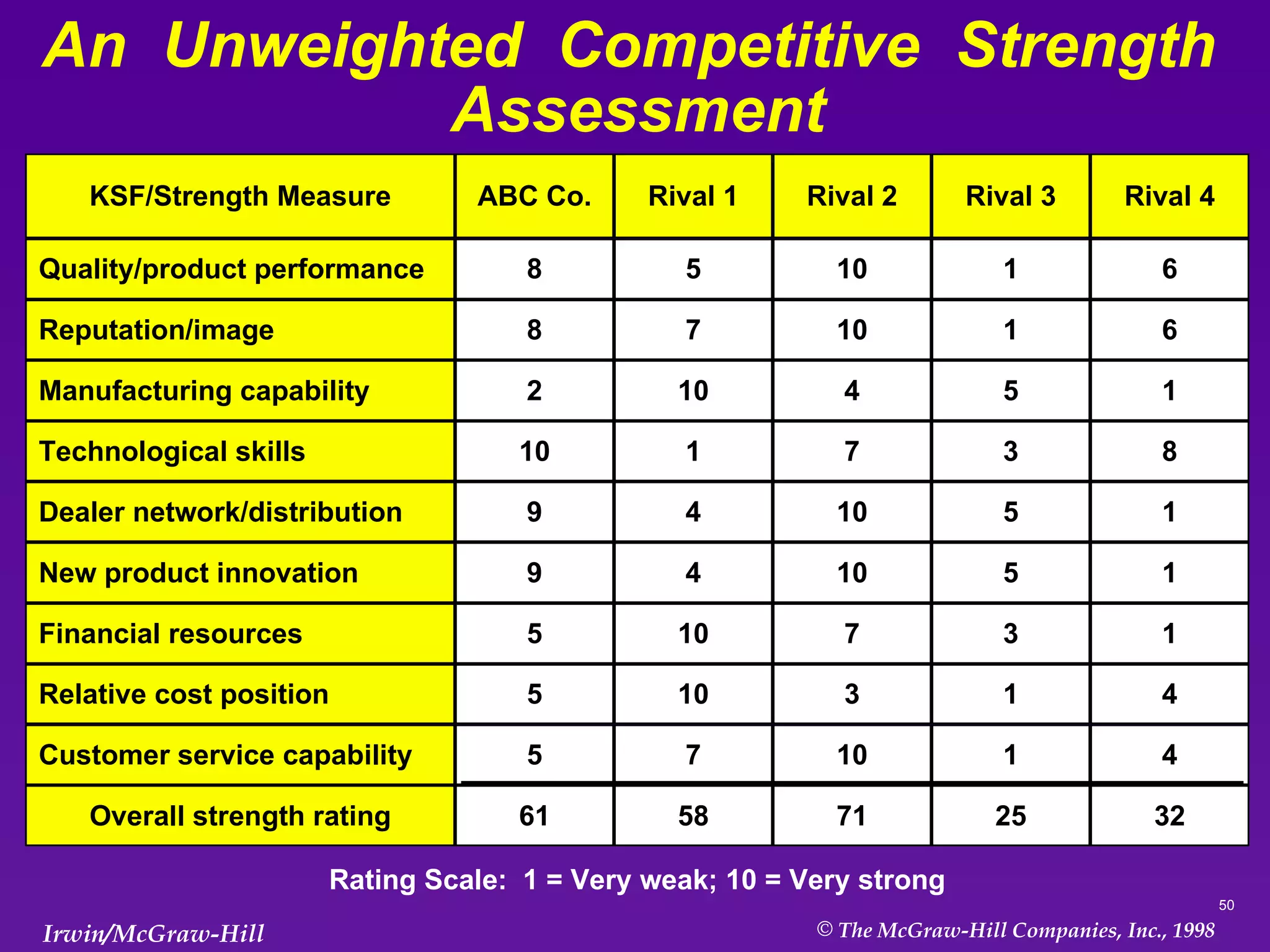

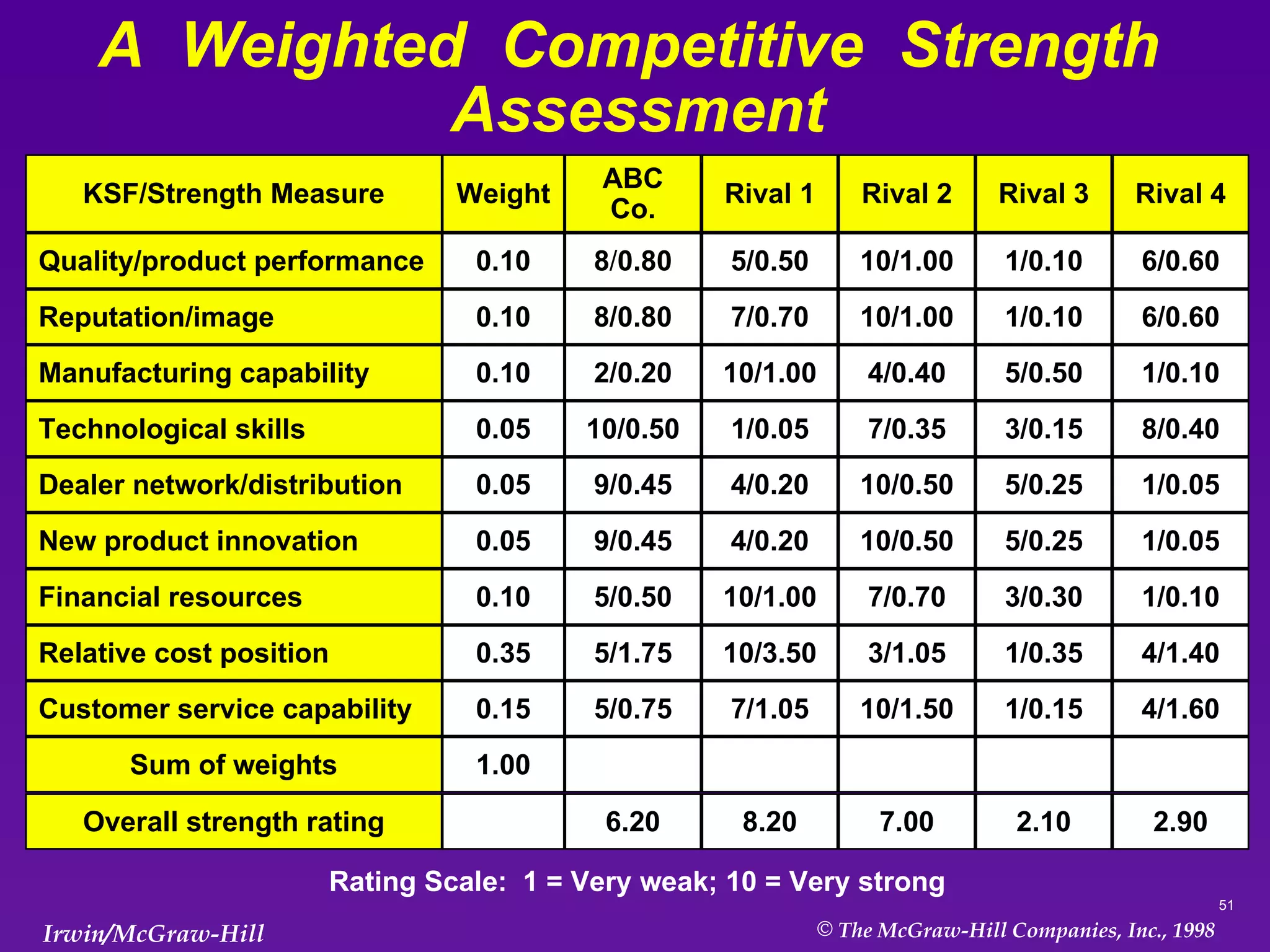

This document discusses methods for evaluating a company's resources and competitive capabilities, including its strengths, weaknesses, opportunities, and threats (SWOT analysis). It describes assessing a company's strategy, costs, value chain activities, and competitive position relative to rivals. Key questions addressed include how well the current strategy is working, identifying the company's strengths and weaknesses, determining if costs are competitive, and ranking the company's position versus competitors. Conducting in-depth analyses across these areas can help identify strategic issues and guide strategic decision making.